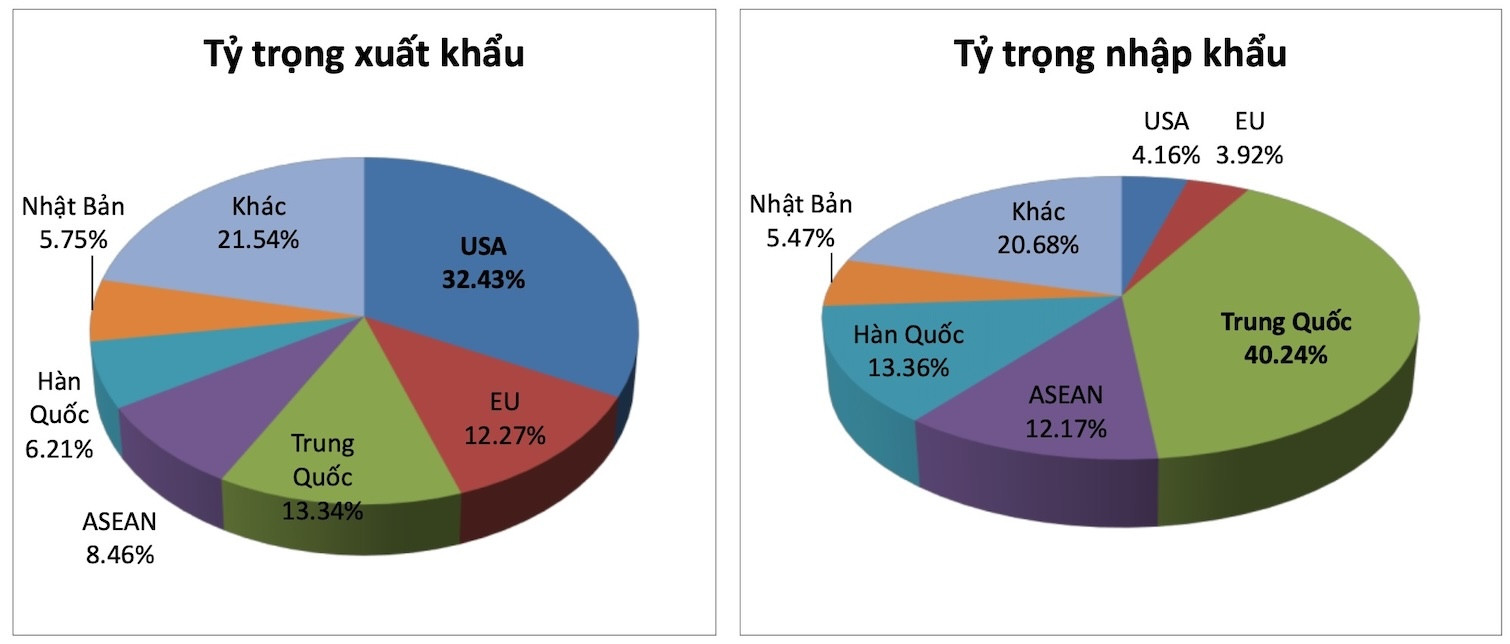

When Dr. Can Van Luc, member of the Prime Minister 's Policy Advisory Council, presented a data table on Vietnam's main commodity trading partners in the first 7 months of 2025, many business representatives in the audience simultaneously picked up their phones and took pictures of the numbers. They were particularly interested in this information.

The economist ’s data shows that the percentage of domestic enterprises in many industries exporting to the US is low. For example, footwear (16.71%); toys, sports equipment (9.84%); electronic products and components (9.63%); machinery, equipment (6.15%) …

Dr. Can Van Luc analyzed the risks of goods transit in Vietnam, on the morning of August 16. Photo: HUBA

Dr. Luc said that Vietnam has had an export-based growth model for many years, but the concept of “transit tax” will be a wake-up call for the business community and an opportunity for businesses to restructure. Businesses need to increase the localization rate in export products. Domestic businesses, especially those in the supporting industry, must develop more strongly in the coming time.

According to HUBA Chairman Nguyen Ngoc Hoa, increasing domestic content in production will achieve two goals. First, avoiding the risk of being imposed high transit tariffs by US trading partners in the future. Second, creating jobs and real production value for the economy.

But, what criteria are considered “transit goods”?

Vietnam's main commodity trading partners in the first 7 months of 2025. Source: CTK, BIDV Research

Regarding this concern, Dr. Luc advised the business community to remain calm. The 40% transit tax rate applies to the whole world, not just Vietnam. In addition, even US specialized agencies are facing difficulties due to the lack of specific evaluation criteria.

According to the World Trade Organization (WTO), with a self-production level of 30-37%, goods are considered a product of a country. However, Mr. Luc said, the regulations from the US government are still unclear.

Therefore, Mr. Luc recommended that the Government stay calm. Vietnam does not need to come up with a specific set of criteria, instead let the host country's agency issue the criteria and Vietnam will negotiate later.

"We also recommend that Vietnamese businesses should increase their self-production level to over 50% to ensure safety," he recommended.

Regarding the 20% reciprocal tax rate that the US imposes on goods from Vietnam, Mr. Phung Quoc Man, Chairman of the Handicraft and Wood Processing Association of Ho Chi Minh City, said that many units have considered setting up production facilities in a third country or right in the US to reduce tax pressure.

Wood businesses with revenue from 50 - 300 million USD are looking to create "Made in USA" products organized by Vietnamese people right in your country.

Regarding the wood industry, Dr. Can Van Luc said that currently, out of every 10 items in American family kitchens, 4 are from Vietnam. Vietnamese wood products are popular in the country because of their sophistication and wood quality, which is very different from that of Chinese wood and many other countries.

Some Vietnamese businesses he knows have gone to Colombia to produce there, and export goods from Colombia to the US to enjoy low tax rates.

American customers love it, a product with a trade surplus of 10 billion USD. The trade surplus of this product reached 10.13 billion USD in just 11 months of 2023. This is also the product with the highest trade surplus in the agricultural sector.

Source: https://vietnamnet.vn/dau-an-kho-tin-cua-do-go-viet-trong-gian-bep-gia-dinh-my-2432781.html

![[Photo] Close-up of the first International Financial Center building in Ho Chi Minh City](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/19/3f06082e1b534742a13b7029b76c69b6)

![[Photo] General Secretary and Prime Minister visit the National Exhibition and Fair Center](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/19/f4503ad032d24a90beb39eb71c2a583f)

![[Photo] President Luong Cuong's wife and Queen of Bhutan visit Tran Quoc Pagoda](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/19/62696af3852a44c8823ec52b03c3beb0)

![[Photo] Politburo works with the Standing Committee of Da Nang City Party Committee and Quang Ninh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/19/b1678391898c4d32a05132bec02dd6e1)

![[Photo] General Secretary To Lam attends the inauguration and groundbreaking ceremony of 250 projects to celebrate National Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/19/3aa7478438a8470e9c63f4951a16248b)

Comment (0)