Stocks regain highest point in more than 3 years

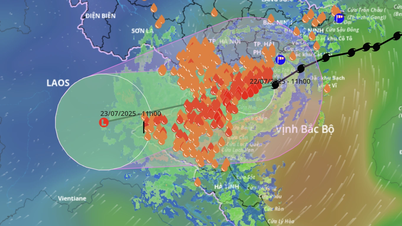

Despite the technical signal slowing down yesterday with the Bearish Engulfing candlestick pattern and profit-taking pressure after failing at the psychological threshold of 1,500 points, the market quickly regained momentum in today's session. In the morning session, VN-Index struggled with strong fluctuations, however, the buying force quickly overwhelmed the afternoon session, helping the index rebound, far surpassing the 1,500 point mark.

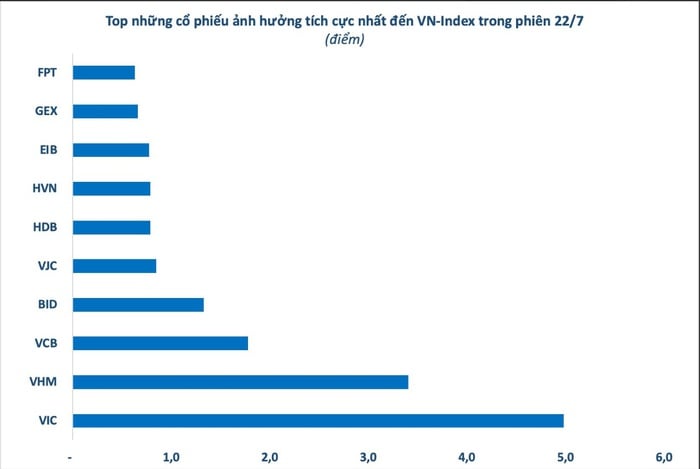

The main driving force came from real estate, banking and securities company stocks. The leadership of large stocks such as VIC (+4.9%), VHM (+3.9%), VCB, BID, along with strong cash flow momentum in securities stocks such as VIX, VND, HCM, helped the VN-Index surpass the 1,505 point threshold at times.

However, at this threshold, a slight increase in selling pressure appeared afterwards, causing the index to fall below the 1,500-point mark. However, good support in the ATC session helped the VN-Index increase again and close at 1,509.54 points.

At the end of the session, the HOSE recorded 224 stocks increasing and 103 stocks decreasing. Liquidity remained positive with more than 1,289 million shares matched, equivalent to a transaction value of more than VND33,731.6 billion - although down slightly by 12% in volume and 5% in value compared to the previous session. Negotiated transactions contributed 62.7 million units, equivalent to VND3,320 billion.

Real estate stocks lead the uptrend

The real estate group was the focus of the session with an average increase of 3.2%. VIC increased by 4.9% to VND117,500; VHM increased by 3.9% to VND95,500; VRE increased by 3.5% to VND30,000. Other small and medium-sized stocks in this group also traded actively: GEX, SJS when hitting the ceiling; SCR +4.4% to VND8,400; VGC +3.9%; VPI +3.5%; DXG and DXS both increased by more than 3%.

Finance and banking are bustling again

Following the group of banking and finance stocks, the most notable were EIB, which increased by 6.9% to VND27,150, and newcomer VAB, which increased by 7.4% to VND15,300. HDB increased by 3.9% to VND25,450, along with large codes such as CTG, VPB, VCB, and BID, which all ended the session in green.

Stock codes also performed positively. VIX and CTS were still the biggest bright spots when maintaining ceiling prices, with VIX alone matching more than 61.7 million units this session, ranking second on the entire floor. FTS, SSI, VDS, DSE, AGR, VCI codes increased by nearly 2%-3%, while HCM, BSI, TVS increased by 4-5%, and VND increased by 5.2% to 19,100 VND, matching more than 53 million units.

Stocks that contributed most positively to the session when VN-Index surpassed the 1,500 point mark

Many small stocks broke out, some were profit-taking

Many individual stocks increased sharply such as VJC, YBM, PAN, PET, VSC, HHP closed at the ceiling price. GEE, DHC, HVN, HAH increased by 3-5%, VSC alone matched more than 33.6 million units - among the highest on the floor.

On the other hand, some small-cap stocks were sold heavily. LDG hit the floor and only matched 0.53 million units, with over 41.2 million units remaining for sale at the floor price. DRH, PTL, HVX also fell to the limit, while BCG, DLG, HAR fell 3.5%-5.5%.

Green color spreads to HNX and derivatives market

On the HNX floor, the HNX-Index also improved after the early fluctuations, closing up 2.06 points (+0.84%) to 247.85 points. The entire floor had 106 stocks increasing, 69 stocks decreasing. The total matched volume reached nearly 150 million units, worth VND2,702 billion; negotiated transactions were more than 3.35 million units, worth VND60.4 billion.

SHS stock was the most prominent with an increase of 6.1% to 17,400 VND, with more than 48.6 million units matched - the highest on HNX. Other names fluctuated slightly with CEO, MBS, APS, BVS increasing from 2% to more than 3%, while VFS, DL1, HUT, IDC adjusted down slightly and PVS, MST stood at reference price.

UpCoM turned down slightly

On UpCoM, the UpCoM-Index recovered in the afternoon session but could not maintain the green color, closing down 0.25 points (-0.24%) to 104.02 points. Trading volume reached more than 77.2 million units, worth VND1,066.4 billion. Negotiated transactions had an additional 15.5 million units, worth VND305.2 billion.

Stocks on this floor were clearly differentiated. Codes such as DDV, DRI, OIL increased slightly, while AAH, VGT, VHG, DFF, TVN, ASS stood at reference price, matching from 0.93 million to 1.89 million units.

Derivatives and warrants markets maintain green color

In the derivatives market, the 41IF8000 futures contract increased sharply by 30.5 points (+1.88%) to 1,655 points, with more than 262,000 matched units and an open volume of more than 48,600 units.

Warrants were actively traded. CHPG2504 led with more than 3.39 million units, up 8.8% to VND2,220/unit; CFPT2404 followed with 3.21 million units, up 2.04% to VND1,000/unit.

The trading session on July 22 showed the strong resilience of the market when VN-Index surpassed the 1,500-point mark despite previous technical correction signals. Cash flow remained strong and spread evenly across many sectors, especially real estate, banking and securities - the groups that have a leading role in the market.

The session’s developments showed that investors’ sentiment remained positive, ready to buy at the bottom when the market fluctuated. The return of pillar stocks helped the index quickly recover and close at the session’s highest level, thereby reinforcing confidence in the short-term uptrend.

If the cash flow continues to maintain stability and spread widely, the index has every chance of reaching higher levels in the coming time, although the possibility of technical fluctuations during the upward process cannot be ruled out.

Source: https://phunuvietnam.vn/10-co-phieu-dong-gop-tich-cuc-nhat-trong-phien-vn-index-vuot-moc-1500-diem-2025072216272363.htm

Comment (0)