USD exchange rate today 07/23/2025

At the time of survey at 4:30 a.m. on July 23, the central exchange rate at the State Bank was currently 25,179 VND/USD, down 12 VND compared to yesterday's trading session.

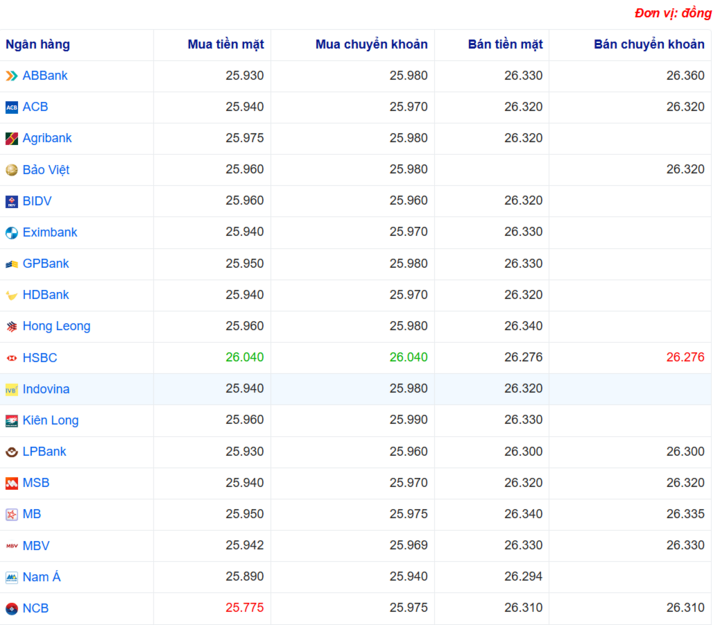

Specifically, at Vietcombank , the USD exchange rate is 25,930 - 26,320 VND/USD, down 20 VND in both directions, compared to yesterday's trading session.

NCB Bank is buying USD cash at the lowest price: 1 USD = 25,775 VND

VietinBank is buying USD transfers at the lowest price: 1 USD = 25,795 VND

HSBC Bank is buying USD cash at the highest price: 1 USD = 26,040 VND

HSBC Bank is buying USD transfers at the highest price: 1 USD = 26,040 VND

OCB Bank is selling USD cash at the lowest price: 1 USD = 26,275 VND

HSBC Bank is selling USD transfers at the lowest price: 1 USD = 26,276 VND

Saigonbank, SCB, UOB are selling USD cash at the highest price: 1 USD = 26,380 VND

SCB Bank is selling USD transfers at the highest price: 1 USD = 26,380 VND

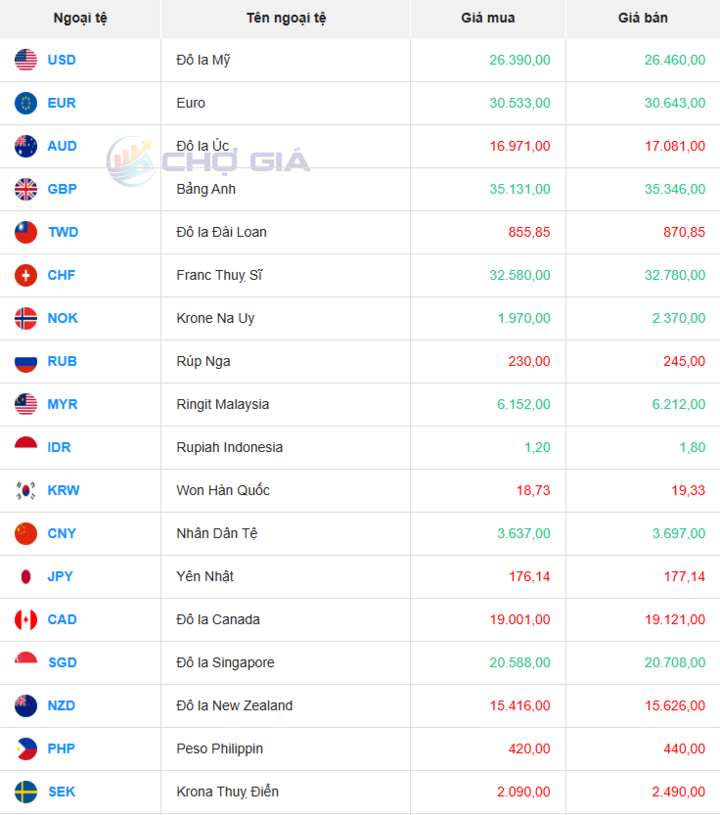

In the "black market", the black market USD exchange rate as of 4:30 a.m. on July 23, 2025 increased by 9 VND in both directions, compared to yesterday's trading session, trading around 26,390 - 26,460 VND/USD.

USD exchange rate today July 23, 2025 on the world market

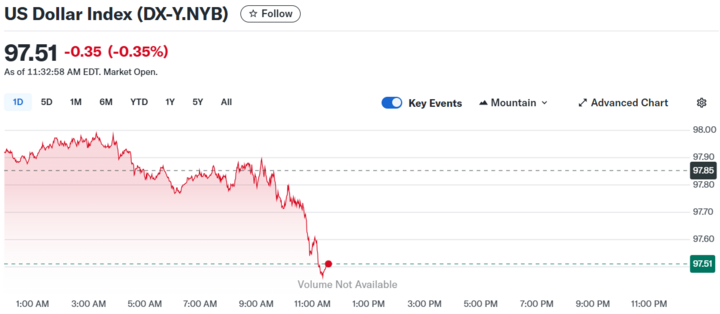

The Dollar Index (DXY), which measures the USD against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stopped at 97.51 - down 1.32 points compared to July 22, 2025.

With just over a week to go before the August 1 deadline, US Treasury Secretary Scott Bessent said the administration was now more concerned about the quality of trade deals than the timing of their signing. Asked whether the deadline could be extended for countries that were actively negotiating with Washington, Bessent said the decision would be up to President Donald Trump.

“The market is waiting and not overreacting to the noise about the August 1 deadline unless something really concrete happens. In fact, a lot of the economic data is still pretty good despite some tariffs,” said Brad Bechtel, global head of foreign exchange at Jefferies in New York.

Uncertainty over the global tariff picture has been a major drag on foreign exchange markets, keeping major currencies mostly in narrow ranges, even as Wall Street stocks continued to hit record highs.

The US dollar index, which measures the greenback against a basket of six major currencies, fell 0.3% to 97.545, after losing about 0.6% in the previous session.

The euro edged up 0.2 percent to $1.1725 ahead of the European Central Bank's policy meeting this week, where the ECB is expected to leave interest rates unchanged.

A trade deal between the EU, which could face 30% tariffs from August 1, and the US remains deadlocked, with EU diplomats saying they are considering a wider range of retaliatory measures as the prospects of a deal fade.

“The Trump administration has shown little tolerance for retaliation and this could trigger a tit-for-tat escalation of tariffs, albeit temporarily,” ING FX strategist Francesco Pesole wrote in a research note.

“The euro’s ability to maintain its advantage over the dollar amid tariff tensions will depend on the extent of the escalation and whether the EU becomes the relative loser while other countries reach a significant deal with the US,” he added.

Another factor that worries investors is the story about the independence of the US Federal Reserve (Fed), when President Trump continuously attacks Chairman Jerome Powell and calls for his resignation because the Fed refuses to lower interest rates.

“However, under our base case scenario, continued strength in US economic data and a rebound in inflation driven by tariffs would see the Fed leave rates unchanged through 2026. That would alter interest rate differentials and support a recovery in the dollar over the next few months,” said Jonas Goltermann, deputy chief market economist at Capital Economics.

Source: https://baohatinh.vn/ty-gia-usd-hom-nay-2372025-ty-gia-usd-ngan-hang-giam-nhe-post292283.html

Comment (0)