Although there was a time when it surpassed the 1,500-point mark for the first time in nearly 39 months, a strong upward trend appeared in the middle of the weekend morning session, helping the VN-Index temporarily surpass 1,500 points thanks to real estate stocks. However, profit-taking pressure quickly appeared, pushing the index below this important psychological mark.

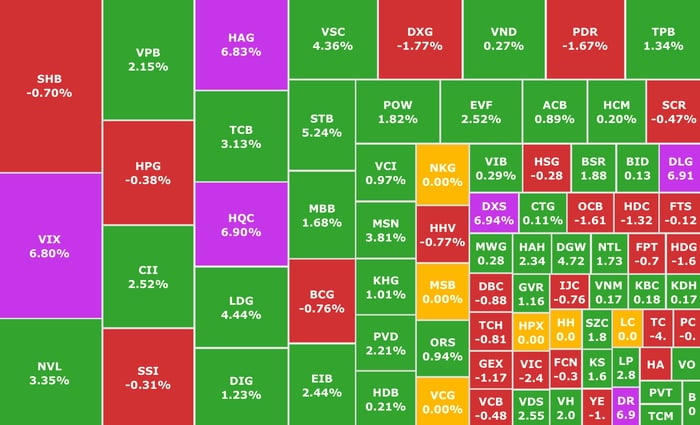

VN-Index closed the week with an increase of 7.3 points, reaching 1,497.3 points, approaching the historical peak of 1,524 points in April 2022. The whole market had 171 stocks increasing (17 stocks hitting the ceiling), 147 stocks decreasing and 57 stocks remaining unchanged.

The market "struggled" with 171 stocks increasing and 147 stocks decreasing after surpassing 1,500 points in the morning session.

Liquidity remains high with total market transaction value reaching about 40,000 billion VND.

Cash flow tends to "surf" real estate penny stocks, but the VN30 group still plays a leading role in the market. The VN30 index ended the session up 9.2 points, approaching the 1,645 point mark with 19 stocks increasing and 11 stocks decreasing.

STB (Sacombank, HOSE) is the code with the strongest increase in the VN30 group with +5.2%, followed by MSN ( Masan , HOSE) (+3.8%), TCB (Techcombank, HOSE) (+3.1%), LPB (LPBank, HOSE) (+2.8%).

Regarding the industry group , real estate stocks played the main role, in which VHM (Vinhomes, HOSE) contributed the most to the increase in the morning session. Next were NVL ( Novaland , HOSE) and CEO (CEO Real Estate, HNX) which had a "purple ceiling" moment with large liquidity.

The positive state also spread to the small-cap group, a series of real estate penny codes such as BCR (BCG Land, UPCoM), TAR (Trung An, UPCoM), HQC (Hoang Quan Real Estate, HOSE), DLG (Duc Long Gia Lai , HOSE), DXS (Dat Xanh, HOSE), DRH (DRH Holdings, HOSE), HAG (Hoang Anh Gia Lai , HNX), ... simultaneously increased to the ceiling, attracting great attention from individual investors.

In addition, the stock group also contributed strongly to today's increase, the focus was on VIX (VIX Securities, HOSE).

Photo: Mirae Asset

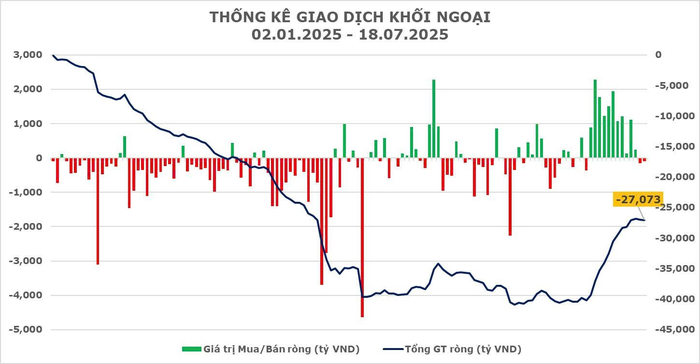

On the foreign side, foreign investors had their second consecutive net selling session, in which FPT (FPT, HOSE) was the code with the strongest net selling value of nearly 162 billion VND, followed by VCB (Vietcombank, HOSE) and GEX (Gelex, HOSE). On the contrary, positive demand appeared in MSN (Masan, HOSE) and VPB (VPBank, HOSE).

According to Mr. Bui Ngoc Trung, consultant, Mirae Asset Securities (Vietnam) , although the market "lost" the 1,500 point mark, the positive point is that liquidity has remained at a fairly high level in recent sessions with more than 35 trillion VND in matched orders to reinforce the market trend and the trading frequency is still quite active, showing that cash flow is still circulating positively in the market with a long increase after the pressure on tariffs was relieved.

Current cash flow is still focusing strongly on real estate and banking stocks,... preparing to welcome the wave of second quarter business results and the time for upgrading is approaching.

The banking sector stood out when buying power began to increase more strongly in the afternoon session, although profit-taking pressure for this group after a period of strong growth occurred, when many codes such as STB, MBB, TCB increased after only a few accumulation sessions thanks to expectations of growth in Q2 profits and good control of bad debt.

In addition, the more impressive real estate market is gradually returning to the race, with the momentum from synchronous legal reforms, businesses are launching key projects in 2025 to help business results and are gradually returning to a new cycle.

In addition, the consumer-retail group also received attention when stocks such as MWG (Mobile World, HOSE), MSN (Masan, HOSE) attracted new foreign buying cash flow, benefiting from the VAT reduction policy and the prospect of recovering purchasing power in the third quarter.

Therefore, he assessed that looking at next week and the rest of July, the market has many opportunities to conquer the target of 1,500 points. This comes from the consensus of cash flow into large-cap stocks, the return of the real estate group - which will be an important driving force to help the market break out. Moreover, the expectation of positive Q2 business results from large enterprises will continue to attract domestic and foreign cash flow, creating a solid foundation for the Q3 journey with the market.

Sharing a positive view, experts recommend that during this period, investors can continue to observe market strength, limit chasing purchases and limit increasing the proportion of stocks that have increased rapidly in recent sessions.

Source: https://phunuvietnam.vn/vn-index-giang-co-ap-sat-dinh-lich-su-tai-1500-diem-20250718173529653.htm

![[Infographic] In 2025, 47 products will achieve national OCOP](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/16/5d672398b0744db3ab920e05db8e5b7d)

Comment (0)