Domestic USD exchange rate today 8/2/2025

At the time of survey at 4:30 a.m. on August 2, the central exchange rate at the State Bank was currently 25,249 VND/USD, an increase of 9 VND compared to yesterday's trading session.

Specifically, at Vietcombank , the USD exchange rate is 26,000 - 26,390 VND/USD, up 10 VND in both directions, compared to yesterday's trading session.

NCB Bank is buying USD cash at the lowest price: 1 USD = 25,840 VND

VietinBank is buying USD transfers at the lowest price: 1 USD = 25,860 VND

HSBC Bank is buying USD cash at the highest price: 1 USD = 26,084 VND

HSBC Bank is buying USD transfers at the highest price: 1 USD = 26,084 VND

HSBC Bank is selling USD cash at the lowest price: 1 USD = 26,320 VND

HSBC Bank is selling USD transfers at the lowest price: 1 USD = 26,320 VND

VietABank is selling USD cash at the highest price: 1 USD = 26,440 VND

ABBank is selling USD transfers at the highest price: 1 USD = 26,430 VND

USD exchange rate at some banks today. Source Webgia.com

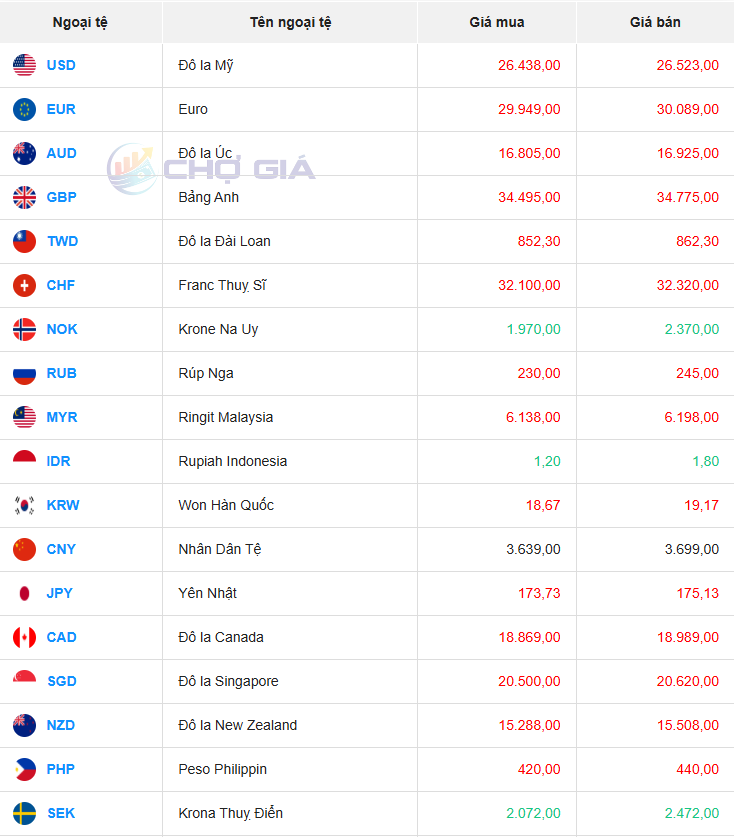

In the "black market", the black market USD exchange rate as of 4:30 a.m. on August 2, 2025 decreased by 14 VND in both directions, compared to yesterday's trading session, trading around 26,438 - 26,523 VND/USD.

Black market on August 2, 2025. Photo: Chogia.vn

USD exchange rate on the world market today August 2, 2025

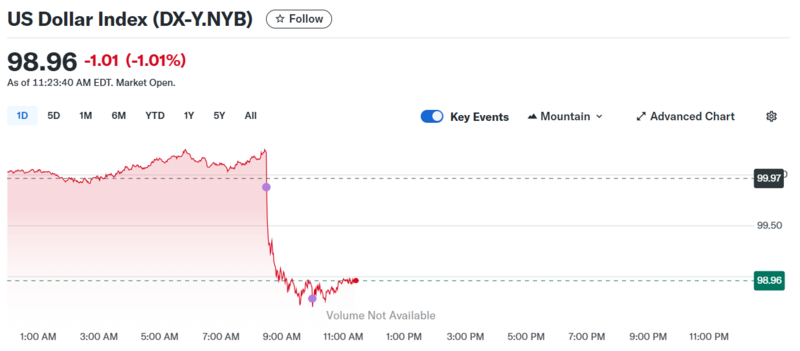

The Dollar Index (DXY), which measures the USD against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stopped at 98.96 - down 0.87 points compared to August 1, 2025.

DXY index developments in recent times.

U.S. employers added just 73,000 jobs in July, below the 100,000 economists polled by Reuters had expected. The unemployment rate edged up to 4.2 percent, as expected, from 4.1 percent in June. The June jobs figure was revised down sharply, from 147,000 to just 14,000 new jobs.

The DXY index, which measures the greenback's strength against a basket of major currencies such as the euro and Japanese yen, fell 1.09% on the day to 98.94.

The euro rose 1.22% to $1.1554, having earlier touched $1.1389, its lowest since June 10. Against the Japanese yen, the dollar fell 1.58% to 148.35. Earlier in the day, the greenback had surged to $150.91, its highest since March 28.

Although the Fed had signaled it would not rush to cut interest rates due to concerns that President Donald Trump's tax policies could cause inflation to rise again, developments following the weak jobs report caused market expectations to quickly reverse.

Fed funds futures show investors now expect a 54 basis point cut in 2025, up from about 34 basis points a day earlier. The first cut is now expected as early as September.

The dollar is currently down 0.82% against the Swiss franc, to 0.806, after hitting 0.8171 - its highest since June 23.

Meanwhile, the Canadian dollar rose 0.58% against the US dollar to CAD1.38 per USD, after hitting its weakest level since May 22 at CAD1.3879. Canada was hit with a 35% tariff, higher than the initial threat of 25%.

The dollar has also risen against other currencies on factors other than tariffs. The yen was headed for its biggest weekly decline this year after the Bank of Japan signaled it was in no rush to raise interest rates again, prompting Finance Minister Katsunobu Kato to say officials were concerned about recent currency moves.

Source: https://baohatinh.vn/ty-gia-usd-hom-nay-282025-ty-gia-thi-truong-tu-do-lao-doc-post292943.html

Comment (0)