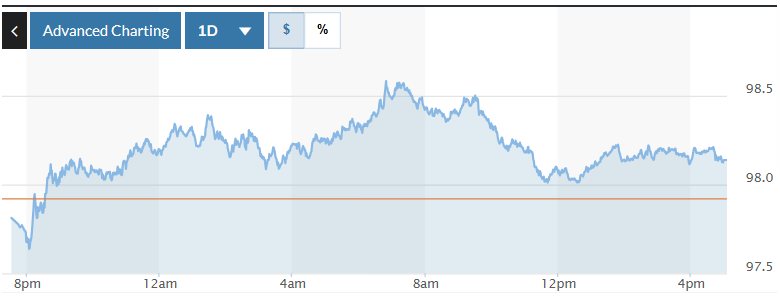

Meanwhile, in the US market, the US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) increased by 0.22%, currently at 98.14.

|

| DXY Index volatility chart over the past 24 hours. Photo: Marketwatch |

USD exchange rate today in the world

The US dollar gained against major currencies, including the euro and the Japanese yen, as markets sought safe-haven assets amid escalating geopolitical tensions in the Middle East following Israel's attack on Iran.

The dollar rose 0.3% to 143.88 yen and 0.1% to 0.8110 Swiss franc, with the greenback on track to snap a two-day losing streak against safe-haven currencies. Still, the dollar was on track for weekly losses against both the yen and Swiss franc amid concerns about Trump’s proposed tariffs. The greenback fell nearly 1% against the yen, on track for its biggest weekly loss since mid-May.

The dollar fell for a second consecutive week against the Swiss franc.

"The Israel-Iran conflict is a new development, but the main concern remains tariffs and barriers to global trade. When armed conflict is likely to be prolonged and escalate, the US dollar and gold are often chosen as safe-haven assets. This is a psychological reaction," said Juan Perez, director of trading at Monex USA in Washington.

Meanwhile, the euro fell 0.4% to $1.1539, ending a four-session winning streak. However, the euro is still on track for a second straight weekly gain against the dollar.

Amid the conflict in the Middle East, investors largely ignored data showing U.S. consumer confidence improved for the first time in six months. The University of Michigan’s Consumer Sentiment Index, released on Friday, showed its index rose to 60.5 this month, beating expectations in a Reuters poll of economists .

“It’s hard to overcome all the factors that we’ve been facing this year that have eroded market confidence in the US dollar. But at the same time, when it comes to military conflict, there seems to be a global consensus that we should move to what have historically been the safest assets, the US dollar as a currency and gold as a store of value,” said Perez from Monex.

|

| Illustration photo: cafef.vn |

Domestic USD exchange rate today

In the domestic market, at the beginning of the trading session on June 14, the State Bank announced the central exchange rate of the Vietnamese Dong to the USD at 24,975 VND.

* The reference USD exchange rate at the State Bank's buying and selling exchange center increased slightly, currently at: 23,777 VND - 26,173 VND.

USD exchange rates at commercial banks are as follows:

USD exchange rate | Buy | Sell |

Vietcombank | 25,833 VND | 26,223 VND |

Vietinbank | 25,853 VND | 26,223 VND |

BIDV | 25,863 VND | 26,223 VND |

* The EUR exchange rate at the State Bank's buying and selling exchange center decreased slightly, currently at: 27,398 VND - 30,282 VND.

EUR exchange rates at commercial banks are as follows:

EUR exchange rate | Buy | Sell |

Vietcombank | 29,271 VND | 30,815 VND |

Vietinbank | 29,629 VND | 30,884 VND |

BIDV | 29,608 VND | 30,860 VND |

* The Japanese Yen exchange rate at the State Bank's exchange office has increased slightly, currently at: 166 VND - 183 VND.

Japanese Yen Exchange Rate | Buy | Sell |

Vietcombank | 174.68 VND | 185.77 VND |

Vietinbank | 178.49 VND | 186.49 VND |

BIDV | 178.08 VND | 185.93 VND |

THUY ANH

*Please visit the Economics section to see related news and articles.

Source: https://baodaknong.vn/ty-gia-usd-hom-nay-14-6-dong-usd-tang-gia-do-cang-thang-trung-dong-leo-thang-255558.html

![[Video] More than 100 universities announce tuition fees for the 2025–2026 academic year](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/18/7eacdc721552429494cf919b3a65b42e)

![[Infographic] In 2025, 47 products will achieve national OCOP](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/16/5d672398b0744db3ab920e05db8e5b7d)

Comment (0)