This is a measure to end the lump-sum tax mechanism - a form that has existed for decades and is no longer suitable for the new situation.

Refusing to accept transfers can result in losing customers.

On social networks, images of signs with the words “Temporarily stop accepting transfers” or transfers with the content “Happy Birthday” are being spread because business owners and individuals think that the tax authorities will not be able to manage this cash flow, nor will they be able to include this cash flow in their revenue. This is considered a form of “tax avoidance” that many business households share with each other.

QR codes are still used normally by businesses in Lao Cai .

In Lao Cai, there are no signs "Stop accepting transfers" from shops and restaurants, but it is not without some individuals, business households, and online sellers spreading word of mouth about transferring money to mislead state management agencies.

However, most businesses believe that this is not a long-term solution, and that doing so will even unintentionally annoy their own customers.

Vegetable stalls with small transactions still accept transfers.

Ms. Nguyen Thi Hien, a fruit juice business owner in Lao Cai city, still accepts money transfers via QR code scanning, even for small amounts of 10,000 - 15,000 VND. Ms. Hien also does not require customers to write information unrelated to the price of the goods.

Previously, although some people "told" her how to avoid taxes when receiving money transfers, according to Ms. Hien, that was only temporary, the State management agency would have a way to make the cash flow of business households transparent and that way of doing things would cause trouble for customers, and gradually they would choose another seller.

Some retailers say that stopping accepting transfers could cause psychological discomfort for buyers.

Sharing the same opinion as Ms. Hien, some small fruit and vegetable sellers at markets still accept bank transfers even though the amount is not large for each transaction.

Ms. Vang Thi Thuong, a vegetable vendor at Kim Tan market (Lao Cai city) shared: Currently, customers are no longer in the habit of carrying cash when going to the market. Cashless payment is convenient for both sellers and buyers. If I asked customers to pay cash to "avoid" taxes, my vegetable stall would probably close soon because customers have many options.

Consumers fear price increases

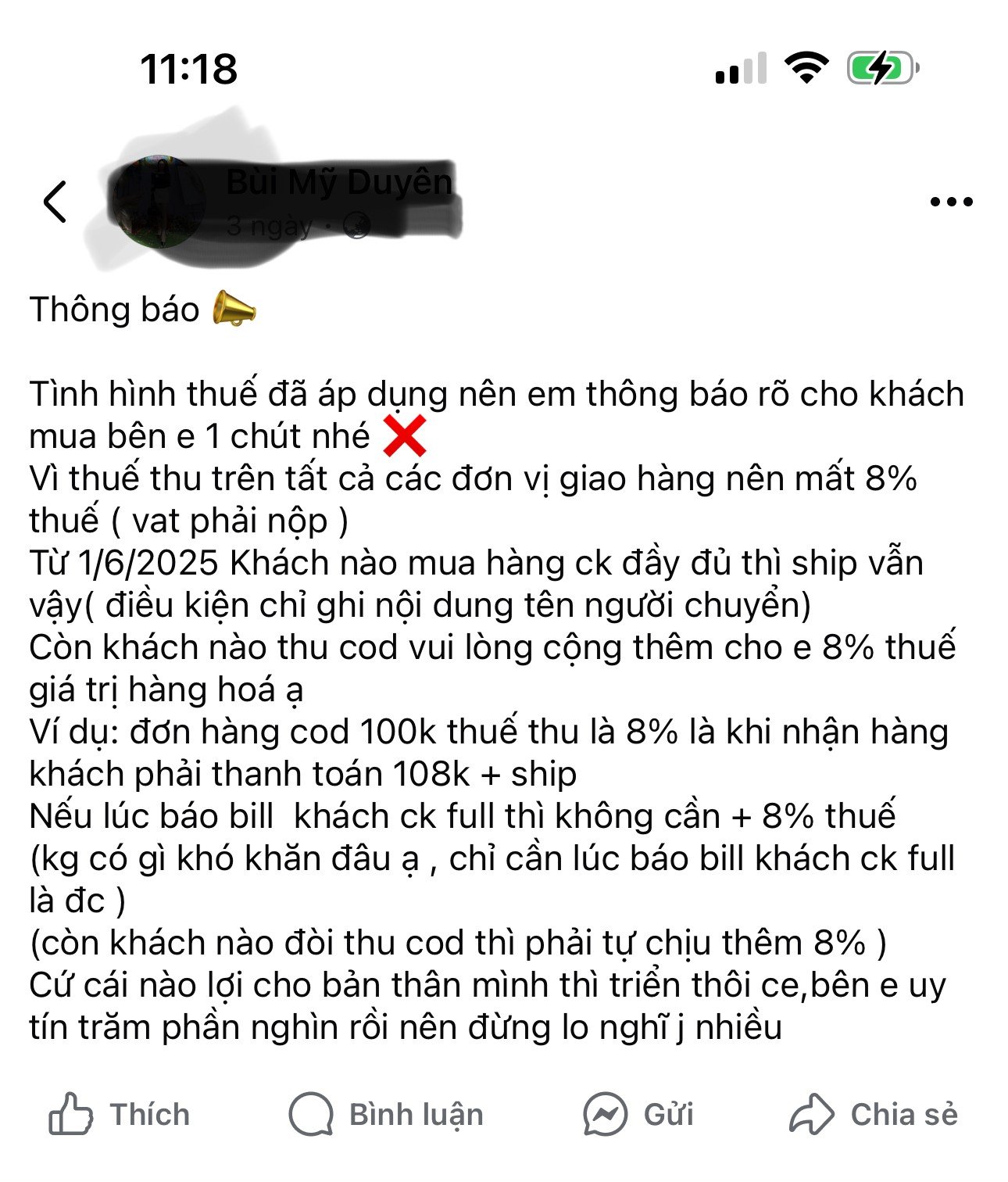

The "tax" story has never been as exciting as it is now. In the market, coffee shops, forums, and social networks, everywhere there is information about changes in tax policies, both positive and negative. Notably, some online businesses have announced that they do not accept COD (customers pay upon receipt of goods) because shipping units collect taxes on COD orders. Therefore, customers must transfer 100% in advance or if they want to buy goods by COD, they must pay an additional 8% VAT and 1.5% personal income tax, which means that for each COD order, consumers will have to pay a price increase of nearly 10% compared to before. For large value orders, this is not a small amount.

Online seller's announcement makes consumers worried.

Mr. Do Huy Hoang (Lao Cai city) often buys goods online, so he cannot help but worry that businesses will push the responsibility onto consumers because of the new tax policy. This means that consumers will have to bear another round of price increases while wages have not increased.

That is also the concern of Ms. Bui Huong Lan (Lao Cai city): "Currently, a bowl of pho costs 40,000 VND, in the future consumers may have to pay 50,000 VND, even bottles of fish sauce and cooking oil will increase in price."

This requires state management agencies to take measures to avoid shifting tax responsibilities onto consumers.

Need transparency, fairness and civilization

According to experts, tax obligations are calculated on all revenue generated, regardless of whether payment is made in cash or by bank transfer. If a business household intentionally accepts only cash to avoid tax declaration, it will be difficult for them to maintain long-term, because tax authorities have enough tools to detect irregularities in revenue.

When determining the act of intentionally concealing revenue to evade taxes, the authorities will not only collect and impose administrative penalties, but can also initiate criminal proceedings, because this is an organized violation and cannot be considered negligence.

Tax authorities have enough tools to detect irregularities in revenue.

Many businesses today are afraid or try to avoid paying taxes because they mistakenly think that the new tax rate is too high. However, the reality is not like that. The tax rate to be paid remains unchanged, the only difference is that businesses will have to declare and declare based on actual revenue. If someone thinks that taxes are "increasing sharply", it may be because they have not paid taxes in accordance with actual revenue.

The tax sector always tries to ensure fairness among businesses: selling the same goods, the same tax must be calculated to ensure transparency and fairness. The tax authority is always ready to support and encourage businesses and individuals to convert and develop into enterprises to enjoy preferential policies on investment, business and tax according to Resolution 198/2025/QH15 dated May 17, 2025 on special mechanisms and policies for private economic development.

According to Ms. Dong Thi Thanh Ha, Deputy Head of the Lao Cai - Muong Khuong Inter-District Tax Team: In preparation for the roadmap from January 1, 2026 to completely eliminate lump-sum tax, the tax sector has promoted and mobilized, first of all, households with revenue from 1 billion VND/year to use electronic invoices generated from cash registers, supporting the connection of service providers with taxpayers; at the same time, promoting and popularizing the legal corridor as well as sanctions if the above households deliberately do not comply. Tax fraud will be punished according to the provisions of law.

Management agencies need to focus on propaganda so that people understand the true nature of the policy and know how to implement and comply.

However, the management agency needs to focus on propaganda so that people understand the true nature of the policy and know how to implement and comply. Specific instructions are needed, close to the reality of each business model. In addition, to effectively implement, it is necessary to review the policy comprehensively, from tax rates to costs, to create more favorable conditions for people, especially small businesses.

Tax is a mandatory amount of money that individuals and businesses must pay. Tax money will be paid directly to the state budget and the collected amount will be used directly for work that brings common benefits to society. Specifically, such as using foreducation services, health care or transportation infrastructure needs...

As a citizen, everyone has the obligation to pay taxes. Fulfilling tax obligations is not only a responsibility but also a demonstration of civilization, contributing to the development of the country. In some countries in the world, tax evasion is condemnable, can be boycotted by the people, even many large enterprises go bankrupt, singers and actors lose their careers when they are discovered to have signs of tax fraud.

Some taxpayers may feel that it is unfair that they, who fully comply with their tax obligations, cannot compete with those who do not. Tax authorities need to take action to make people believe in transparency and fairness. It is important to have tax policies that are appropriate to the actual situation so that people can agree and support them and easily implement them.

In addition, taxpayers and business households need to determine long-term goals, proactively learn tax laws and fully fulfill their obligations, otherwise they will face many legal risks, affecting future business activities.

Source: https://baolaocai.vn/tranh-thue-bang-giao-dich-tien-mat-can-hieu-dung-de-khong-gap-rui-ro-phap-ly-post403036.html

Comment (0)