Staff of the People's Credit Fund of Thot Not district and the Farmers' Association of Trung Kien ward visited the preferential loan model for mulberry planting of members.

Support production and business development

According to Mr. Huynh Thien Chi, Chairman of the Farmers' Association of Thuan An Ward, Thot Not District, the Association is managing 6 savings and loan groups (TK&VV), with capital of over 13 billion VND, supporting 317 households to borrow to develop production and business. The overdue debt rate is 0.05%.

Since receiving a preferential loan of 40 million VND, Ms. Nguyen Thi Dung in Thoi An 3 area has been able to buy materials and expand her business of gluing paper bags containing sugar and flour. Previously, Ms. Dung glued bags for processing to earn extra income. Later, Ms. Dung bought and distributed materials for her sisters to work with. Ms. Dung bought each paper bag for 1.2 million VND, after gluing the finished bags, she sold them for 1.8-1.9 million VND. Ms. Vo Kim Hai in Thoi An 3 area said: “Previously, I made a living from traditional basket weaving and now I glue paper bags for processing. Every day, after finishing housework, I can glue 1,000 paper bags, earning 100,000 VND. The job of gluing paper bags is easy to do, the source of goods is continuous, the income depends on the skill, suitable for middle-aged women”. In Thoi An 3 area, there are over 60 people with stable income from this job.

Mr. Nguyen Minh Hieu, Director of the Transaction Office of the Social Policy Bank of Thot Not District, said that by the end of May 2025, the loan turnover through the Farmers' Association was nearly 22 billion VND, with 490 borrowing households. Outstanding loans were over 166.5 billion VND, with 3,755 households still in debt. The District Farmers' Association is managing 72 savings and credit groups classified as good and fairly; 61 savings and credit groups have no overdue debts. Policy credit has supported farmer members in wards in the area to build many effective production and business models.

The Farmers' Association of Phu Thu Ward, Cai Rang District is managing over 45 billion VND, with 887 households borrowing to expand production and business and having no overdue debts. Most members use the capital for the right purpose, increase income, and improve their lives. With a convenient location on the traffic route and a spacious area, Ms. Bui Thi Hong Dung's grocery store in Phu Khanh area is open from 5 am to 8 pm. Ms. Dung said that she used to work as a seafood processing worker for over 10 years. After the COVID-19 pandemic, Ms. Dung gave birth to a baby and quit her job. Taking over the management and expansion of the grocery store from her mother, Ms. Dung also sells soft drinks to meet customer demand. Ms. Dung said: "Thanks to the loan of 70 million VND, I buy enough items according to consumer demand. Every day, I earn 130,000 VND, plus my husband's daily wage as a bricklayer, enough to cover expenses."

According to the Cai Rang District Social Policy Bank Transaction Office, since the beginning of the year, the loan turnover of the District Farmers' Association has been over 8 billion VND, with 141 households borrowing. The outstanding debt is nearly 187 billion VND, with 3,585 households still having outstanding debt. 67/69 Savings and Credit Groups have no overdue debt.

Promoting the effectiveness of policy credit

According to the City Branch of the Vietnam Bank for Social Policies, policy credit creates conditions for the Farmers' Association to effectively build and maintain cooperative models, cooperative groups, and professional associations in the region and hamlets, to gather members to exchange and share production experiences. On the other hand, the Farmers' Association coordinates to organize activities to support members and farmers in vocational training, supply of agricultural materials and equipment, access to science and technology, promote and consume products, etc. With the entrusted lending method, the Farmers' Association at all levels has transferred policy credit capital to all members in need; guided on proper use. At the same time, it contributes to limiting negative occurrences; publicizing and making transparent the loan evaluation and loan management. The Farmers' Association synchronously integrates policy credit capital with agricultural and industrial promotion programs, transferring science and technology in production, helping members increase income and improve living standards. By the end of May 2025, the outstanding debt through the Farmers' Association was over VND 1,678 billion, accounting for over 35.4%, with 746 Savings and Credit Groups with 36,125 households still in debt. Overdue debt accounted for 0.14%. The whole city currently has 27 Farmers' Associations in communes, wards and towns with no overdue debt.

In the coming time, the City Branch of the Vietnam Bank for Social Policies will continue to coordinate with the Farmers' Association at all levels to effectively implement policy credit policies to the people, especially after the merger of administrative units; continue to improve the quality and efficiency of policy credit activities, implement new lending programs; review and increase the loan level for households using capital effectively, having the need to expand production, business, create on-site jobs, OCOP products, etc. Thereby, contributing to the completion of national target programs on sustainable poverty reduction and new rural construction in the period of 2021-2025.

Article and photos: ANH PHUONG

Source: https://baocantho.com.vn/tich-cuc-huong-dan-hoi-vien-nong-dan-su-dung-von-vay-hieu-qua-a187847.html

![[Photo] More than 124,000 candidates in Hanoi complete procedures for the 2025 High School Graduation Exam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/25/fa62985b10464d6a943b58699098ae3f)

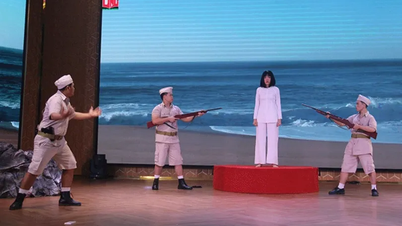

![[Photo] First training session in preparation for the parade to celebrate the 80th anniversary of National Day, September 2nd](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/25/ebf0364280904c019e24ade59fb08b18)

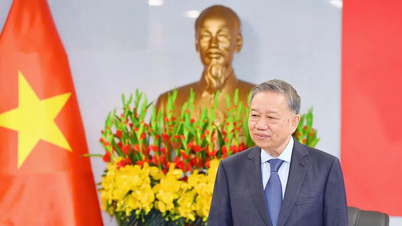

![[Photo] General Secretary To Lam works with the Standing Committee of Quang Binh and Quang Tri Provincial Party Committees](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/25/6acdc70e139d44beaef4133fefbe2c7f)

Comment (0)