The Tax Department ( Ministry of Finance ) has just issued a notice on the temporary suspension of electronic tax systems to upgrade the information technology system. The Department has temporarily suspended a number of electronic tax systems to serve the upgrade and conversion, including the electronic information website, the tax procedure service practice management system (THI), and the e-commerce information portal.

The electronic information portal for households and individuals doing e-commerce and digital business, and the information portal systems serving information exchange with external units and organizations will also be temporarily suspended. Electronic tax applications including eTax, eTax Mobile, and electronic tax for individuals (iCanhan) will also be temporarily suspended.

The suspension time is from 6:00 p.m. June 27 to 8:00 a.m. July 1.

The electronic invoice system for taxpayers will be temporarily suspended from 0:00 to 3:00 on July 1.

The internal tax management system, including the electronic invoice subsystem for tax officials, only allows the use of lookup functions for data transfer. The electronic information portal for foreign suppliers operates normally.

The Tax Department explained that this is to meet the requirements of arranging tax agencies according to the two-tier local government model and some new tax regulations that take effect from July 1.

The Tax Department noted that the tax authority will continue to receive and process administrative procedures directly at the one-stop department and via post during the process of upgrading and converting applications.

During the suspension period, the system may experience service interruptions, leading to delays in processing and returning results. The Tax Authority hopes to receive taxpayers' understanding.

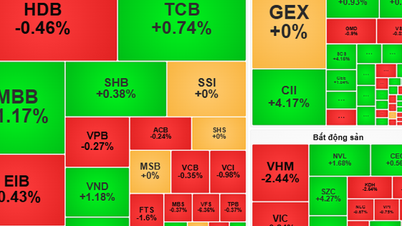

Some electronic tax systems will temporarily stop operating from 6:00 p.m. on June 27 to 8:00 a.m. on July 1 to upgrade the information technology system to meet the requirements of the new model (Illustration photo).

Previously, in the draft amendment to Decree No. 29/2025, the Ministry of Finance proposed to reorganize the tax system in a direction consistent with the current two-level local government model and provincial-level administrative unit organization.

The Ministry proposes to convert the current model of 20 regional tax branches into 34 provincial and municipal tax units (an increase of 14 units). At the same time, 350 district-level tax teams will also be converted into corresponding units under the provincial and municipal tax to manage at the commune level.

The Ministry of Finance said the model adjustment aims to ensure consistency within the industry, in line with the principles of organizing the administrative apparatus at the provincial and district levels. It is expected to take effect from July 1.

In addition, from July 1, Vietnam's tax policy system will enter a new phase with a series of important regulations taking effect, deeply affecting taxpayers including both individuals and businesses such as: electronic identification for organizations; conversion of personal tax codes to personal identification numbers; e-commerce platforms with payment functions must deduct and pay taxes on behalf of individuals doing business...

Source: https://dantri.com.vn/kinh-doanh/tam-dung-loat-he-thong-thue-dien-tu-trong-4-ngay-20250626172631463.htm

![[Photo] Cuban artists bring "party" of classic excerpts from world ballet to Vietnam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/26/797945d5d20b4693bc3f245e69b6142c)

![[Photo] General Secretary To Lam receives Australian Ambassador to Vietnam Gillian Bird](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/26/ce86495a92b4465181604bfb79f257de)

Comment (0)