Growth momentum from internal strength

Many years ago, Vietnam's growth story was often associated with export indicators and attracting foreign direct investment (FDI). According to Mr. Le Anh Tuan - Director of Dragon Capital Investment, currently, external factors only play a role in macroeconomic balance, and are no longer the main driving force in sustainable growth.

Furthermore, the role of the FDI sector also needs to be objectively re-evaluated. With only 8% (about 4.5 million people out of a total of 55-58 million workers) of the national workforce, this sector clearly cannot be the main driver for growth.

Therefore, the expert believes that the core strategy in the next 5-10 years is to liberate and maximize the potential of the private economic sector, domestic enterprises and domestic consumption, which is the right reflection of the policy and spirit of Resolution 68 set forth by the Government.

Capital Market - Pillar of Infrastructure Development and Economic Strength of Vietnam

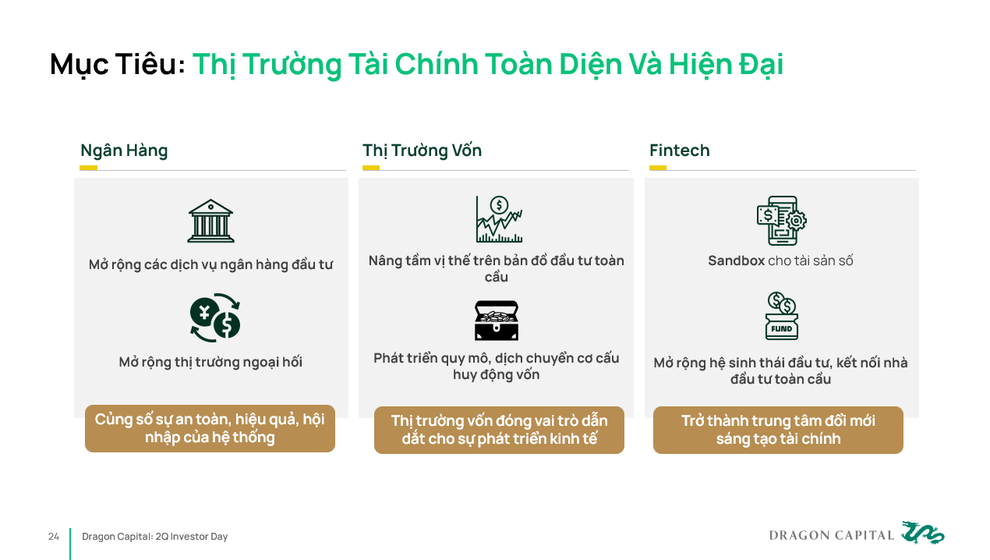

According to Dragon Capital experts, to realize the “infrastructure dream” and put the Vietnamese economy into a sustainable growth cycle, the capital market must play a central role. Building a regional financial center has now been included in the strategic priority group of the Government . When the capital market is upgraded in both depth and quality, cash flow will be allocated more effectively, creating momentum to accelerate large infrastructure projects, technological innovation, and especially supporting the private sector to expand investment and scale development.

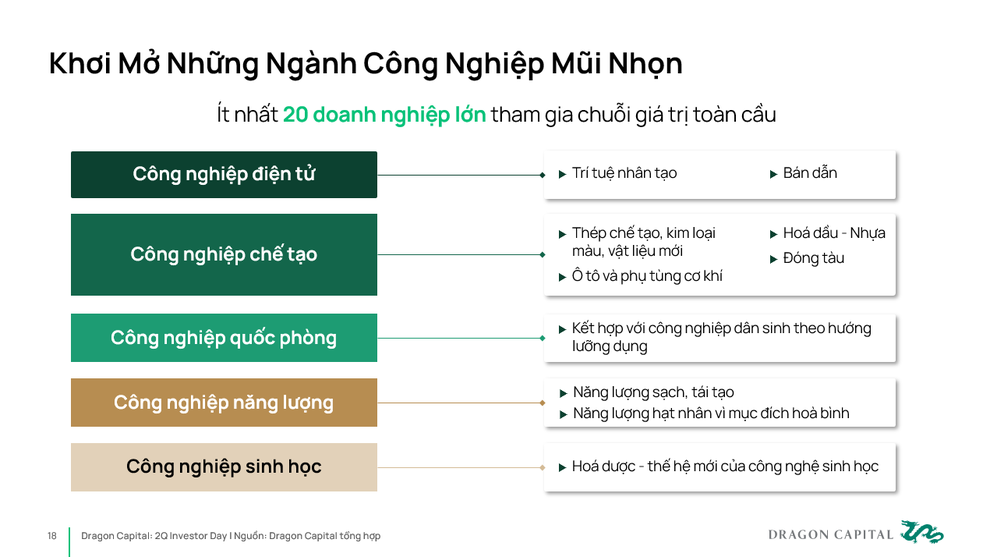

Along with that, the Government is laying the foundation for 5 strategic industrial clusters expected to create breakthroughs in the future, including: Electronics industry; Manufacturing industry; Defense industry; Energy industry; Biotechnology.

The private sector with big names such as Hoa Phat, Vingroup, FPT , Techcombank... is for the first time empowered to lead national economic missions, creating influential industry clusters.

Stick to long-term investment strategy, flexible restructuring

Thanks to many positive indicators from the real economy, Dragon Capital still maintains its forecast for Vietnam's GDP growth in 2025 at 7.5-8%. Key drivers include credit growth in the first 6 months of the year reaching 9.9%, public investment disbursement also recorded a 5-year high, especially focusing on key infrastructure projects.

This development not only reinforces growth expectations, but also creates a foundation for Dragon Capital to stick to its long-term investment strategy, regardless of short-term fluctuations in the market.

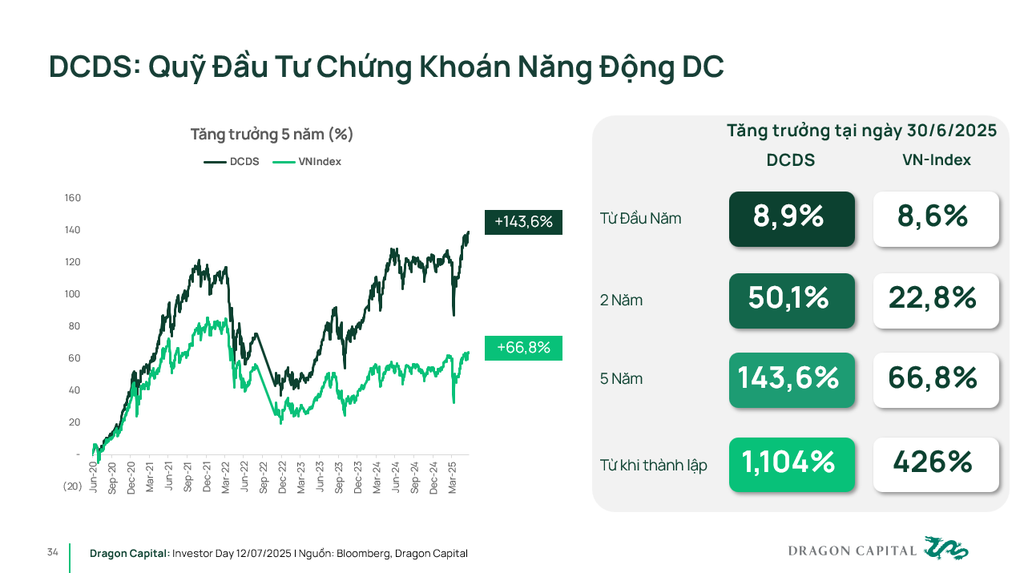

This investment strategy has been proven through the actual results of funds managed by Dragon Capital. A typical example is the strong breakthrough of DC Dynamic Securities Investment Fund (DCDS).

Data from Fmarket shows that as of July 8, DCDS recorded an impressive investment performance of 51.87% within 2 years. In the last 3 years, this fund continued to maintain its leading position with a profit rate of 57.27%.

In 2024 alone, DCDS recorded a growth rate of 23.9%, outperforming the growth of the VN-Index by 11.8%. This result comes from the decision to intelligently allocate assets to sectors with strong growth such as banking, software and retail.

With an average 10-year compound return of 14.6% per year, DCDS has not only delivered top investment performance over the past decade, but has also become the number one choice for 7 out of 10 new investors at Dragon Capital. The fund also leads the market in community size with more than 35,000 investors participating.

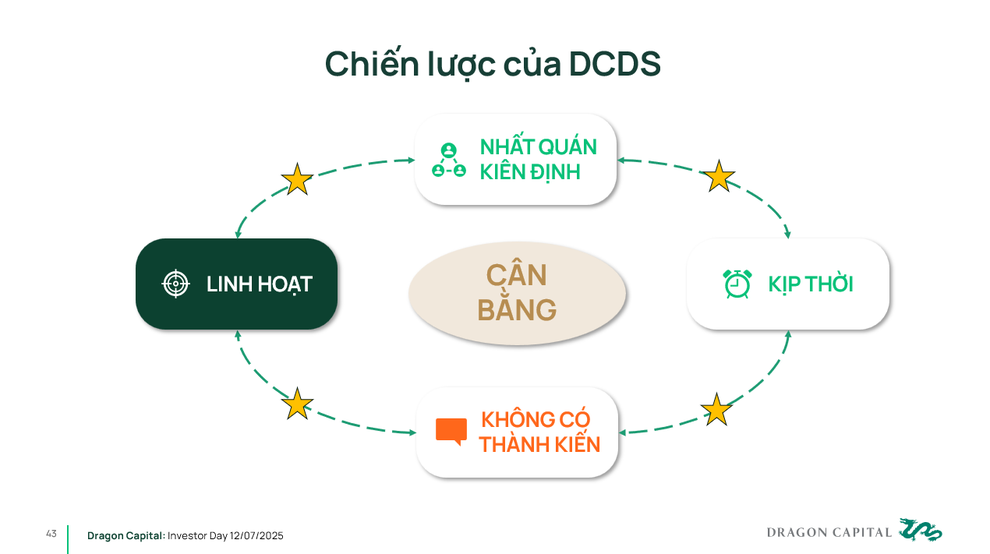

One of the factors that makes DCDS different is its unbiased investment philosophy, which complements the four core principles: consistency, steadfastness; timeliness and flexibility. In investing, maintaining an open, unbiased mindset will help investors improve their adaptability, turning market crises into golden opportunities to accumulate valuable assets.

Source: https://dantri.com.vn/kinh-doanh/suc-manh-noi-tai-dong-luc-chinh-tang-truong-ben-vung-cho-kinh-te-viet-nam-20250715201918075.htm

![[Maritime News] More than 80% of global container shipping capacity is in the hands of MSC and major shipping alliances](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/16/6b4d586c984b4cbf8c5680352b9eaeb0)

Comment (0)