On the afternoon of June 26, the National Assembly passed a Resolution on exemption of agricultural land use tax. The Resolution takes effect from January 1, 2026.

According to the resolution, households, individuals and organizations directly using land for agricultural production are exempt from this land tax until the end of 2030.

In case the State assigns an agricultural land area to an organization for management but does not directly use the land for agricultural production but assigns it to another organization or individual to receive a contract for agricultural production, 100% of the agricultural land use tax must be paid during the period the State has not yet reclaimed the land.

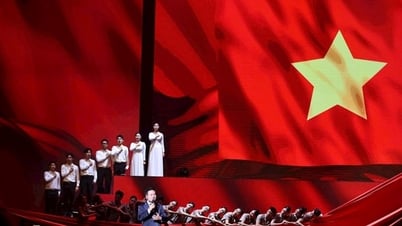

The National Assembly has passed a Resolution of the National Assembly on exemption of agricultural land use tax (Photo: National Assembly Media).

Previously, reporting on the explanation, acceptance and revision of this draft resolution, Chairman of the Economic and Financial Committee Phan Van Mai said that accepting the opinions of National Assembly deputies, the National Assembly Standing Committee (NASC) requested the Government, if necessary, to study and propose amendments to the Law on Agricultural Land Use Tax to suit the reality and management requirements in the new period.

Some opinions proposed not to exempt tax for cases of land being left fallow, not being used for production, or not being used for the right purpose. Some opinions proposed to stipulate specific principles, conditions, and criteria for tax exemption, and at the same time have sanctions to handle cases of taking advantage of policies to use land for the wrong purpose or accumulate land and leave land fallow.

Regarding this content, the Standing Committee of the National Assembly said that as the opinions of the National Assembly deputies have stated, in reality, the situation of using land for the wrong purpose, leaving land fallow, causing waste of resources is still quite common.

According to the Standing Committee of the National Assembly, specifying the criteria to determine the right subjects to be exempted from tax or not exempted from tax for abandoned land or land used for the wrong purpose requires time for research and appropriate preparation. The draft Resolution on continuing to exempt agricultural land use tax submitted by the Government to the National Assembly at this time has not resolved the above issues.

In order for the draft Resolution to be issued promptly and avoid interruptions in policy implementation, the Standing Committee of the National Assembly requests the National Assembly to keep the draft resolution on the subjects eligible for tax exemption.

However, the Standing Committee of the National Assembly requested the Government to conduct a full and comprehensive assessment of the current situation and effectiveness of agricultural land use in recent times, the effectiveness of the agricultural land use tax exemption policy on agricultural economic development and farmers' lives, in order to develop appropriate policy solutions.

In the immediate future, it is recommended that the Government pay attention to fully guiding the provisions of the Land Law and have practical solutions to ensure that there is no waste or waste of land resources, prevent and handle cases of policy abuse, and improve the efficiency of land management and use in general and agricultural land in particular.

There are suggestions to consider and expand the tax exemption subjects. The Standing Committee of the National Assembly said that according to current regulations, the scope of application of the agricultural land use tax exemption policy is households, individuals and organizations directly using land for agricultural production.

The Standing Committee of the National Assembly requests the National Assembly to keep the draft resolution as it is, not to expand the beneficiaries of the agricultural land use tax exemption policy.

Some opinions say that the draft decree of the Government stipulating exemption for land for growing rice from one crop or more or land for growing annual crops with at least one rice crop is not suitable and not feasible for land for growing annual crops. It is recommended that the Government provide specific guidance to avoid taking advantage of the policy.

The Standing Committee of the National Assembly requested the Government to clarify the issues raised by National Assembly deputies, take responsibility for issuing decrees, ensure handling of problems (if any) and avoid taking advantage of policies.

The Standing Committee of the National Assembly requested the Government to pay attention to the guidance contents related to land for annual crops with at least one rice crop, tax exemption for households living in border areas... ensuring full regulations on the contents that need guidance, avoiding inconsistent understandings, facilitating the implementation process.

Dantri.com.vn

Source: https://dantri.com.vn/xa-hoi/quoc-hoi-chot-mien-thue-dat-nong-nghiep-them-5-nam-20250626144510746.htm

Comment (0)