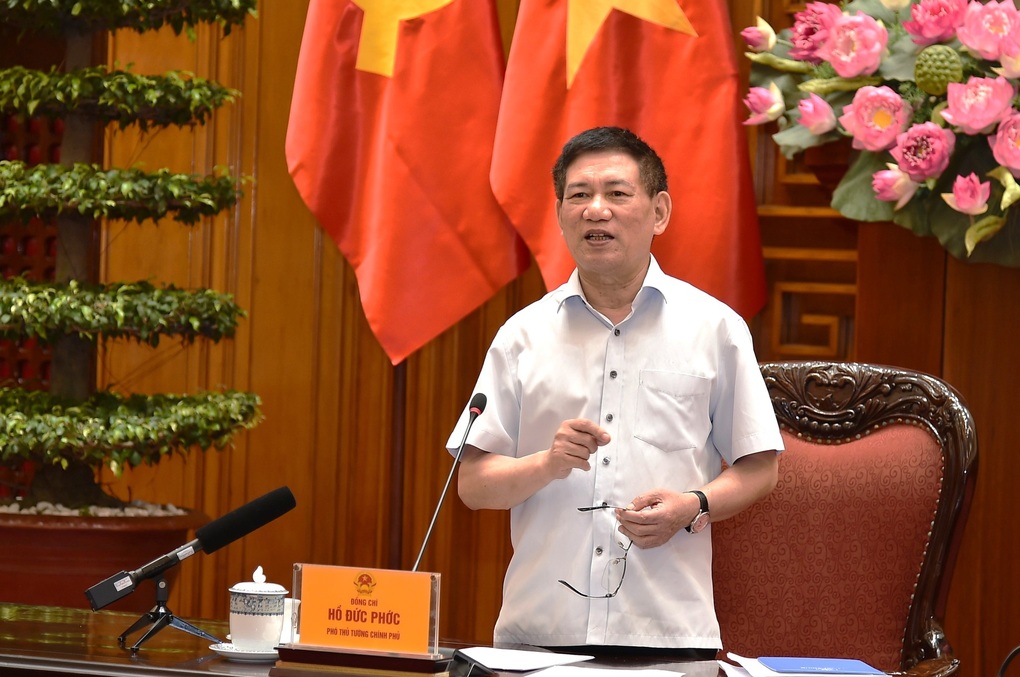

On the afternoon of July 31, Deputy Prime Minister Ho Duc Phoc met with ministries, branches, associations, securities and real estate enterprises on the draft Law on Personal Income Tax (replacement).

Speaking at the opening of the meeting, Deputy Prime Minister Ho Duc Phoc emphasized the importance and impact of the draft Law on Personal Income Tax (replacement) on people's lives as well as production and business activities of enterprises and the stock market, which has received great public attention.

The Deputy Prime Minister requested that associations, businesses, and representatives of ministries and branches give frank and responsible comments to contribute to completing the draft law with the highest quality before submitting it to competent authorities for consideration and decision.

According to the report of the Ministry of Finance , the purpose of promulgating the Law on Personal Income Tax (replacement) is to expand the tax base; review, amend and supplement regulations on taxpayers and taxable income.

Thereby, research to adjust the threshold as well as the personal income tax rate for some types of income to ensure consistency with the nature of each type of income and the regulatory goals of personal income tax.

At the meeting, representatives of associations, corporations and businesses gave comments on issues related to calculating personal income tax from real estate and securities.

Specifically, representatives of the parties gave their opinions on the timing of calculating personal income tax on income from dividends in cash and shares; calculating tax on securities transactions, bonus shares, and transfers of listed securities; tax calculation methods; applying personal income tax to investment activities through investment funds; etc.

Representatives of associations and enterprises also gave their opinions on calculating personal income tax related to capital contribution in real estate; tax rates and roadmap for calculating personal income tax related to real estate transfer; tax solutions to keep real estate prices at a reasonable level, consistent with real life, bringing the real estate market to develop healthily and sustainably, preventing speculation and price inflation...

Associations and businesses also contributed ideas on adjusting the family deduction level to suit the living standards of the majority of people, the reality of the country and each province...

Deputy Prime Minister Ho Duc Phoc met with ministries, branches, associations, securities and real estate enterprises on the draft Law on Personal Income Tax (Photo: VGP).

Representatives of the Ministry of Construction, Ministry of Home Affairs, Ministry of Justice , and Vietnam General Confederation of Labor also emphasized the need for personal income tax policies to be designed so that the real estate market can develop healthily and effectively, ensuring harmony of interests among entities.

Representatives of ministries and branches also gave comments on contents such as supplementing other tax-exempt income; reasonable securities tax methods to develop the market; taxing personal income from salary sources; proposing to assign the Government to regulate family deductions...

At the meeting, Deputy Minister of Finance Cao Anh Tuan thanked the opinions of associations, businesses and ministries, and discussed and explained some contents that representatives of businesses and associations were interested in contributing.

Concluding the meeting, Deputy Prime Minister Ho Duc Phoc thanked the businesses and associations for their very useful, important, frank and highly constructive comments.

Deputy Prime Minister Ho Duc Phoc emphasized that the Personal Income Tax Law involves many people and has a profound impact on people's lives and business and production activities of enterprises, so it needs to be carefully studied and assessed when designing and proposing new regulations and policies.

The Government leader requested the Ministry of Finance to study and absorb reasonable comments, especially those related to real estate transfer tax; stocks, dividends, bonus shares; family deductions, etc. to design truly suitable regulations, develop a draft of the Law on Personal Income Tax (replacement) with the highest quality, submit it to competent authorities for consideration and decision, and ensure feasibility after promulgation.

Source: https://dantri.com.vn/kinh-doanh/pho-thu-tuong-hop-voi-doanh-nghiep-ve-tinh-thue-chuyen-nhuong-bds-co-phieu-20250731181912836.htm

Comment (0)