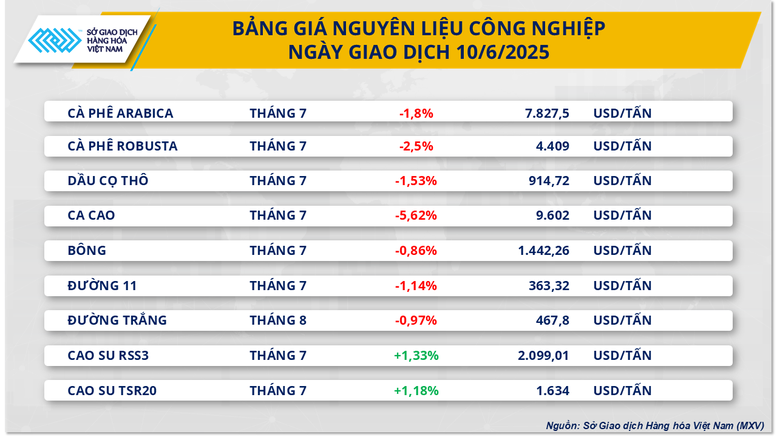

Cocoa prices plunge, palm oil market under great pressure

At the end of yesterday's trading session, the industrial raw material group was deep in red. Cocoa was the commodity that recorded the sharpest decline in the group, losing more than 5.6% to 9,602 USD/ton - the lowest level in the past week. In addition, the price of Malaysian palm oil also decreased by more than 1.5% to 914 USD/ton.

According to MXV, relatively favorable weather conditions in West African production areas and a strong recovery in inventories were the main factors that put pressure on cocoa prices in yesterday's trading session. According to statistics on Monday, cocoa inventories monitored by ICE at US ports increased to the highest level in the past 9 months, more than 2.25 million bags.

For Malaysian palm oil, supply pressure continues to weigh on prices. According to the Malaysian Palm Oil Performance Report, the country’s palm oil inventories rose for the third consecutive month in May, reaching 1.99 million tonnes – an eight-month high.

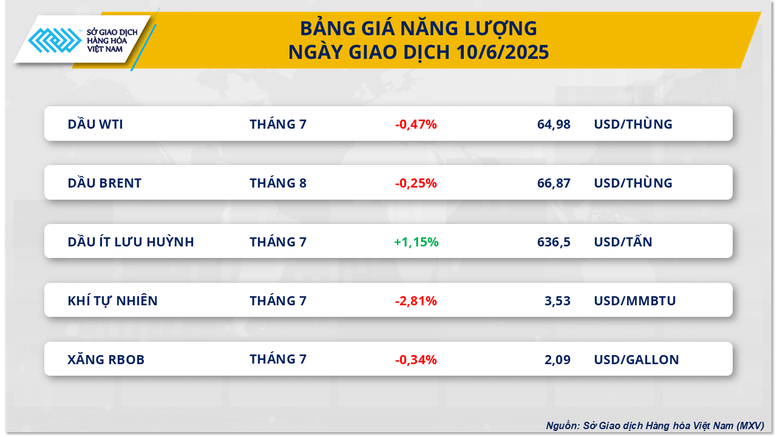

Crude oil prices turn to weaken

According to MXV, strong selling pressure also occurred in the world energy market in yesterday's trading session. In the context that investors are still waiting for the results of negotiations between the US and China, forecasts from the World Bank and the US Energy Information Administration (EIA) have pushed oil prices down.

Specifically, Brent oil price has slightly decreased by about 0.25%, down to 66.87 USD/barrel. Similarly, WTI oil price also decreased to 64.98 USD/barrel, down about 0.47%.

While markets view any easing of trade tensions between the world’s two largest economies as a positive sign, investors are still waiting for concrete results from both sides to assess the real impact of this round of negotiations on oil prices and global commodity markets. In that context, concerns about the world economic outlook remain, with the World Bank recently forecasting global growth in 2025 to fall to its lowest level since 2008, excluding recessions, mainly due to trade tensions and increased policy uncertainty.

According to the World Bank's June Global Economic Prospects report, the global economic growth forecast for 2025 has been lowered to 2.3%, down from 2.7% in the January report and the lowest level since 2008 if excluding the years of economic recession.

The World Bank said that rising tariffs and policy uncertainty have created “significant headwinds” for most economies, weakening the outlook for global recovery. While it does not predict deflation, the organization warned that growth of 2.3% would be the weakest since the 2008 global financial crisis, excluding recession years. This negative macroeconomic backdrop is expected to lead to a decline in energy demand, thereby increasing pressure on international oil prices.

Also yesterday, the US Energy Information Administration (EIA) released its June Short-Term Energy Outlook, predicting that oil prices will continue to decline in the coming time. Accordingly, both key commodities, Brent crude and WTI crude, are forecast to maintain their downward trend for the rest of 2025, with averages of about $61/barrel and $57/barrel, respectively. EIA stated that the main reason comes from the sharp increase in global crude oil reserves, mainly due to the world's supply continuing to grow beyond demand, thereby creating downward pressure on oil prices.

Source: https://baochinhphu.vn/luc-ban-manh-quay-lai-mxv-index-cham-dut-chuoi-tang-diem-1022506110954215.htm

![[Photo] National Assembly Chairman Tran Thanh Man receives Chairman of Morocco-Vietnam Friendship Association](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/26/b5fb486562044db9a5e95efb6dc6a263)

Comment (0)