Special deposit interest rates for VIP customers with deposit balances of hundreds of billions of VND, laddered deposit interest rates to encourage customers to deposit large amounts of money... are policies maintained by many banks to attract savings deposits.

In addition, the policy of adding interest rates for depositors is also maintained by some banks.

According to a survey of current banks, Vietnam Technological and Commercial Joint Stock Bank (Techcombank) and Southeast Asia Commercial Joint Stock Bank ( SeABank ) are two banks that add deposit interest rates to customers at certain terms.

Techcombank recently announced an additional interest rate of 0.5%/year for the first 3, 6, and 12-month term savings deposits from August 11, 2025.

Applicable subjects are individual customers who have not held any savings deposits, term deposits, or deposit certificates at Techcombank since January 1, 2025; customers with newly opened and first effective deposits on the system.

In addition to the listed interest rate for deposits according to Techcombank's regulations at each period, newly opened deposits and first recorded in effect on the system will receive an additional 0.5%/year interest rate, applied to Phat Loc savings products, Phat Loc online deposits, flexible principal withdrawal deposits, and Regular savings with interest paid at the end of the term.

Techcombank said the guaranteed additional interest rate does not exceed 4.4%/year for 3-month terms, 5.3%/year for 6-month terms and 5.5%/year for 12-month terms.

Accordingly, the online mobilization interest rate after adding at Techcombank with terms of 3 months, 6 months, 12 months is 4.25%/year, 5.15%/year and 5.35%/year respectively.

Among the banks that maintain the policy of adding interest rates for depositors, SeABank has long maintained this policy by adding preferential interest rates of up to 0.5%/year when depositing for 6-month, 12-month, and 13-month terms when making online savings deposits.

Accordingly, the online savings interest rate after adding interest for a 6-month term is 4.45%/year, and for a 12-13 month term is 5.2%/year.

In addition to offering additional interest rates to depositors for certain terms, many banks also maintain a tiered savings interest rate policy. Customers who deposit larger savings balances will receive higher savings interest rates than those for regular deposits (under 100 million or under 1 billion VND, depending on the bank).

Banks applying the ladder deposit interest rate policy include: LPBank, OCB,ACB , VPBank, Bac A Bank, VIB, GPBank, MB (savings at the counter) and PVCombank (savings at the counter).

Notably, Techcombank recently no longer maintains this policy by posting only one interest rate table for different deposit levels.

Meanwhile, some banks have special policies for VIP customers, typically ACB, MSB, Vikki, ABBank, Viet A Bank, PVCombank, LPBank, HDBank.

Special interest rates applied by banks are usually from 6%/year.

Notably, Viet A Bank announced the mobilization interest rate for the Dac Tai Savings product with the highest mobilization interest rate of up to 6.8%/year. The Dac Loc Savings and Dac Loi Savings products are listed by this bank with the highest interest rates of 6.3%/year and 6.4%/year, respectively.

| ONLINE DEPOSITS INTEREST RATES AT BANKS ON AUGUST 25, 2025 (%/year) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| AGRIBANK | 2.4 | 3 | 3.7 | 3.7 | 4.8 | 4.8 |

| BIDV | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETINBANK | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETCOMBANK | 1.6 | 1.9 | 2.9 | 2.9 | 4.6 | 4.6 |

| ABBANK | 3.1 | 3.8 | 5.3 | 5.4 | 5.6 | 5.4 |

| ACB | 3.1 | 3.5 | 4.2 | 4.3 | 4.9 | |

| BAC A BANK | 3.8 | 4.1 | 5.25 | 5.35 | 5.5 | 5.8 |

| BAOVIETBANK | 3.5 | 4.35 | 5.45 | 5.5 | 5.8 | 5.9 |

| BVBANK | 3.95 | 4.15 | 5.15 | 5.3 | 5.6 | 5.9 |

| EXIMBANK | 4.3 | 4.5 | 4.9 | 4.9 | 5.2 | 5.7 |

| GPBANK | 3.95 | 4.05 | 5.65 | 5.75 | 5.95 | 5.95 |

| HDBANK | 3.85 | 3.95 | 5.3 | 5.3 | 5.6 | 6.1 |

| KIENLONGBANK | 3.7 | 3.7 | 5.1 | 5.2 | 5.5 | 5.45 |

| LPBANK | 3.6 | 3.9 | 5.1 | 5.1 | 5.4 | 5.4 |

| MB | 3.5 | 3.8 | 4.4 | 4.4 | 4.9 | 4.9 |

| MBV | 4.1 | 4.4 | 5.5 | 5.6 | 5.8 | 5.9 |

| MSB | 3.9 | 3.9 | 5 | 5 | 5.6 | 5.6 |

| NAM A BANK | 3.8 | 4 | 4.9 | 5.2 | 5.5 | 5.6 |

| NCB | 4 | 4.2 | 5.35 | 5.45 | 5.6 | 5.6 |

| OCB | 3.9 | 4.1 | 5 | 5 | 5.1 | 5.2 |

| PGBANK | 3.4 | 3.8 | 5 | 4.9 | 5.4 | 5.8 |

| PVCOMBANK | 3.3 | 3.6 | 4.5 | 4.7 | 5.1 | 5.8 |

| SACOMBANK | 3.6 | 3.9 | 4.8 | 4.8 | 5.3 | 5.5 |

| SAIGONBANK | 3.3 | 3.6 | 4.8 | 4.9 | 5.6 | 5.8 |

| SCB | 1.6 | 1.9 | 2.9 | 2.9 | 3.7 | 3.9 |

| SEABANK | 2.95 | 3.45 | 3.95 | 4.15 | 4.7 | 5.45 |

| SHB | 3.5 | 3.8 | 4.9 | 5 | 5.3 | 5.5 |

| TECHCOMBANK | 3.45 | 4.25 | 5.15 | 4.65 | 5.35 | 4.85 |

| TPBANK | 3.7 | 4 | 4.9 | 5 | 5.3 | 5.6 |

| VCBNEO | 4.35 | 4.55 | 5.6 | 5.45 | 5.5 | 5.55 |

| VIB | 3.7 | 3.8 | 4.7 | 4.7 | 4.9 | 5.2 |

| VIET A BANK | 3.7 | 4 | 5.1 | 5.3 | 5.6 | 5.8 |

| VIETBANK | 4.1 | 4.4 | 5.4 | 5.4 | 5.8 | 5.9 |

| VIKKI BANK | 4.15 | 4.35 | 5.65 | 5.65 | 5.95 | 6 |

| VPBANK | 3.7 | 3.8 | 4.7 | 4.7 | 5.2 | 5.2 |

Source: https://vietnamnet.vn/lai-suat-ngan-hang-hom-nay-25-8-2025-dieu-kien-de-dang-de-nhan-them-lai-suat-2435668.html

![[Photo] Hanoi: Authorities work hard to overcome the effects of heavy rain](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/380f98ee36a34e62a9b7894b020112a8)

![[Photo] Multi-colored cultural space at the Exhibition "80 years of the journey of Independence - Freedom - Happiness"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/fe69de34803e4ac1bf88ce49813d95d8)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

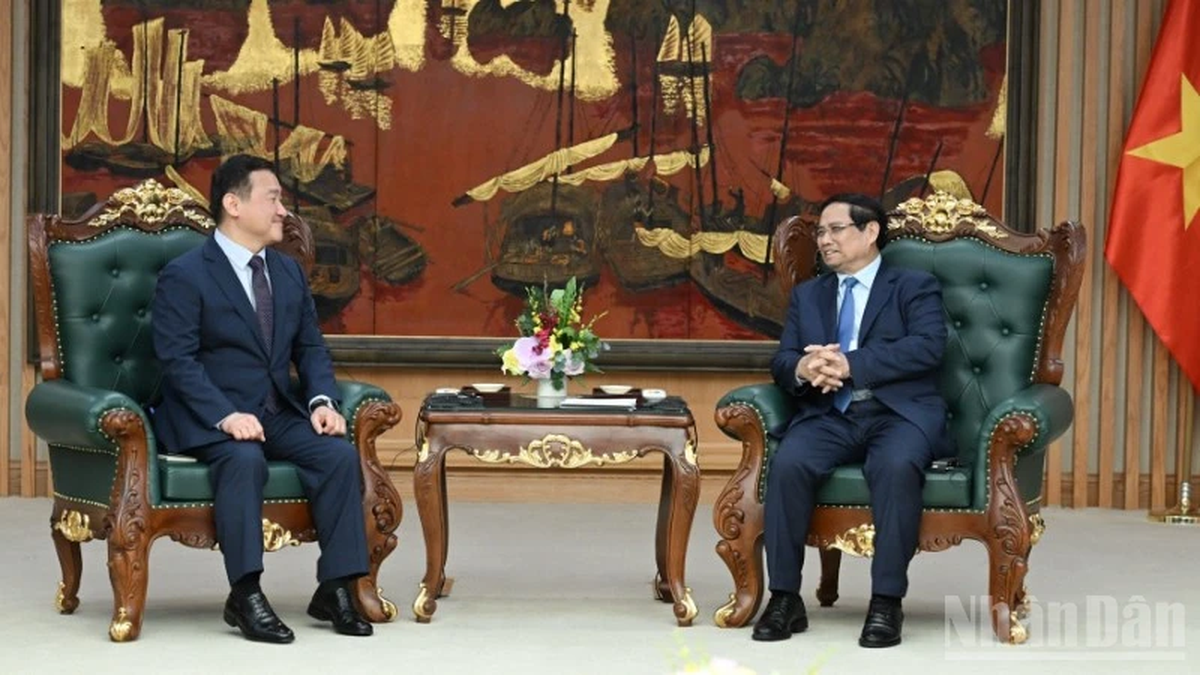

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

Comment (0)