Ms. Nguyen Thi Thanh Hang, Head of the International Tax Policy Department (Tax Department), said that from next year, the tax sector will classify business households and individual businesses according to revenue to apply management methods.

On June 19, the Tax Department held a conference to discuss solutions to support taxpayers in order to synchronously implement the Resolution on developing the private economic sector. From next year, the tax sector will classify business households and individuals based on revenue to apply management methods.

Speaking at the conference, Deputy Director of the Tax Department Mai Son affirmed that developing the private economic sector is a major policy of the Party and State.

This is clearly shown in Resolution No. 68-NQ/TW of the Politburo on private economic development, specified in Resolution No. 198/2025/QH15 of the National Assembly on a number of special mechanisms and policies for private economic development and the Government's Action Plan in Resolution No. 138/NQ-CP.

These are strategic, comprehensive and consistent orientations and plans, affirming the important role of the private economy as one of the main driving forces of the socialist-oriented market economy, which needs to be promoted for comprehensive, sustainable and transparent development.

According to Mr. Mai Son, in recent times, the tax sector has actively implemented many synchronous activities from policy development to implementation at the grassroots level, with the motto of "taking taxpayers as the center of service."

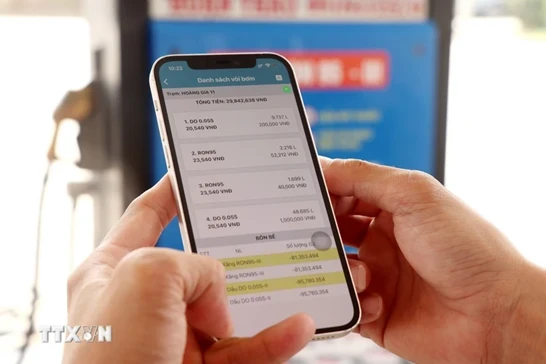

In particular, to ensure effective implementation of new regulations in Decree 70/2025/ND-CP, the industry has launched a "Peak Month to Support Households and Individual Businesses", focusing on providing guidance, removing difficulties, promoting the use of electronic invoices from cash registers, and supporting taxpayers to convert their models in accordance with new regulations.

Ms. Nguyen Thi Thanh Hang, Head of the International Tax Policy Department (Tax Department), said that from next year, the tax sector will classify business households and individual businesses according to revenue to apply management methods.

Accordingly, Group 1 is below the taxable revenue threshold (under 200 million VND/year). Group 2 is from 200 million VND/year to under 1 billion VND/year. Group 3 is from 1 - 3 billion VND/year (for agriculture , industry, construction) and 1 - 10 billion VND/year (for trade and service). Group 4 is over 10 billion VND/year.

The Tax Department also said that after the tax is abolished, business households in groups 1 and 2 are encouraged to use electronic invoices. The roadmap for applying electronic invoices with tax authority codes or electronic invoices generated from cash registers for business households in group 2 is from 2027 to 2028.

Group 3 and Group 4 business households are required to use electronic invoices with tax authority codes or electronic invoices generated from cash registers when selling retail.

At the conference, a representative of the Tax Department said that in order to prepare for the elimination of lump-sum tax, and for business households to switch to self-declaration and tax payment, the tax sector has set out specific directions, tasks and key solutions to implement policies to encourage business households to become enterprises.

Accordingly, the tax sector identified 6 key groups of tasks, including: innovating management thinking; perfecting tax institutions and policies towards transparency and fairness; promoting digital transformation; strengthening compliance management; supporting small and micro enterprises, business households and promoting the role of accompanying and supporting taxpayers.

Along with that, it is proposed to amend and supplement the relevant Tax and Tax Administration Laws in the direction of completely abolishing the lump-sum tax collection mechanism for business households and individuals, switching to applying the mechanism of self-declaration and self-payment of taxes along with the implementation of accounting books, invoices and documents like enterprises.

This is a major step forward in modernizing tax administration, helping to improve transparency, fairness and encourage business households to convert to enterprise models.

In addition, continue to simplify tax administrative procedures, simplify the tax declaration and payment process for business households and individuals: reduce at least 30% of administrative procedure processing time, at least 30% of legal compliance costs, at least 30% of business conditions and continue to reduce them strongly in the following years.

To support taxpayers in the transition process, the tax sector is closely coordinating with associations, consults, and criticizes to perfect tax policy mechanisms in line with the orientation of private economic development.

At the same time, coordinate with technology enterprises to design sales management software solutions, accounting software, and electronic invoices suitable for each industry group and business scale, ensuring ease of use, reasonable costs, and convenient implementation./.

Source: https://baolangson.vn/hai-nhom-ho-kinh-doanh-thuoc-dien-bat-buoc-su-dung-hoa-don-dien-tu-5050640.html

![[Video] Forecast of benchmark scores of mid-ranking universities to drop sharply](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/18/be12c225d0724c00a7e25facc6637cb9)

![[Infographic] In 2025, 47 products will achieve national OCOP](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/16/5d672398b0744db3ab920e05db8e5b7d)

Comment (0)