Gold's bullish reversal

World gold prices made an impressive comeback in the last trading session of the week (August 23), erasing concerns about the previous sharp decline. Specifically, spot gold on the Comex floor increased by 33 USD/ounce, equivalent to 1%, closing at 3,373 USD/ounce. During the week, this precious metal had plummeted, at times down to 3,310 USD/ounce due to profit-taking pressure from investors and expectations of a stable US economy .

However, two major "shocks" pushed gold prices back up, affirming its position as a safe haven asset.

The first factor is the clear easing signal from the US Federal Reserve (Fed). In a speech at the Jackson Hole conference on August 22, Fed Chairman Jerome Powell emphasized the "shifting balance of risks" between employment and inflation, with the risk of economic weakness increasing due to tariff and trade policies.

Mr. Powell acknowledged that interest rates are in tight territory and the Fed can adjust its stance if needed, paving the way for a rate cut in September. This is the first time in a long time that the Fed has sent such a clear "dovish" message, despite the risk of inflation flare up again.

Many financial and commodity markets in the US and around the world reacted positively: the US Dow Jones industrial stock index increased by more than 600 points in the last session of the week, US bond yields fell sharply. The gold market also benefited.

World gold prices increase strongly again. Photo: Kitco

The second factor is the worsening prospects for peace in Ukraine, which has heightened geopolitical tensions. Just a week after the summit between Mr. Trump and Mr. Putin in Alaska on August 15, US President Donald Trump on August 22 threatened to impose “very big sanctions or very big tariffs, or both” if there was no peace progress within two weeks.

The momentum in negotiations appears to have dissipated, leaving the parties back at square one. This has increased uncertainty, supporting gold as a hedge against risk.

In addition, gold prices were also pushed up by a sharp increase in crude oil (WTI oil rose to 63.66 USD/barrel due to concerns about supply from the Middle East and Russia) and a weakening USD. The DXY index fell 0.9% to 97.73 points in the session on August 22, making gold cheaper for foreign investors.

In the domestic market, SJC gold prices also "heated up" following the world trend. In the last session of the week, Saigon Jewelry Company (SJC) listed the buying price at 125.6 million VND/tael and the selling price at 126.6 million VND/tael, an increase of 1.2 million VND compared to the previous session - a new record high.

The price of plain round gold rings at Doji also peaked at 121.8 million VND/tael (sold).

The gap between SJC and world gold prices remains high, at around VND17.7 million per tael, reflecting strong domestic demand. Since the beginning of the year, world gold prices have increased by 28.5%, while SJC gold has increased by more than 50%.

Will SJC go up to 130 million VND/tael?

The world gold price is facing many strong supporting factors, but also faces the risk of correction. Experts from major financial institutions predict that the increase could last until the end of 2025, with an average of 3,500-3,700 USD/ounce, thanks to the Fed's easing and geopolitical instability.

However, the possibility of stagflation and softening trade could cap gold's rally.

First, the prospect of a Fed rate cut is a key driver. Powell at Jackson Hole acknowledged that the downside risks to the economy are heightened, even as inflation could flare up as tariffs “spillover through supply chains.” The Fed is heading into an easing cycle, with its benchmark interest rate currently at 4.25% to 4.5%.

Although investors had already priced in some of the September 17 rate cut, new signals suggest the Fed is becoming more dovish, making gold, a non-yielding asset, more attractive. Pressure from President Trump has been mounting: he has repeatedly criticized the Fed, called for sharp rate cuts, even considered appointing the next Fed chair early, and recently threatened to fire Governor Lisa Cook over allegations of fraud.

The weakening USD is also a positive factor. The DXY index has fallen not only due to the Fed but also the trend of de-dollarization (countries like China and Russia increasing their gold reserves), the US budget deficit is increasing. Central banks and ETFs continue to buy gold: according to the World Gold Council, net gold purchases in the first half of 2025 hit a record, with ETFs like SPDR increasing their holdings when the price dipped below $3,300.

On the other hand, the tariff war eased: Trump signed an executive order to postpone tariffs on China for another 90 days, Canada withdrew retaliatory tariffs, opening the way for negotiations. This reduced the risk of inflation, which could cause gold to lose momentum.

Most experts from major financial institutions are optimistic about gold. JP Morgan Research forecasts gold to average $3,675 an ounce in the fourth quarter of 2025, rising to $4,000 in mid-2026, thanks to central bank and investor demand.

Goldman Sachs says central demand will push prices to new records. InvestingHaven sees gold hitting $3,500 by 2025, peaking at $5,155 by 2030.

UBS also made a forecast, with a target of 3,600 USD by the end of the first quarter of 2026 due to Ukraine tensions and the risk of US economic stagnation.

Domestically, SJC and gold ring prices are further supported by the USD/VND exchange rate exceeding 26,500 VND - a record level due to increased imports and foreign capital withdrawal. If world gold hits 3,400-3,500 USD and VND weakens further, SJC could reach 130 million VND/tael in the fourth quarter. However, if the Fed delays cutting due to inflation, prices could adjust downward.

Overall, gold remains the "king of safe haven" amid uncertainty, with many forecasts of a 5-10% increase by the end of the year, with the focus on the Fed's actions and the situation in Ukraine as well as the tariff war between the US and other countries. Domestically, SJC gold prices are not far from the 130 million VND/tael mark.

US - Russia has not reached an agreement: What is the forecast for the upcoming gold price? The world gold price experienced the sharpest decline since June in the week of August 11-15 amid mixed US inflation data. The US - Russia summit ended without reaching an agreement on Ukraine, which could boost gold demand.

Source: https://vietnamnet.vn/hai-cu-soc-cuoi-tuan-du-bao-gia-vang-sjc-co-len-130-trieu-dong-2435460.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

![[Photo] Multi-colored cultural space at the Exhibition "80 years of the journey of Independence - Freedom - Happiness"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/fe69de34803e4ac1bf88ce49813d95d8)

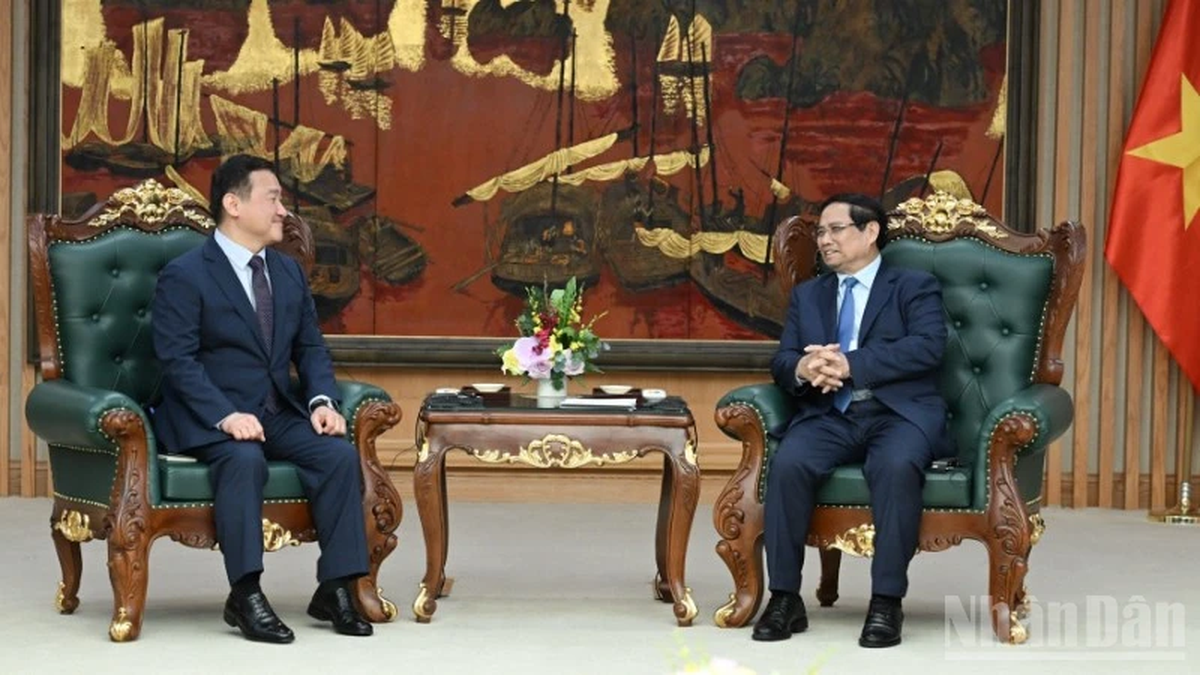

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

Comment (0)