Latest 12-month savings interest rates

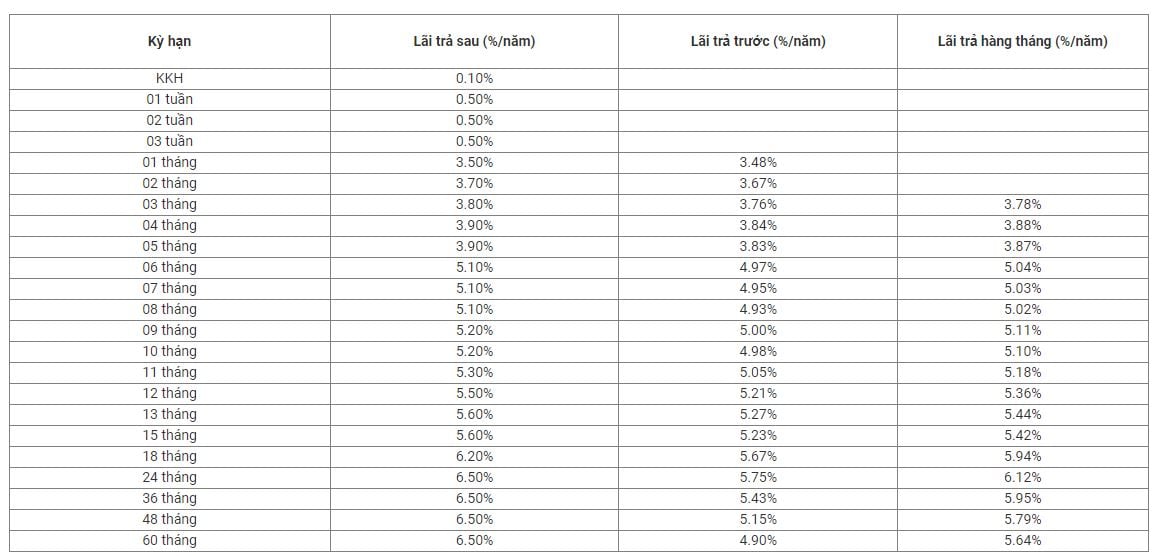

According to Lao Dong reporter (October 7, 2023), at 20 banks today, 12-month savings interest rates are fluctuating from 4.2 - 11%.

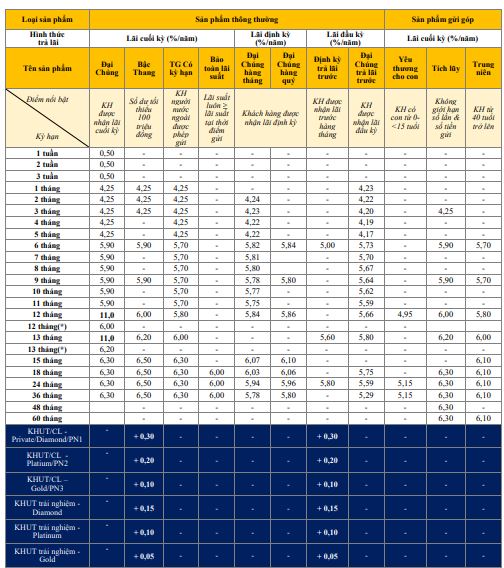

In particular, PVcomBank's highest interest rate for a 12-month term is 11%, when the minimum deposit amount is 2,000 billion VND. In case customers deposit savings online, PVcomBank's highest interest rate for this term is 6.4%.

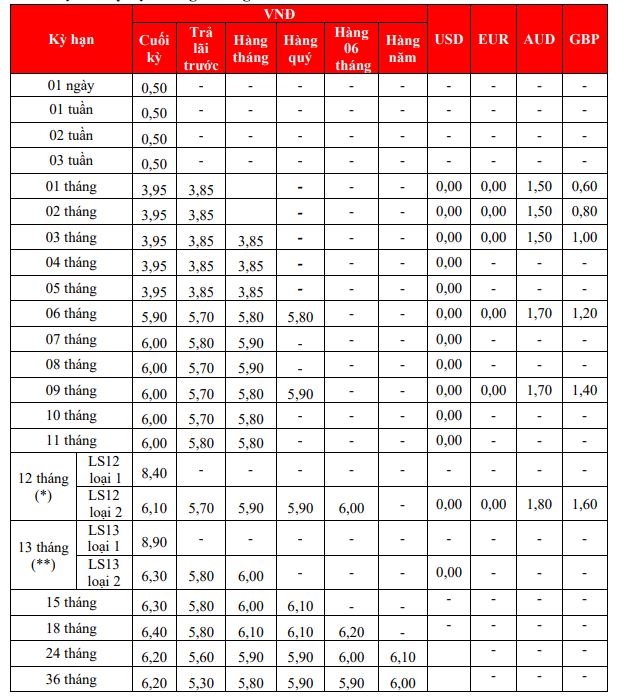

Next is HDBank , with a 12-month term interest rate of up to 8.4%. Customers are eligible for high interest rates when depositing savings of 300 billion VND or more. In addition, other cases receive interest rates from 6.0 - 6.1%.

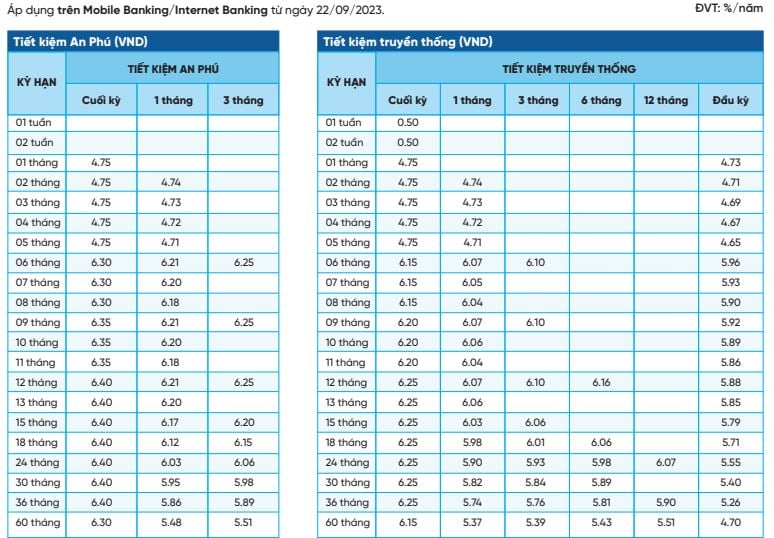

At NCB, the 12-month interest rate is 6.4% when customers deposit savings online. In case of opening a book at the counter, NCB's interest rate is 6.3%.

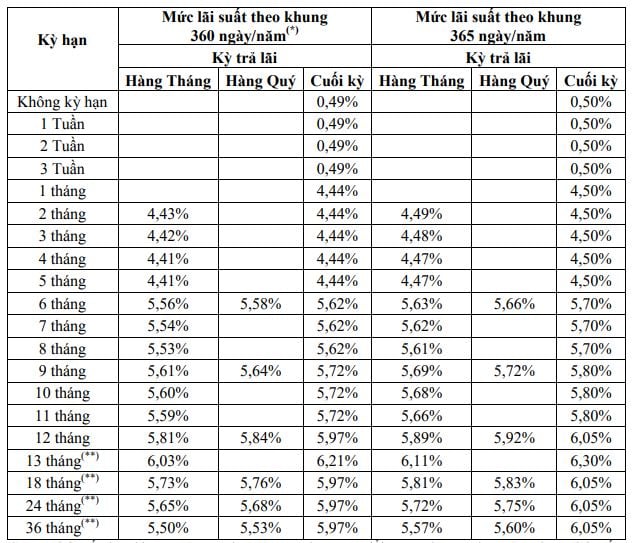

In addition, readers can refer to interest rates of other banks below.

NamABank interest rate:

MB interest rate:

TPBank Interest Rates

Deposit 700 million VND in savings, how much interest will you receive after 12 months?

To quickly calculate bank interest, you can apply the interest calculation formula:

Interest = Deposit x interest rate/12 months x actual number of months of deposit.

For example, if you save 700 million at bank A, with an interest rate of 6.4%, the interest received is as follows: 700 million x 6.4%/12 x 12 months = 44.8 million VND.

With the same amount and term above, if you save at bank B with an interest rate of 4.2%/year, the amount you can receive will be: 700 million VND x 4.2%/12 x 12 months = 29.4 million VND.

* Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

Source

Comment (0)