The Vietnam Banks Association (VNBA) updated report on individual deposit interest rates of 36 banks last week recorded stability. Of which, 7 banks adjusted interest rates, of which 5 banks decreased and 2 banks increased interest rates for some terms.

There are 3 banks that have reduced deposit interest rates both at the counter and online with a reduction of 0.1-0.2 percentage points including Bac A Bank , VPBank and Eximbank.

In particular, VPBank reduced 0.2 percentage points for all terms from 3-36 months. Currently, customers who deposit 10 billion VND or more at VPBank will receive the highest interest rate of 5.5%/year for terms of 24-36 months.

On the other hand, HDBank increased sharply by 0.6 percentage points when customers deposit online for a 9-month term (both at the counter and online) to 5.2%/year at the counter and 5.3%/year. Currently, the highest rate at this bank is 6.1%/year for an 18-month term applied to customers depositing online.

Last week, 5 banks reduced and 2 banks increased deposit interest rates.

GPBank increased 0.2 percentage points for 1-3 month term to 3.45% - 3.55%/year. Currently, the highest interest rate at this bank is 5.95%/year for 13-36 month term when deposited online.

According to the reporter, it is not uncommon for customers to have a savings interest rate of over 6%/year when depositing for a long time. Some banks apply sky-high interest rates but with conditions that are not easy to meet. For example, MSB applies a mobilization interest rate of 7% - 8%/year when customers deposit from 500 billion VND; HDBank has an interest rate of 7.7% - 8.1%/year when customers deposit from 500 billion VND or more...

Some banks such as PVcomBank offer interest rates of up to 9%/year with the condition that customers must deposit from 2,000 billion VND for a term of 12-13 months, applied at the counter. The highest interest rate recorded on the market up to now is 9.65%/year when customers deposit at the counter, term of 13 months with an amount of 1,500 billion VND, at ABBank.

According to the State Bank, by mid-June, credit growth of the banking system was around 6.9% while new capital mobilization increased by around 4%.

To meet the economy's increasing credit demand, a number of banks are actively implementing incentive programs to attract idle cash flow.

For example, BVBank has just launched a series of attractive incentives for customers who deposit savings, adding interest rates of up to 0.4% when depositing in groups; adding bonus points to receive a refund of up to 150,000 VND. In addition, BVBank also continues to deploy online deposit certificates on Digimi digital bank with interest rates of up to 6.15%/year.

Source: https://nld.com.vn/ngan-hang-nao-vua-tang-lai-suat-gui-tiet-kiem-cao-nhat-la-bao-nhieu-196250618175044759.htm

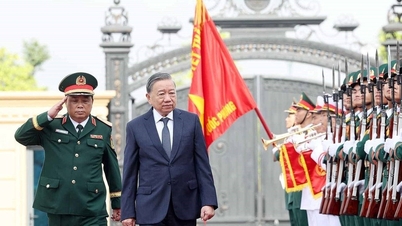

![[Photo] General Secretary To Lam chaired a working session with the Standing Committee of the Party Committee of the Ministry of Foreign Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/15/f26e945b18984e8a99ef82e5ac7b5e7d)

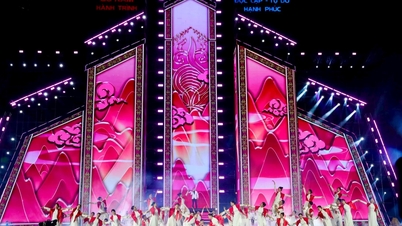

![[Photo] Prime Minister Pham Minh Chinh attends the closing ceremony of the exhibition of national achievements "80 years of the journey of Independence - Freedom - Happiness"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/15/a1615e5ee94c49189837fdf1843cfd11)

![[Video] Closing Ceremony of the National Achievement Exhibition on the Evening of September 15, 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/15/a85c829960f340789cb947f8b5709fa8)

![[Live] Closing of the National Achievements Exhibition "80 Years of Journey of Independence - Freedom and Happiness"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/15/de7064420213454aa606941f720ea20d)

Comment (0)