Tax officials are guiding business households to issue electronic invoices generated from cash registers. To help people better understand the new regulations, Tuoi Tre organizes an online exchange 'Answering and resolving difficulties regarding electronic invoices for business households' tomorrow morning, June 12 - Photo: T.HAI

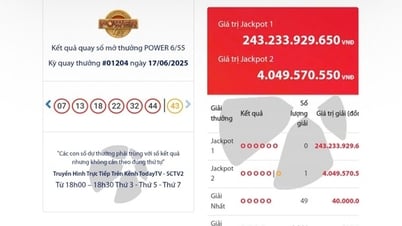

Implementing Decree 70 of the Government in 2025, from June 1, the tax sector will apply electronic invoices to business households with revenue of 1 billion VND/year or more.

Specifically, from June 1, business households with revenue of 1 billion VND/year and belonging to the following 6 industry groups must issue electronic invoices generated from cash registers connected to data with tax authorities, instead of paying lump-sum taxes as at present.

6 groups of industries include: activities of selling goods and providing services, including selling goods and providing services directly to consumers (commercial centers; supermarkets; retail - except for cars, motorbikes, motorcycles and other motor vehicles); food and beverage; restaurants; hotels; passenger transport services, direct support services for road transport, art services, entertainment, recreation, cinema activities, other personal services...

This is a preparation step for businesses to get acquainted with new management methods and transparent revenue like enterprises.

However, the policy has been implemented for less than 2 weeks. Many businesses are still confused, even hesitant and worried because they do not fully understand the benefits of this tax policy as well as the registration process and use of electronic invoices generated from cash registers...

In order to support taxpayers in understanding and implementing tax declaration methods and feel secure in doing business, Tuoi Tre newspaper organized an online exchange session "Answering and resolving difficulties regarding electronic invoices for business households", from 9:30-11:00 on June 12.

The program has the participation of guests:

- Mr. Mai Son - Deputy Director of Tax Department.

- Ms. Nguyen Thi Cuc - Tax Consulting Association.

- Ms. Dinh Thi Thuy - Vice Chairman of Board of Directors of Misa Joint Stock Company.

The program also had the participation of specialized departments of the Tax Department including the Tax Operations Department; Technology, Digital Transformation and Automation Department; E-commerce Tax Department; Policy Department, International Tax, etc.

At the program, leaders of the Tax Department, professional departments and tax experts will answer all questions and concerns, and support taxpayers, especially business households, to understand and implement electronic invoices generated from cash registers connected to tax authorities conveniently.

From now on, interested readers can send their questions and concerns to the program in the question box below. The answers will be updated on tuoitre.vn from 9:30 to 11:00 on June 12. Please stay tuned.

- All questions

Source: https://tuoitre.vn/giao-luu-truc-tuyen-giai-dap-go-vuong-ve-hoa-don-dien-tu-cho-ho-kinh-doanh-2025061108351726.htm

Comment (0)