The Banking industry has more than 123.9 million individual customer profiles collected and compared with biometric information (reaching 100% of the number of individual customer payment accounts generating transactions on digital channels).

For institutional customers, more than 1.3 million records have been verified for biometric information (reaching 100% of the total number of payment accounts of institutional customers generating transactions on digital channels).

Thanks to biometrics and data cleansing, the number of fraud cases decreased by more than 59%, and accounts related to fraud decreased by 52% compared to before implementation.

The National Credit Information Center (CIC) has coordinated with the Ministry of Public Security to complete 6 rounds of data comparison and cleaning with about 57 million customer records offline.

63 credit institutions and foreign bank branches have deployed the application of chip-embedded citizen identification cards via counter devices; 57 credit institutions and 39 payment intermediaries have deployed the application of chip-embedded citizen identification cards via Mobile apps; 32 credit institutions and 15 payment intermediaries are deploying the VNeID application.

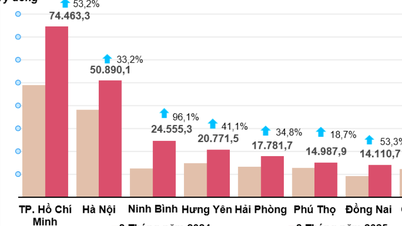

Also according to the latest data from the State Bank, in the first 7 months of 2025, non-cash payment transactions increased by 44.40% in quantity and 25.04% in value compared to the same period in 2024; via the internet channel increased by 49.65% in quantity and 35.61% in value.

In addition, transactions via mobile phone channels increased by 38.34% in quantity and 21.24% in value; transactions via QR Code increased by 66.73% in quantity and 159.58% in value; transactions via the Interbank Electronic Payment System increased by 4.41% in quantity and 45.27% in value; transactions via the Financial Switching and Electronic Clearing System increased by 15.77% in quantity and 3.77% in value.

On the contrary, ATM transactions continued to decrease by 15.83% in quantity and 4.97% in value, showing that people's demand for payment and cash withdrawal is decreasing and being replaced by non-cash payment methods and habits.

Regarding the implementation of meeting payment needs for gift giving to people on the occasion of the 80th anniversary of the August Revolution and National Day September 2, 32 units have linked with VNeID to serve social security payments; including 28 banks, foreign bank branches and 4 units providing intermediary payment services (VNPT Money, Mobifone Money, Viettel Money, MOMO).

Source: https://hanoimoi.vn/giam-59-so-vu-lua-dao-ngan-hang-nho-doi-chieu-sinh-trac-hoc-715200.html

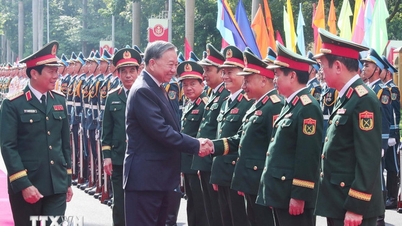

![[Photo] 80th Anniversary of the General Staff of the Vietnam People's Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/6/49153e2a2ffc43b7b5b5396399b0c471)

![[Photo] Rescuing people in flooded areas at the foot of Prenn Pass overnight](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/6/19095b01eb844de98c406cc135b2f96c)

![[Photo] Many people directly experience beloved Uncle Ho and the General Secretaries](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/6/2f4d9a1c1ef14be3933dbef3cd5403f6)

![[Photo] General Secretary To Lam attends the 80th Anniversary of the General Staff of the Vietnam People's Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/6/126697ab3e904fd68a2a510323659767)

Comment (0)