Domestic gold price today August 18, 2025

As of 4:00 a.m. today, August 18, 2025, the domestic gold bar price remained unchanged compared to yesterday. Specifically:

DOJI Group listed the price of SJC gold bars at 123.5-124.5 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday. The price increased by 300 thousand VND/tael in buying direction - increased by 100 thousand VND/tael in selling direction compared to the beginning of last week.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 123.5-124.5 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to the closing price on August 16 yesterday. The price increased by 300 thousand VND/tael in buying direction - increased by 100 thousand VND/tael in selling direction compared to the closing price on August 10 last week.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 124-124.5 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 200 thousand VND/tael for buying - unchanged for selling. Compared to the beginning of last week, the gold price increased by 600 thousand VND/tael for buying - increased by 100 thousand VND/tael for selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 123.5-124.5 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to yesterday; the price increased by 300 thousand VND/tael in buying direction - increased by 100 thousand VND/tael in selling direction compared to the same period last week.

SJC gold price at Phu Quy is traded by businesses at 122.7-124.5 million VND/tael (buy - sell), gold price is unchanged in both buying and selling directions compared to yesterday, gold price increased by 500 thousand VND/tael in buying direction - increased by 100 thousand VND/tael in selling direction compared to Monday last week.

As of 4:00 a.m. on August 18, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 116.5-119.5 million VND/tael (buy - sell); the price remained unchanged in both buying and selling directions compared to yesterday; the price decreased by 1 million VND/tael in buying direction - decreased by 500 thousand VND/tael in selling direction compared to the beginning of last week.

Bao Tin Minh Chau listed the price of gold rings at 116.8-119.8 million VND/tael (buy - sell); unchanged in both buying and selling compared to yesterday; down 1 million VND/tael in both buying and selling compared to the same period last week.

The latest gold price list today, August 18, 2025 is as follows:

| Gold price today | August 18, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 123.5 | 124.5 | - | - |

| DOJI Group | 123.5 | 124.5 | - | - |

| Red Eyelashes | 124 | 124.5 | - | - |

| PNJ | 123.5 | 124.5 | - | - |

| Bao Tin Minh Chau | 123.5 | 124.5 | - | - |

| Phu Quy | 122.7 | 124.5 | - | - |

| 1. DOJI - Updated: August 18, 2025 4:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| AVPL/SJC HN | 123,500 | 124,500 |

| AVPL/SJC HCM | 123,500 | 124,500 |

| AVPL/SJC DN | 123,500 | 124,500 |

| Raw material 9999 - HN | 109,300 | 110,300 |

| Raw material 999 - HN | 109,200 | 110,200 |

| 2. PNJ - Updated: August 18, 2025 4:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC 999.9 gold bar | 123,500 | 124,500 |

| PNJ 999.9 Plain Ring | 116,600 | 119,500 |

| Kim Bao Gold 999.9 | 116,600 | 119,500 |

| Gold Phuc Loc Tai 999.9 | 116,600 | 119,500 |

| PNJ Gold - Phoenix | 116,600 | 119,500 |

| 999.9 gold jewelry | 116,100 | 118,600 |

| 999 gold jewelry | 115,980 | 118,480 |

| 9920 jewelry gold | 115,250 | 117,750 |

| 99 gold jewelry | 115,010 | 117,510 |

| 916 Gold (22K) | 106,240 | 108,740 |

| 750 Gold (18K) | 81,600 | 89,100 |

| 680 Gold (16.3K) | 73,300 | 80,800 |

| 650 Gold (15.6K) | 69,740 | 77,240 |

| 610 Gold (14.6K) | 65,000 | 72,500 |

| 585 Gold (14K) | 62,030 | 69,530 |

| 416 Gold (10K) | 41,990 | 49,490 |

| 375 Gold (9K) | 37,130 | 44,630 |

| 333 Gold (8K) | 31,790 | 39,290 |

| 3. SJC - Updated: 8/18/2025 4:00 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 123,500 | 124,500 |

| SJC gold 5 chi | 123,500 | 124,520 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 123,500 | 124,530 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 116,600 | 119,200 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 116,600 | 119,100 |

| Jewelry 99.99% | 116,400 | 118,200 |

| Jewelry 99% | 112,529 | 117,029 |

| Jewelry 68% | 73,334 | 80,534 |

| Jewelry 41.7% | 42,244 | 49,444 |

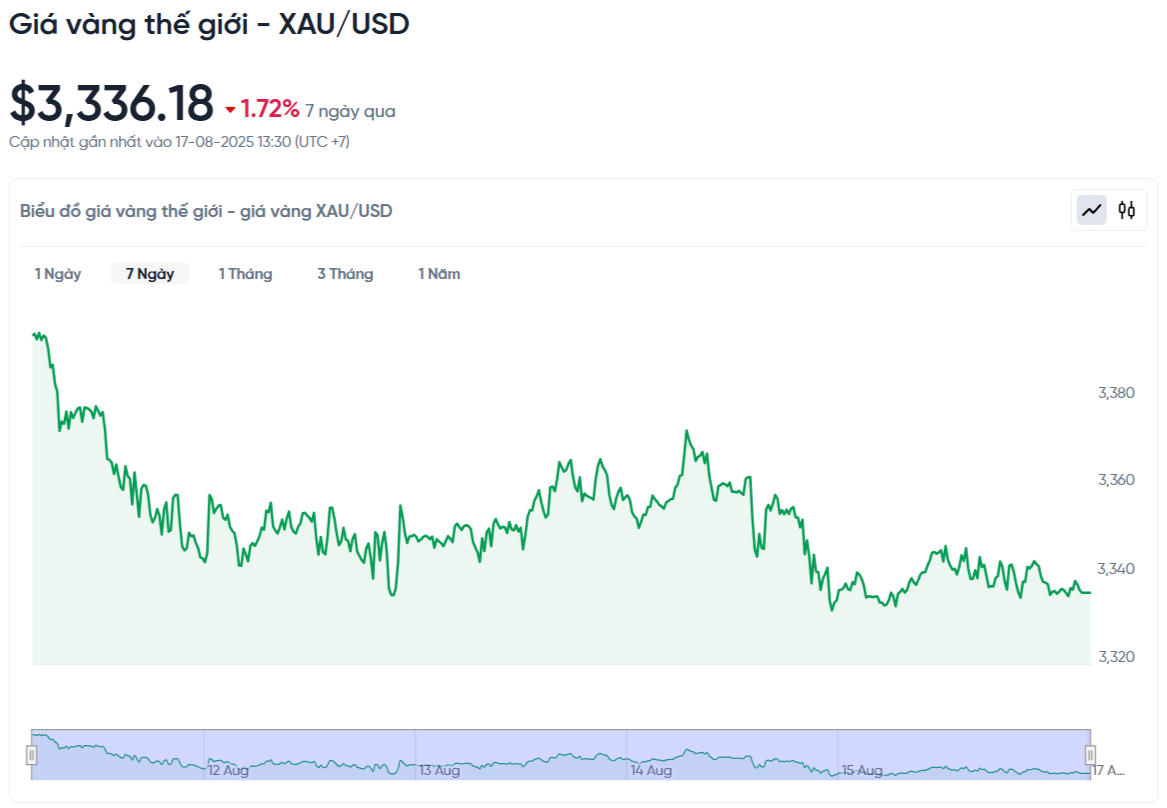

World gold price today August 18, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:00 a.m. on August 18, Vietnam time, was 3,336.18 USD/ounce. Today's gold price remained unchanged compared to yesterday and decreased by 58.44 USD/ounce compared to the beginning of last week. Converted according to the USD exchange rate at Vietcombank (26,450 VND/USD), the world gold price is about 106.39 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 18.11 million VND/tael higher than the international gold price.

At Saigon Jewelry Company (SJC), the price of gold bars has increased to an all-time high, reaching VND124.5 million/tael for selling. The gap between buying and selling prices has narrowed to VND1 million/tael, lower than last week.

The price of SJC 4-9 gold rings has dropped sharply after a week. Although the domestic gold price has peaked, gold bar buyers still lost nearly 1 million VND/tael, while gold ring buyers lost up to 3.2 million VND because the difference between buying and selling prices remained at 2.5 million VND/tael.

Kevin Grady, president of Phoenix Futures and Options, believes that interest rates are higher than they need to be. He predicts that the Fed will likely cut rates by 50 basis points unless inflation continues to rise. However, Grady's analysis shows that the recent increase in inflation is mainly due to tariffs, and that if you exclude that factor, inflation is only 2%. He believes that this is just a one-time effect of tariffs taking effect, not a long-term trend.

On the gold market, Grady said the market is in a correction phase after last week’s volatility. The spread between futures and physical gold (EFP) jumped from $8 to over $100 on July 21 due to uncertainty over tariffs. The spread has since narrowed to $60 after the government confirmed that gold is not subject to tariffs. Grady stressed that such extreme volatility makes it difficult to trade physical gold, especially for banks and traders.

He explained that the market is currently cautious due to the lack of clarity on transaction fees. Investors do not want to trade when they are uncertain about fees, as sudden price movements can cause big losses. With many people on vacation, risk management departments are also looking to reduce trading activity after recent volatility.

The consumer price index (CPI) rose 0.2% in July from the previous month, in line with expectations, according to the Bureau of Labor Statistics. The CPI rose 2.7% year-over-year, slightly below expectations of 2.8%. Core inflation, which excludes food and energy prices, rose 0.3% in July, in line with expectations. However, annual core inflation rose 3.1%, higher than the market's expectation of 3.0%.

The main reason for the decline in confidence is inflation concerns, said Joanne Hsu, director of the Consumer Survey. Bill Adams, chief economist at Comerica Bank, said the US consumer is doing quite well. Spending is still up across many categories, especially electric vehicles, furniture and clothing. However, spending on restaurants and building materials is down, showing that some consumers are still cautious with their money.

There will be little major economic data next week, so the market will focus on the Fed’s moves. Most notably, the minutes of the July FOMC meeting and Fed Chairman Jerome Powell’s speech at the Jackson Hole conference on Friday.

Gold Price Forecast

According to the latest survey from Kitco News, the majority of experts on Wall Street predict that gold prices will continue to move sideways in the near future. Meanwhile, the majority of individual investors remain optimistic that gold prices can increase.

Specifically, 10 experts participated in the Kitco News survey. The results showed that only 1 person expected gold prices to increase, 1 person predicted prices to decrease, and the remaining 8 people believed that gold would continue to fluctuate within a narrow range. From the perspective of retail investors, the results of the online survey with 183 votes showed that 63% (115 people) expected gold prices to increase, 18% (33 people) predicted a decrease, and 19% (35 people) thought prices would stabilize.

Daniel Pavilonis, senior commodities broker at RJO Futures, assessed the recent gold price action against the medium-term trend. He said gold prices had rallied sharply due to the impact of the Swiss gold import tax, but then eased slightly. Then inflation data led to a slight increase in interest rates, leading to a risk-off sentiment in the market.

Despite the recovery in the stock market, gold prices have remained in a narrow range. Pavilonis expects gold to continue to move sideways in the near term. He previously expected gold to fall below $3,000, but now he thinks it could rise slightly or hold its current price.

According to Pavilonis, if the Fed starts cutting interest rates and inflation picks up, gold could rise. He doesn’t think gold will fall much unless there is a major change in economic data. On the geopolitical front, the conflict between Russia, Ukraine and the US could put pressure on gold if a peace deal is reached, but the most likely scenario is for gold to continue moving sideways.

Pavilonis hopes that the recent rally is not a false signal and that prices will not reverse. He looks at technical indicators and price charts, and notes that gold has been in neutral territory since April – a four-month period of trading. The 50-day moving average is still trending up but losing momentum.

If gold fails to make a new high in October or November, it is likely to fall to support around the 200-day moving average, around $2,964.

As for upcoming events such as the FOMC minutes or Jackson Hole, Pavilonis said that they are unlikely to have a significant impact on gold prices unless the Fed unexpectedly cuts interest rates. Meeting minutes usually reflect past data, and the market has already priced in some rate cuts. Therefore, he expects gold to continue moving in its current sideways price channel.

Source: https://baonghean.vn/gia-vang-hom-nay-18-8-gia-vang-mieng-co-ky-luc-moi-vang-nhan-va-vang-the-gioi-giam-manh-10304612.html

![[Photo] Party and State leaders visit President Ho Chi Minh's Mausoleum and offer incense to commemorate Heroes and Martyrs](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/8/17/ca4f4b61522f4945b3715b12ee1ac46c)

Comment (0)