Domestic gold price today 9/1/2025

As of 4:00 a.m. today, September 1, 2025, the domestic gold bar price increased to a record high of 4 million VND. Specifically:

DOJI Group listed the price of SJC gold bars at 129.1 - 130.6 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday. The gold price increased sharply by 3.5 million VND/tael in buying direction - increased sharply by 4 million VND/tael in selling direction compared to the beginning of last week.

At the same time, the price of gold bars was listed by Saigon Jewelry Company Limited - SJC at 129.1 - 130.6 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to the closing price on August 30 yesterday. The gold price increased by 3.5 million VND/tael for buying - increased by 4 million VND/tael for selling compared to the closing price on August 25 last week.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 129.6-130.6 million VND/tael for buying and selling. Compared to yesterday, the gold price remained unchanged in both buying and selling directions. Compared to last week, the gold price increased by 3.6 million VND/tael for buying and increased by 4 million VND/tael for selling.

The price of gold bars at Bao Tin Minh Chau Company Limited is traded by the enterprise at 129.1 - 130.6 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to the same period yesterday, the price increased by 3 million VND/tael for buying - increased by 4 million VND/tael for selling compared to the same period last week.

The price of SJC gold bars in Phu Quy was traded by businesses at 128.1-130.6 million VND/tael (buying - selling), the gold price remained unchanged in both buying and selling directions compared to yesterday. The gold price increased by 3.5 million VND/tael in buying direction - increased by 4 million VND/tael in selling direction compared to last week.

As of 4:00 a.m. on September 1, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 122.5-125.5 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday; increased by 3.7 million VND/tael in both buying and selling directions compared to last week.

Bao Tin Minh Chau listed the price of gold rings at 122.6-125.6 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday; increased by 3.6 million VND/tael in both buying and selling directions compared to last week.

The latest gold price list today, September 1, 2025 is as follows:

| Gold price today | September 1, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 129.1 | 130.6 | - | - |

| DOJI Group | 129.1 | 130.6 | - | - |

| Red Eyelashes | 129.6 | 130.6 | - | - |

| PNJ | 129.1 | 130.6 | - | - |

| Bao Tin Minh Chau | 129.1 | 130.6 | - | - |

| Phu Quy | 128.1 | 130.6 | - | - |

| 1. DOJI - Updated: 09/01/2025 04:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| AVPL/SJC HN | 129,100 | 130,600 |

| AVPL/SJC HCM | 129,100 | 130,600 |

| AVPL/SJC DN | 129,100 | 130,600 |

| Raw material 9999 - HN | 114,400 | 115,400 |

| Raw material 999 - HN | 114,300 | 115,300 |

| 2. PNJ - Updated: September 1, 2025 04:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC 999.9 gold bar | 129,100 | 130,600 |

| PNJ 999.9 Plain Ring | 122,500 | 125,400 |

| Kim Bao Gold 999.9 | 122,500 | 125,400 |

| Gold Phuc Loc Tai 999.9 | 122,500 | 125,400 |

| PNJ Gold - Phoenix | 122,500 | 125,400 |

| 999.9 gold jewelry | 120,000 | 122,500 |

| 999 gold jewelry | 119,880 | 122,380 |

| 9920 jewelry gold | 119,120 | 121,620 |

| 99 gold jewelry | 118,880 | 121,380 |

| 916 Gold (22K) | 109,810 | 112,310 |

| 750 Gold (18K) | 84,530 | 92,030 |

| 680 Gold (16.3K) | 75,950 | 83,450 |

| 650 Gold (15.6K) | 72,280 | 79,780 |

| 610 Gold (14.6K) | 67,380 | 74,880 |

| 585 Gold (14K) | 64,310 | 71,810 |

| 416 Gold (10K) | 43,610 | 51,110 |

| 375 Gold (9K) | 38,590 | 46,090 |

| 333 Gold (8K) | 33,080 | 40,580 |

| 3. SJC - Updated: 09/01/2025 04:00 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 129,100 | 130,600 |

| SJC gold 5 chi | 129,100 | 130,620 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 129,100 | 130,630 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 122,500 | 125,100 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 122,500 | 125,000 |

| Jewelry 99.99% | 121,500 | 123,500 |

| Jewelry 99% | 117,277 | 122,277 |

| Jewelry 68% | 76,638 | 84,138 |

| Jewelry 41.7% | 44,154 | 51,654 |

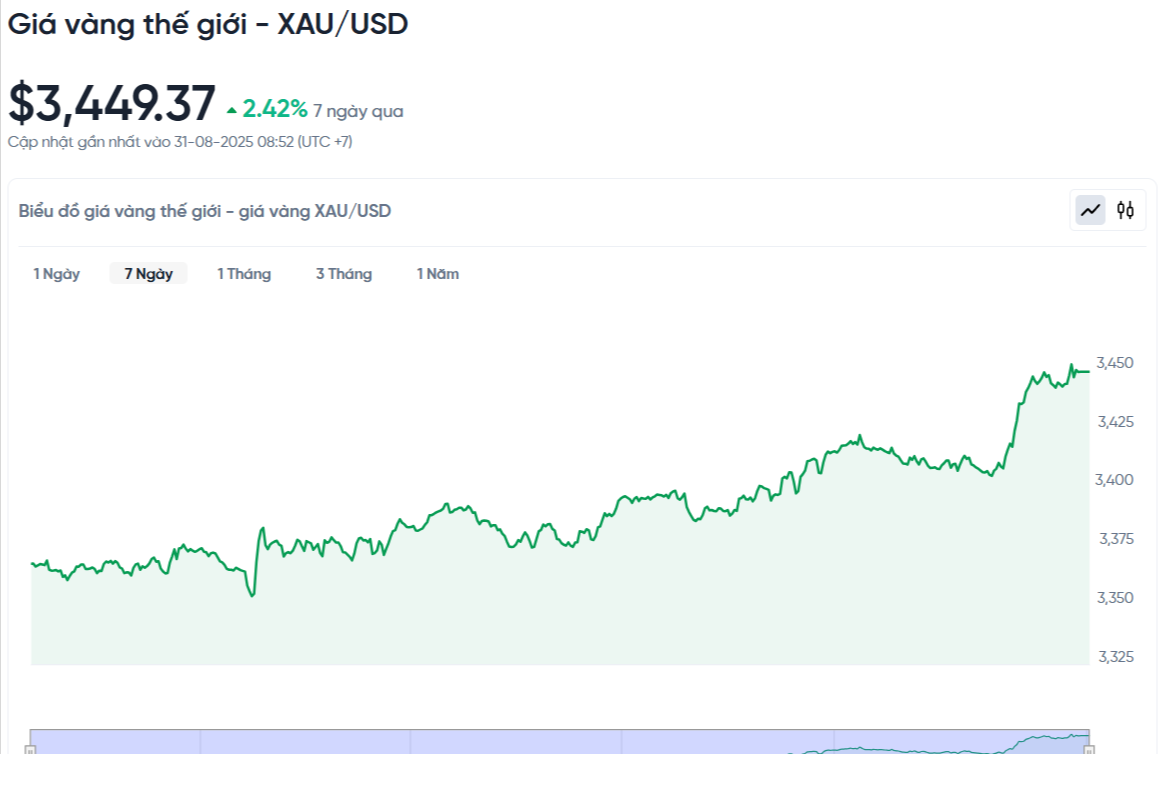

World gold price today September 1, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:00 a.m. on September 1, Vietnam time, was 3,449.37 USD/ounce. Today's gold price remained unchanged from yesterday and increased by 81.66 USD/ounce compared to last week. Converted according to the USD exchange rate at Vietcombank (26,502 VND/USD), the world gold price is about 110.2 million VND/tael (excluding taxes and fees). Thus, the price of gold bars is 20.4 million VND/tael higher than the international gold price.

Domestic gold prices are experiencing an unprecedented surge. In just 2 weeks, the price of SJC gold bars has increased by more than 6 million VND/tael. This price is still not the highest peak. Some small jewelry stores have even listed prices at record levels, with 131.6 - 132.6 million VND/tael for buying and selling, about 2 million higher than large systems.

This is the fifth consecutive week of increase for gold bars. In addition, the price of gold rings also increased following the general trend, around 122.5 - 125 million VND/tael for both buying and selling, an increase of about 4 million VND compared to the end of last week. The difference between gold bars and gold rings exceeded 5 million VND.

Faced with this situation, experts warn buyers to be extremely cautious. The risk of buying fake gold or counterfeit gold is real. Some fake SJC gold bars have been marked as losses or refused to be bought back by SJC, causing losses to the owners. Buying gold through Facebook groups or unofficial online channels poses many legal risks and risks of fraud.

The world gold price this August has increased to a very impressive record, increasing by 86.84 USD/ounce (up 2.42%) compared to July, breaking out strongly to reach the highest level in 4 months. The main reason comes from the fact that the US Central Bank (Fed) will cut interest rates in September.

It’s hard to pinpoint the exact reason for Friday’s surge in gold prices, said John Weyer, director of commercial hedging at Walsh Trading. Typically, when investors seek safe-haven assets, the stock market plunges. However, this time the Dow Jones Industrial Average only fell slightly, about 150-160 points, which is not a huge drop in the current environment.

Analyst Jesse Colombo explains that gold’s surge is largely based on technical factors. Gold prices are compressing like a spring. Since hitting a peak in April, gold has been moving sideways and forming a triangle pattern, which is like accumulating energy. The recent strong price breakout is like the spring being released, releasing all the pressure that has built up.

There is no specific event that caused the rally, he said. It could simply be the end of summer. Trading is usually slow during the summer, but now traders are returning to the market. Trading volumes are expected to pick up after the Labor Day holiday, when gold prices will resume the upward trend that has been in place since April.

Jesse Colombo expects Comex gold futures to break and close above $3,500 an ounce, a key resistance level since April. Once that level is broken, he believes gold could potentially hit $4,000 or even higher in the coming months.

If gold prices hold above these highs, the next phase of the multi-year bull market will officially begin. He predicts a strong increase in gold purchases by ETFs (exchange-traded funds) in the West and the US this fall.

Gold Price Forecast

FxPro expert Alex Kuptsikevich predicts that gold prices will continue to move within a certain price range next week. Gold prices once again traded above the $3,400 mark at the end of the week. Investors are focusing on the important resistance level around $3,430, which is the upper limit of the price range that gold has been fluctuating in since April.

According to him, the main driving force for gold prices comes from the downward trend in the yields of 2- and 10-year US Treasury bonds. The market is sketching a less optimistic economic outlook, with a combination of slow growth and persistent inflation. This is considered an ideal environment for gold prices to develop.

Gold prices are expected to continue to rise in the coming time, mainly due to expectations that the US Federal Reserve (Fed) will lower interest rates at its meeting in September. Currently, up to 87% of market participants believe in this possibility. This certainty creates a big push for gold prices.

Another important factor is the profit-taking mentality that often appears when the price breaks the psychological threshold of $3,400. However, many opinions believe that despite the technical correction, the general trend will still be upward.

In addition, political uncertainties, specifically the tension between President Trump and Ms. Lisa Cook, are expected to cause investors to seek gold as a safe haven, instead of holding USD. Trading activities are also expected to be active again when investors end their summer vacations and return to the market.

Against that backdrop, many experts are bullish. Attacks on the Fed’s independence, coupled with the prospect of a weak jobs report, are seen as factors that could push gold prices higher.

Gold prices have had strong gains and surpassed the $3,400/ounce mark. The next targets are the July high around $3,439/ounce and then the June high around $3,451/ounce.

Next week is a short one as North American markets are closed on Monday for Labor Day. All eyes will be on the labor market data. Tuesday sees the manufacturing Purchasing Managers’ Index (PMI). Wednesday sees the JOLTS jobs report. On Thursday, the market awaits the ADP private payrolls report along with weekly jobless claims and the services PMI.

Friday's U.S. nonfarm payrolls report will be the most important event, with traders looking for signs of a cooling labor market that could bolster expectations the Fed will cut interest rates mid-month.

Source: https://baonghean.vn/gia-vang-hom-nay-1-9-gia-vang-mieng-tang-4-trieu-dong-tuan-qua-vang-the-gioi-tang-gan-100-usd-10305612.html

![[Photo] The first meeting of the Cooperation Committee between the National Assembly of Vietnam and the National People's Congress of China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/31/f5ed4def2e8f48e1a69b31464d355e12)

![[Photo] General Secretary To Lam receives Chairman of the National People's Congress of China Zhao Leji](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/31/5af9b8d4ba2143348afe1c7ce6b7fa04)

![[Photo] National Assembly Chairman Tran Thanh Man welcomes and holds talks with Chairman of the National People's Congress of China Zhao Leji](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/31/9fa5b4d3f67d450682c03d35cabba711)

![[Photo] Marching together in the hearts of the people](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/31/8b778f9202e54a60919734e6f1d938c3)

Comment (0)