Domestic gold price this afternoon July 30, 2025

As of 12:30 p.m. today, July 30, 2025, the price of domestic gold bars increased sharply. Specifically:

DOJI Group listed the price of SJC gold bars at 120-121.5 million VND/tael (buy - sell), an increase of 300 thousand VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 120-121.5 million VND/tael (buy - sell), an increase of 300 thousand VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 120.7-121.5 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 500 thousand VND/tael for buying and 300 thousand VND/tael for selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 120-121.5 million VND/tael (buy - sell), the price increased by 300 thousand VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 119.5-121.5 million VND/tael (buy - sell), gold price increased 300 thousand VND/tael in both buying and selling directions compared to yesterday.

As of this afternoon, July 30, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 116.1-118.6 million VND/tael (buy - sell); the price increased by 200 thousand VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 116.3-119.3 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday.

The latest gold price list this afternoon, July 30, 2025 is as follows:

| Gold price this afternoon | July 30, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 120 | 121.5 | +300 | +300 |

| DOJI Group | 120 | 121.5 | +300 | +300 |

| Red Eyelashes | 120.5 | 121.5 | +500 | +300 |

| PNJ | 120 | 121.5 | +300 | +300 |

| Bao Tin Minh Chau | 120 | 121.5 | +300 | +300 |

| Phu Quy | 119.5 | 121.5 | +300 | +300 |

| 1. DOJI - Updated: July 30, 2025 12:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 120,000 ▲300K | 121,500 ▲300K |

| AVPL/SJC HCM | 120,000 ▲300K | 121,500 ▲300K |

| AVPL/SJC DN | 120,000 ▲300K | 121,500 ▲300K |

| Raw material 9999 - HN | 108,600 ▲200K | 109,600 ▲200K |

| Raw material 999 - HN | 108,500 ▲200K | 109,500 ▲200K |

| 2. PNJ - Updated: July 30, 2025 12:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 115,400 ▲400K | 118,400 ▲500K |

| Hanoi - PNJ | 115,400 ▲400K | 118,400 ▲500K |

| Da Nang - PNJ | 115,400 ▲400K | 118,400 ▲500K |

| Western Region - PNJ | 115,400 ▲400K | 118,400 ▲500K |

| Central Highlands - PNJ | 115,400 ▲400K | 118,400 ▲500K |

| Southeast - PNJ | 115,400 ▲400K | 118,400 ▲500K |

| 3. SJC - Updated: 7/30/2025 12:30 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 120,000 ▲300K | 121,500 ▲300K |

| SJC gold 5 chi | 120,000 ▲300K | 121,520 ▲300K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 120,000 ▲300K | 121,530 ▲300K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,700 ▲300K | 117,200 ▲300K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,700 ▲300K | 117,300 ▲300K |

| Jewelry 99.99% | 114,700 ▲300K | 116,600 ▲300K |

| Jewelry 99% | 110,945 ▲297K | 115,445 ▲297K |

| Jewelry 68% | 72,546 ▲224K | 79,446 ▲224K |

| Jewelry 41.7% | 41,877 ▲125K | 48,777 ▲125K |

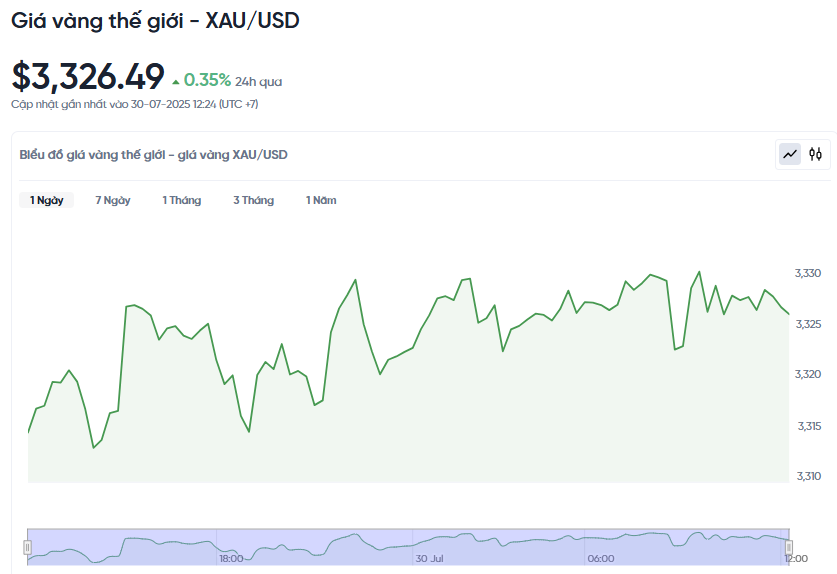

World gold price this afternoon July 30, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 12:30 on July 30, Vietnam time, was 3,326.49 USD/ounce. This afternoon's gold price increased by 11.63 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,400 VND/USD), the world gold price is about 109.3 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 12.2 million VND/tael higher than the international gold price.

In an interview with Kitco News, Aakash Doshi, Head of Gold Strategy at State Street Investment Management, said that gold price corrections are buying opportunities.

Mr. Doshi analyzed that despite the stock market being at record highs, market volatility decreasing, bond yields remaining high and the US dollar attracting investors' attention, gold prices still maintained solid support above $3,300/ounce.

He believes that the gold price at $3,000/ounce has become a basic support level. According to him, the current financial market sentiment is only "superficial" optimism.

“Gold investors are waiting for the next catalyst, but there are also some structural factors that are supporting buying on dips,” said Doshi.

Instead of focusing solely on gold’s upside potential, investors should pay attention to the underlying strength of the market. “Turn the question around and instead of asking why gold hasn’t hit $4,000 yet, when it’s already up 26%, we should be asking why gold hasn’t fallen below $3,000, even when the stock market is at an all-time high and volatility is at its lowest point of the year.

Doshi expects gold prices to continue to consolidate for about a month, but may start to attract renewed interest after the US Federal Reserve's annual meeting in Jackson Hole, Wyoming, where Fed Chairman Jerome Powell is expected to provide guidance on a rate cut roadmap starting in September and lasting through the end of the year.

According to Mr. Doshi, the gold market is well-positioned to benefit from falling interest rates and rising inflationary pressures. Although geopolitical uncertainties have eased in recent weeks, the market is now focused on concerns about rising government debt and the risk of inflation.

Earlier this month, the US government passed the largest spending bill in recent history. However, the Congressional Budget Office (CBO) forecasts that the massive tax cuts will add nearly $4 trillion to the budget deficit.

At the same time, trade deals with Japan and the European Union, including an increase in import tariffs to 15%, are also expected to cause inflation to rise.

The expert also noted that rising public debt and persistent inflation will slow economic growth, forcing the Fed to loosen monetary policy.

“That’s reflected in their forecasts. If you compare the June Economic Projections Report to March, they’ve lowered their growth forecasts and raised their inflation and unemployment expectations,” he said. “Listen to the Fed itself.”

In such a “stagflationary” environment, State Street argues that gold remains a valuable asset diversifier. Doshi argues that higher inflation will push real interest rates lower, making bonds less attractive. At the same time, high debt levels are creating volatility at the top end of the yield curve, increasing gold’s appeal as a safe haven.

“If valuations remain high across most markets and uncertainty continues to dominate the long end of the yield curve, investors will seek safe havens and diversifiers like gold to hedge against unforeseen risks,” Doshi concluded.

Source: https://baonghean.vn/gia-vang-chieu-nay-30-7-2025-gia-vang-trong-nuoc-va-the-gioi-tang-manh-co-hoi-tot-de-mua-vao-10303509.html

![[Maritime News] Container shipping faces overcapacity that will last until 2028](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/30/6d35cbc6b0f643fd97f8aa2e9bc87aea)

Comment (0)