Masan Group Corporation (stock code: MSN) has just announced its unaudited financial statements for the second quarter of 2025 and the first 6 months of this year.

In the second quarter, the company's net revenue reached VND18,315 billion. The corresponding after-tax profit was VND1,619 billion. According to Masan, the growth mainly came from the effective operation of the retail chains WinCommerce (WCM) and Masan MEATLife (MML). During the period, the group also recorded profits from the divestment of HC Starck (HCS).

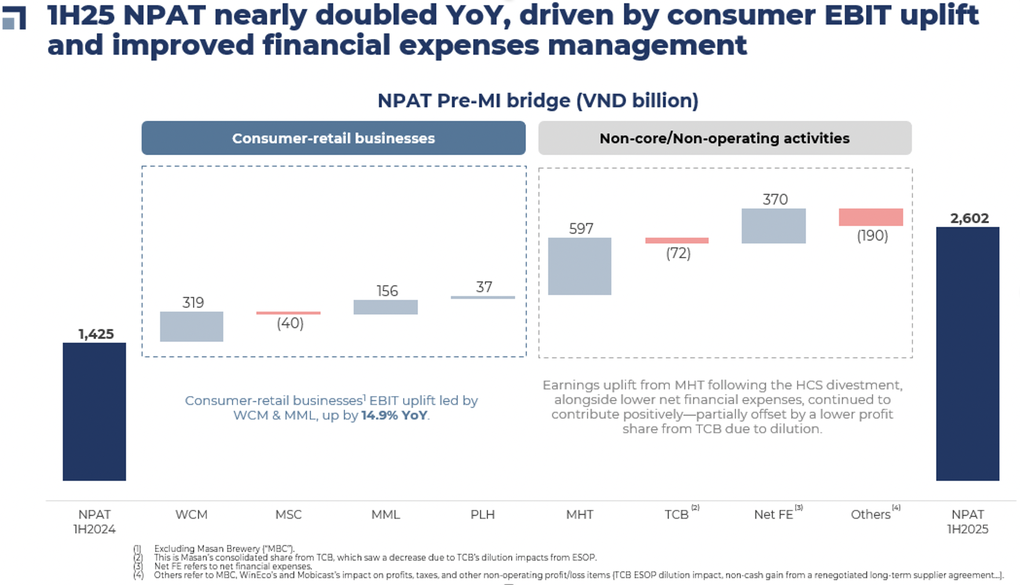

Accumulated profit after tax in the first 6 months of the year reached VND 2,602 billion, nearly double that of the same period. This year, the company expects consolidated net revenue to be around VND 80,000-85,500 billion, up 7-14% over the same period (after adjusting for the separation and consolidation of HCS). Profit after tax is expected to be from VND 4,875 to VND 6,500 billion, up 14-52% compared to VND 4,272 billion in 2024.

Masan is currently a multi-industry corporation, operating in areas ranging from retail, consumer goods production, fresh meat to investments in minerals and finance.

In particular, the retail chain WinCommerce (WCM, the operator of the WIN supermarket chain) had revenue of VND9,130 billion in the second quarter, up 16% over the same period. Profit after tax reached VND10 billion, the fourth consecutive quarter that WCM made a profit.

In the first half of the year, WCM's revenue reached VND17,915 billion, up 13% over the same period. Profit after tax reached VND68 billion.

As of the end of the second quarter, WCM had 4,146 stores nationwide, of which the Group opened 318 new stores.

Regarding the consumer goods sector, Masan Consumer Corporation (MCH) recorded revenue of VND6,276 billion in the second quarter, down 15% year-on-year. EBITDA (Earnings before interest, taxes, depreciation and amortization) reached VND1,605 billion, down 13%. In the first 6 months of the year, MCH revenue decreased by 1.5% year-on-year, thanks to positive results in the first quarter.

It is known that during the period, MCH faced short-term challenges arising from structural changes in the Vietnamese retail industry. Specifically, the application of new tax regulations on individual business households caused temporary disruption to the traditional sales channel (GT) - a channel in which MCH has a large presence.

As a result, many large and small traditional retailers have reduced inventory significantly, with inventory days reduced by about 8 days for large retailers and 3 days for small retailers. This leads to an estimated revenue reduction of about 600-800 billion VND for MCH in the quarter.

Benefiting from rising pork prices, the chilled meat segment of Masan MEATLife (MML) recorded revenue of VND2,340 billion in the period, up 31% over the same period. Profit after tax reached VND249 billion.

According to Masan, meat revenue increased not only due to rising pork prices, but also due to the expansion of the WCM network. The processed meat segment grew 23% during the period. MML is integrating with WCM. As of the end of the second quarter, MML held 62% market share in the animal protein industry at WCM, and was the leader in both fresh meat and processed meat with market shares of 91% and 29%, respectively.

The main growth drivers come from retail segments WinCommerce (WCM) and Masan MEATLife (MML).

The "youngest" member of the Masan ecosystem, the Phuc Long Heritage chain (PLH), recorded revenue of VND434 billion in the period, up 11% over the same period. Profit after tax reached VND43 billion, up 39%.

In the first half of 2025, PLH's revenue reached VND858 billion, up 10% over the same period. After-tax profit reached VND86 billion, up 63.5%. Business activities improved thanks to a strong increase in delivery channels and increased revenue from the food segment.

Masan also invested in the mineral sector through its subsidiary Masan High-Tech Materials (MHT) . In the second quarter, MHT's revenue reached VND1,614 billion, up 28% year-on-year. Net profit reached VND6 billion. In the first half of 2025, MHT's revenue reached VND3,007 billion, up 20% but still had a loss of VND212 billion.

Finally, the investment in Techcombank (TCB) helped Masan earn a profit of VND1,216 billion in Q2/2025, down slightly by 1.6% YoY, mainly due to the dilution impact from TCB's ESOP program.

In the market, MSN shares have been increasing continuously since hitting bottom last April. MSN shares are currently trading at 76,400 VND/unit, with a capitalization of approximately 109,500 billion VND.

Source: https://dantri.com.vn/kinh-doanh/doanh-nghiep-cua-ty-phu-nguyen-dang-quang-thu-hon-2600-ty-sau-nua-nam-20250729103241918.htm

![[Photo] National Assembly Chairman attends the seminar "Building and operating an international financial center and recommendations for Vietnam"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/28/76393436936e457db31ec84433289f72)

Comment (0)