Update gold price today August 28, 2025 latest

The price of SJC gold bars in Hanoi and DOJI Group is listed at the same price: 127.0 million VND/tael (buy) and 128.5 million VND/tael (sell). Compared to the previous session, the buying price increased sharply by 1,000 thousand VND/tael, while the selling price also increased by 500 thousand VND/tael.

At Mi Hong, the price of gold bars was adjusted to 127.2 million VND/tael (buy) and 128.5 million VND/tael (sell). The buy price increased by 700 thousand VND/tael, while the sell price increased by 500 thousand VND/tael.

Similarly, PNJ also listed the price of gold bars at 127.0 million VND/tael (buy) and 128.5 million VND/tael (sell), increasing by 1,000 thousand VND/tael for buying and 500 thousand VND/tael for selling, respectively.

Notably, Bao Tin Minh Chau recorded the strongest increase in buying price, up to 1,200 thousand VND/tael, listed price at 127.0 million VND/tael (buy) and 128.5 million VND/tael (sell), with selling price increased by 500 thousand VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold at 126.0 million VND/tael (buy) and 128.5 million VND/tael (sell). The buy price increased by 600 thousand VND/tael, while the sell price increased by 500 thousand VND/tael.

At Vietinbank Gold, the selling price of gold also increased by VND500,000/tael, to VND128.5 million/tael. However, this brand did not list the buying price.

At 6:00 p.m. on August 28, 2025, the price of DOJI's 9999 Hung Thinh Vuong round gold ring was listed at VND 120.2 million/tael (buy) and VND 123.2 million/tael (sell), an increase of VND 400,000/tael in both buying and selling directions compared to the previous day, with a buying - selling difference of VND 3 million/tael.

Bao Tin Minh Chau kept the price of gold rings at 120.3 million VND/tael (buy) and 123.3 million VND/tael (sell), an increase of 300 thousand VND/tael in both directions compared to early this morning, with a difference of 3 million VND/tael.

Phu Quy Group also listed the price of gold rings at 120.0 million VND/tael (buy) and 123.0 million VND/tael (sell), an increase of 500 thousand VND/tael in both directions compared to yesterday, with the difference between buying and selling being 3 million VND/tael.

Gold price list today 8/28/2025 in Vietnam in detail

| Gold price today | August 28, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 127.0 | 128.5 | +1000 | +500 |

| DOJI Group | 127.0 | 128.5 | +1000 | +500 |

| Red Eyelashes | 127.2 | 128.5 | +700 | +500 |

| PNJ | 127.0 | 128.5 | +1000 | +500 |

| Vietinbank Gold | 128.5 | +500 | ||

| Bao Tin Minh Chau | 127.0 | 128.5 | +1200 | +500 |

| Phu Quy | 126.0 | 128.5 | +600 | +500 |

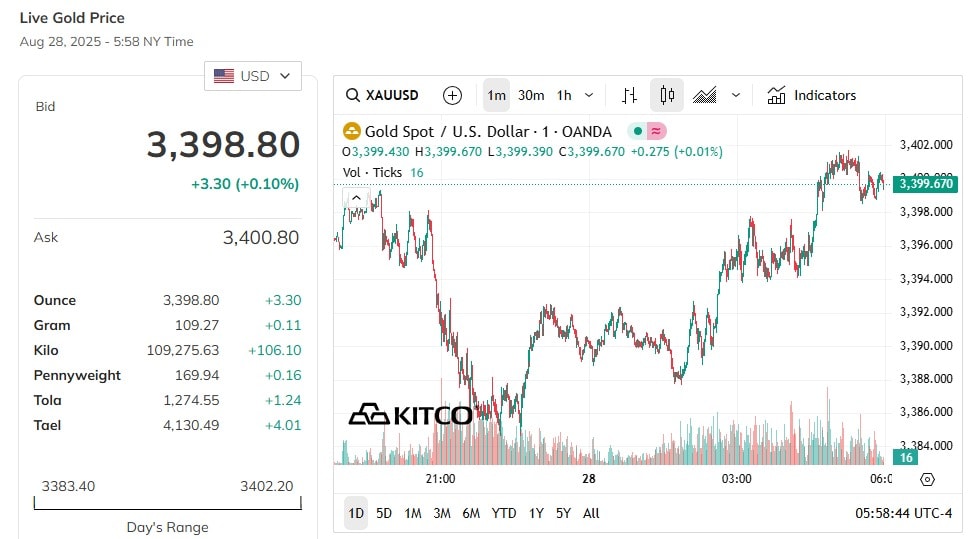

Update on world gold price this afternoon increased close to the peak of 3400 USD

World gold price, at 5:00 p.m. on August 28, 2025 (Vietnam time), the world spot gold price was at 3,398.6 USD/ounce. Today's gold price increased by 3.3 USD compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,531 VND/USD), the world gold price is about 113.01 million VND/tael (excluding taxes and fees). Compared to the domestic SJC gold bar price on the same day (126.7-128.2 million VND/tael), the current SJC gold price is about 15.19 million higher than the international gold price.

Gold prices held steady at their highest in more than two weeks on Thursday as the dollar eased. Investors are holding their breath as they await U.S. inflation data on Friday for clues on the Federal Reserve’s policy path.

Spot gold was up 0.1% at $3,399.60 an ounce by 0851 GMT, after hitting $3,401.73 earlier in the session – its highest since August 11. Similarly, U.S. gold futures for December delivery edged up 0.2% to $3,456.20.

The weakening of the US Dollar (Dollar Index) by 0.1% against other major currencies gave the precious metal a boost.

Market attention is now turning to tomorrow’s release of the Personal Consumption Expenditures (PCE) price index, the Fed’s preferred inflation gauge. Economists polled by Reuters expect the PCE index to rise 2.6% in July, matching June’s gain.

"The market has priced in a slight increase in July PCE inflation. If the data surprises higher, the dollar will strengthen and Treasury yields will rise, putting pressure on gold. Conversely, if inflation falls, this will reinforce expectations of a more dovish Fed policy, weakening the dollar and supporting the precious metal," said Ricardo Evangelista, senior analyst at ActivTrades.

Investors now see a more than 87% chance of the Fed cutting interest rates by 25 basis points at its policy meeting next month, according to CME Group's FedWatch tool. Gold, a non-yielding asset, tends to rise in a low-interest-rate environment.

In addition, the market is also closely watching US President Donald Trump's moves to intervene in the Fed. Mr. Trump previously announced the dismissal of Fed Governor Lisa Cook. Mr. Evangelista said: "Many people see this as a threat to the independence and credibility of the Fed, which is a supporting factor for gold prices."

News, gold price forecast tomorrow August 29, 2025

The price of gold on August 29, 2025 is likely to continue to increase, especially domestic SJC gold bars. The main reason is that the world gold price is on the rise, leading to fluctuations in the domestic market.

In recent days, the world gold price has reached its highest level in more than two weeks, reaching 3,398.6 USD/ounce. This is equivalent to about 113.01 million VND/tael when converted at the current exchange rate. This price has increased slightly by 3.3 USD compared to yesterday. Domestic SJC gold, which is already about 15.19 million VND/tael higher than world gold, is likely to continue to increase. The current price of SJC gold is around 126.7-128.2 million VND/tael and may exceed 128 million VND in tomorrow morning's trading session.

The US dollar is falling, making gold more attractive to foreign investors. When a currency weakens, people often seek safer assets like gold to protect the value of their assets.

The US Federal Reserve (Fed) is expected to cut interest rates soon. Low interest rates tend to weaken the US dollar and increase the attractiveness of gold. Investors are paying close attention to the upcoming US PCE inflation report as it is an important factor in the Fed's decision to cut interest rates or not. If this report is as predicted, gold prices could break out and surpass the threshold of 3,400 USD/ounce.

In general, the gold market is showing positive signs. Besides gold, other precious metals such as silver, platinum, and palladium are also increasing in price, showing a general trend of the market.

Source: https://baodanang.vn/du-bao-gia-vang-ngay-mai-29-8-2025-lieu-cham-moc-lich-su-129-trieu-dong-luong-khi-vang-the-gioi-can-moc-3400-usd-3300586.html

![[Photo] Politburo works with the Standing Committee of Cao Bang Provincial Party Committee and Hue City Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/fee8a847b1ff45188749eb0299c512b2)

![[Photo] General Secretary To Lam presents the 45-year Party membership badge to comrade Phan Dinh Trac](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/e2f08c400e504e38ac694bc6142ac331)

![[Photo] Prime Minister Pham Minh Chinh meets with Speaker of the New Zealand Parliament Gerry Brownlee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/cec2630220ec49efbb04030e664995db)

![[Photo] General Secretary To Lam attends the opening ceremony of the National Achievements Exhibition](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/d371751d37634474bb3d91c6f701be7f)

![[Photo] Red flag with yellow star flutters in France on National Day September 2](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/f6fc12215220488bb859230b86b9cc12)

Comment (0)