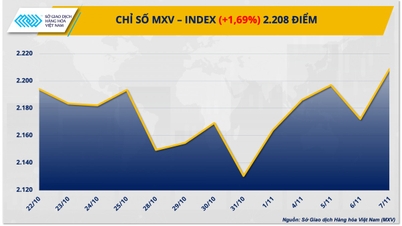

Energy stocks led the gains with overwhelming buying, pushing crude oil prices to their highest since August.

According to MXV, the risk of increasing global geopolitical tensions has caused energy prices to skyrocket. In particular, two crude oil products reached their highest price since early August. Specifically, Brent oil price increased by about 1.45%, stopping at 69.14 USD/barrel, while WTI oil price continued to climb to 65.59 USD/barrel, corresponding to an increase of up to 2.47%.

Red covers most of the key commodities in the industrial raw material group. Notably, the prices of two coffee commodities simultaneously decreased sharply. Of which, the price of Arabica coffee lost more than 4% to 8,164 USD/ton, the price of Robusta coffee also recorded a decrease of nearly 5% to 4,399 USD/ton.

Exchange rate fluctuations along with positive changes in weather conditions in major coffee producing countries such as Brazil and Vietnam have put pressure on coffee prices.

However, the coffee market still faces two major challenges from the negative impacts of tariffs and the prospect of a significant decline in Brazil's 2025-2026 crop year output.

Over the weekend, the Brazilian Coffee Exporters Council (CECAFÉ) expressed concern that the federal government has begun considering the possibility of using the Reciprocity Act to retaliate against the United States, a move that could result in a 50% tariff on Brazilian goods exported to the United States, including coffee.

Source: https://hanoimoi.vn/dong-tien-chay-manh-day-mxv-index-len-dinh-gan-hai-thang-714971.html

![[Photo] The majestic "sea eye" in the middle of the ocean of Da Nang city](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/3/a2cdfcc4501140e6a6bc2ad767f64b36)

Comment (0)