According to Decree 70, from June 1, businesses will use electronic invoices generated from cash registers that have data connected to the tax authority for each sale. Each sales and purchase order will be recorded by the system and information will be transmitted to the tax authority.

This has led many businesses to worry that if revenue suddenly increases, the tax department may collect back taxes from them for previous months.

Fear of being charged back taxes has even caused many businesses to refuse to accept transfers recently. Some places accept transfers but ask customers not to write details such as purchase, deposit, or goods price, but to change them to details such as “happy birthday”, “happy wedding”...

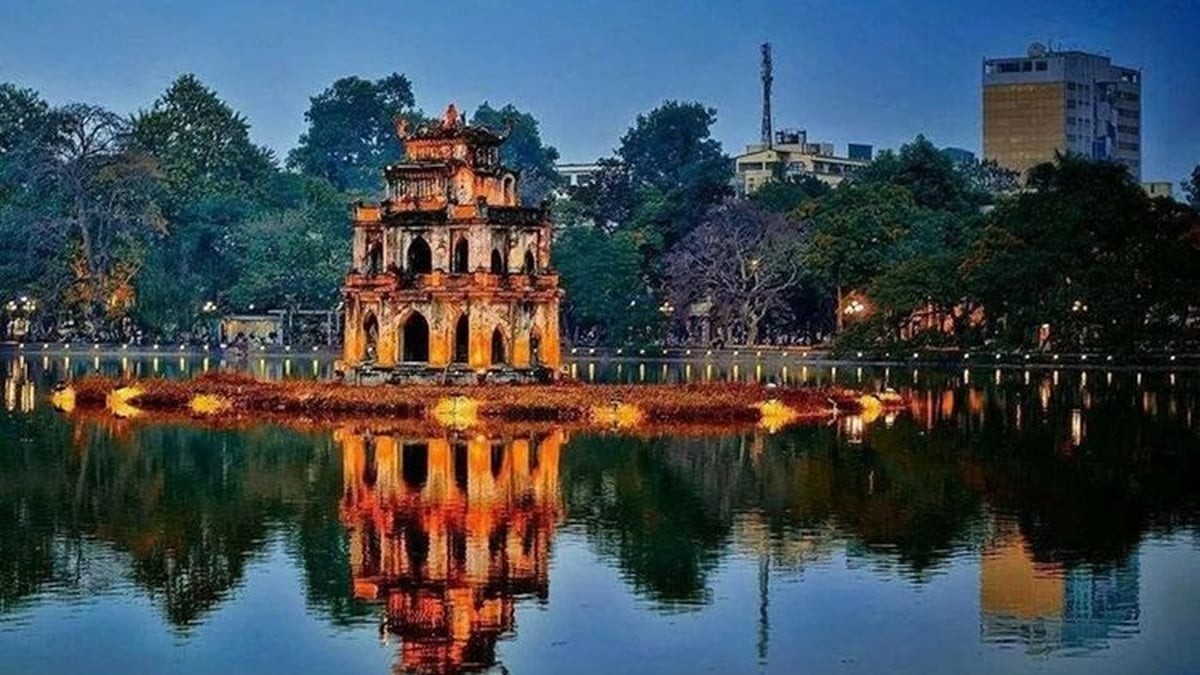

Business households worry about being charged additional taxes after the lump-sum tax is abolished (Photo: Hai Long).

Sharing at a recent press conference, Deputy Director of the Tax Department Mai Son said that the tax authority calculates the lump-sum tax of business households based on the tax authority's data and the annual declaration of the business household to determine the revenue in the year, and evaluates to determine.

However, during the year, if the business household's revenue increases or decreases, fluctuating by more than 50%, the business household can request the tax authority to adjust the tax rate. The adjustment is only calculated from the time of fluctuation onwards. That is a legal provision, there is no story of additional collection in this policy."

In the process of implementing new regulations and policies of the tax industry, typically the use of electronic invoices generated from cash registers, Mr. Son affirmed that it is inevitable that there will be mistakes and errors.

"Among more than 30,000 tax officials and civil servants, there are individuals who lack patience, courage, and character in the implementation process, causing frustration for the people. We affirm that we will strictly handle those cases," said the leader of the Tax Department.

Source: https://dantri.com.vn/kinh-doanh/cuc-thue-khong-truy-thu-thue-khoan-20250617114327560.htm

![[Maritime News] More than 80% of global container shipping capacity is in the hands of MSC and major shipping alliances](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/16/6b4d586c984b4cbf8c5680352b9eaeb0)

Comment (0)