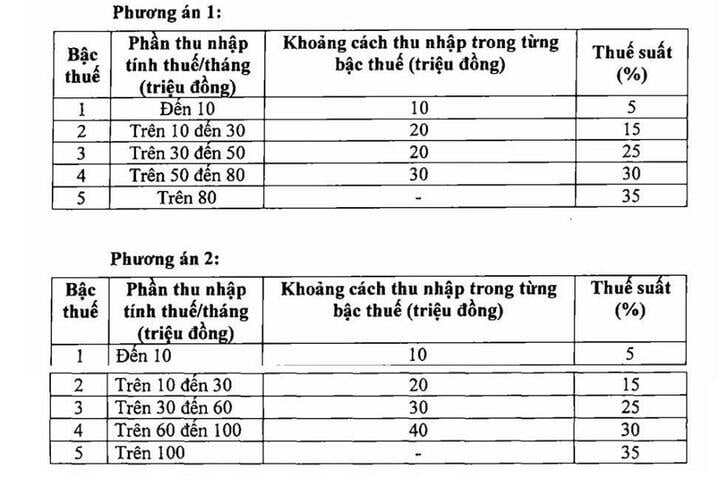

The Ministry of Finance is proposing two options to amend the progressive personal income tax schedule in a way that reduces the number of levels and widens the income gap. In both options, the minimum tax rate of 5% corresponds to a monthly taxable income of VND10 million (after deducting family circumstances and other taxable expenses). The maximum tax rate is 35%, for taxable income of over VND80 million (option 1) and VND100 million or more (option 2).

However, many opinions say that 35% is too high, inappropriate and should be adjusted down.

Mr. Nguyen Van Duoc - Head of Policy Department of Ho Chi Minh City Tax Consultants and Agents Association, General Director of Trong Tin Accounting and Tax Consulting Company Limited - expressed his support for shortening the tax table to 5 levels, because this will make the tax system simpler and more convenient.

However, Mr. Duoc emphasized: "My personal opinion is that the 35% tax rate should be removed because it is too high and can easily discourage taxpayers from wanting to get rich."

Mr. Duoc even fears that maintaining a tax rate that is too high not only discourages development but also creates negative consequences such as fraud and tax evasion. “If we reduce it to 30%, it may encourage people to get rich in a transparent way, while limiting negative behaviors. Moreover, in the context of globalization, this also creates a more competitive working environment, helping to attract and retain high-quality human resources,” Mr. Duoc added.

In addition, Mr. Duoc proposed stronger reform options for levels 1 and 2: “If possible, levels 1 and 2 should be expanded. For example, a 5% tax rate can be applied to income up to VND20 million. Then, from VND20 million to VND40 million, the tax rate will be 15%. Then, levels 3, 4 and 5 should be redesigned in the most scientific way.”

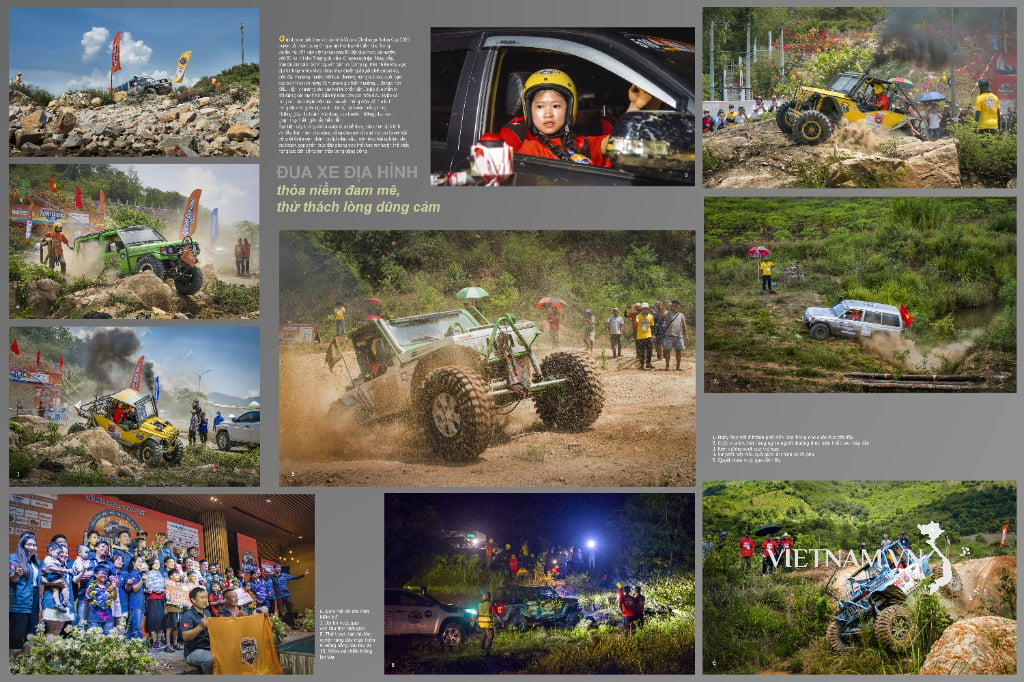

Many experts propose reducing the personal income tax rate by 35% (Illustration: Finance Magazine)

Mr. Duoc explained that restructuring low tax brackets will help reduce the burden on the majority, support low-income workers, and make tax policy more fair and effective .

Sharing the same view, tax expert Nguyen Ngoc Tu - former Director of the General Department of Taxation, currently a lecturer at Hanoi University of Business and Technology - shared that the highest tax rate of 35% is too high, which can cause difficulties in unlocking resources and high-quality human resources . "The tax schedule should be designed so that the average rate is around 20 - 25%, which is okay." Mr. Tu said.

Meanwhile, Mr. Nguyen Quang Huy, CEO of the Faculty of Finance and Banking (Nguyen Trai University) commented that according to the revised plan 1 proposed by the Ministry of Finance, taxable income of less than 1 billion VND/year is subject to a tax rate of up to 35%, which is too high, reducing the motivation to earn money. Such an income level at present is only considered good, not rich. It is necessary to consider redesigning the tax schedule to be similar to the level of inflation since the Personal Income Tax Law was enacted.

“The outdated personal income tax table has only been revised for more than ten years, so it is no longer suitable for reality due to inflation, average income and living costs all increasing. This time, we should consider a mechanism to adjust the tax threshold in the progressive tax table according to inflation. For example, if inflation increases each year, it will be adjusted accordingly. Along with that, the National Assembly should give the Ministry of Finance the right to increase the family deduction level every two years, without having to wait too long to amend the law to do it.” Mr. Huy suggested.

Regarding the maximum tax rate of 35%, Mr. Nguyen Quang Huy said that if it is applied, the operator should only apply it to people with income over 100 million VND/month, like option 2 of the Ministry of Finance. This level corresponds to the group of 2% richest people.

Source: https://baolangson.vn/chuyen-gia-nen-giam-muc-35-thue-tncn-de-kich-khich-nguoi-dan-lam-giau-5054538.html

![[Photo] National Assembly Chairman attends the seminar "Building and operating an international financial center and recommendations for Vietnam"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/28/76393436936e457db31ec84433289f72)

Comment (0)