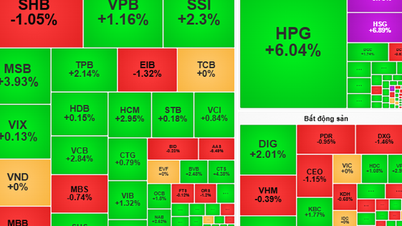

Market excited after surpassing 1,700 point peak

At the beginning of this morning's trading session (September 5), VN-Index easily conquered the 1,700-point mark - the highest ever. At 9:47, the index increased by 5.5 points to 1,701.66 points. Green dominated both floors, with HoSE liquidity exceeding VND7,400 billion.

The VN30 large-cap stocks group mostly moved in green, but still could not conquer the resistance level of 1,900 points.

At the end of the morning session, VN-Index increased by 9 points to 1,705.3 points. Liquidity on HoSE reached over 20,134 billion VND. Cash flow trend is leaning towards large-cap stocks, such as VIC, TCB, KBC, VJC, SSI, MSN...

According to experts, the stock market's growth momentum comes from profit growth of domestic enterprises, the possibility of upgrading the stock market in early October and the prospect of the US Federal Reserve (Fed) easing monetary policy.

Mr. Ho Huu Tuan Hieu - Investment Strategy Expert, SSI Research Investment Analysis and Consulting Center - said that in the past week, the market has shown signs of shaking and changing status. Investors should flexibly follow this movement.

When liquidity returns, the banking group may prosper, and cash flow will spread to many other stock groups. Allocating the portfolio to many industries will help exploit opportunities from cash flow rotation.

According to Mr. Hieu, there will come a time when cash flow returns to the banking industry, so investors need to anticipate when market sentiment improves. However, they should not constantly change their portfolios and disburse too quickly.

At this time, SSI Research representative commented that the market has not shown any negative signals for investors to sell their entire portfolio or reduce their holdings sharply. However, this is no longer the right time to trade too strongly or use high leverage ratios. Investors should enjoy the positive growth of the market, combining caution and perseverance for the trend over a longer period of time.

During the cash flow rotation period, in August, the market was bustling almost every day. But in September, liquidity showed signs of decline, each industry group only had strength for a short period. The oil and gas group has the ability to recover later, investors can take advantage of this opportunity. In addition, instead of focusing only on stocks that are increasing strongly, investors should pay attention to stocks that are in the process of adjustment.

VN-Index easily conquered the 1,700 point mark (Photo: Hai Long).

According to Mr. Dao Hong Duong, Director of Stock and Industry Analysis at VPBank Securities (VPBankS), in the short term there will be some information that can affect market sentiment.

The Fed’s interest rate decision and exchange rate movements can have a relatively large impact on medium- and long-term market sentiment. Specifically, if the Fed lowers interest rates, the market will be very good, but if it does not lower interest rates in September, the market will not be affected more negatively.

In addition, fluctuations in the trade balance and export turnover in August and September can also affect the market. Mr. Duong said that this is a signal factor showing the actual impact of tariffs.

The expert said that in the first 7 months of the year, Vietnam's import-export turnover was still very good. By mid-August, the trade surplus was still over 10 billion USD, but there were signs of slowing down.

Securities stocks will be early indicators for the market

According to the assessment report of MB Securities Company (MBS), the domestic market has some remarkable signals. Firstly, VN-Index increased sharply in the last week of August and the main driving force came from Vingroup (VIC, VHM) and VCB.

Strong net selling by foreign investors is holding back the index's growth, with net sales of VND42,700 billion in August alone. Market liquidity has shown signs of peaking at VND62,000 billion (total market), down 27% in the last week of August. Current cash flow is mainly concentrated in banking and securities stocks.

MBS believes that the market focus will be on the FTSE Russell upgrade information. Therefore, the group of securities stocks will be an early indicator for the market.

Outstanding stocks such as SSI, VND, SHS are higher than the VN-Index at 1,700 points. Therefore, the performance of the stock group in the first 2 weeks of September could be an early indicator of whether the market will be upgraded in early October or not.

This securities company believes that investors should take partial profits, bringing the proportion of stocks and cash to a balanced level. In the current context, investors should focus on specific stocks, instead of referring to the general index which can easily cause "illusion".

VN-Index increased sharply in the last week of August (Photo: D.D).

Mr. Tong Nguyen Khoa Tri, Director of Binh Duong branch of Mirae Asset Securities Company (Vietnam), said that VN-Index has just surpassed the 1,700 point mark. The growth momentum comes from two main factors: the determination to boost GDP and the goal of upgrading the stock market set by the Government.

In terms of valuation, the market is currently returning to its 10-year average. Therefore, the VN-Index is expected to reach 1,770 - 1,780 points. In addition, the market is developing strongly with many new products and mechanisms such as expected upgrades, T0 transactions, or midday transactions, creating more attraction for investors.

Despite strong foreign net selling, the market still absorbed well and continued to rise. This shows that domestic investors are playing an increasingly important role, becoming the driving force of the trend, although foreign investors are still a notable factor.

Regarding market developments, Mr. Tri commented: after surpassing the peak, stocks will often have corrections. When a resistance zone is broken, it will become a new support zone for the index. Therefore, 1,700 points could be a short-term peak, and investors should patiently wait for safer disbursement opportunities.

From a technical analysis perspective, VN-Index still has the potential to reach the 1,900-point mark in this uptrend. Therefore, market corrections can be considered as opportunities for new investors to participate.

Expectations of market upgrade?

Vietnam's stock market will be considered for upgrading from frontier market to emerging market by FTSE on October 7.

According to HSBC, in an optimistic scenario, the upgrade could help Vietnam attract a maximum of $10.4 billion in foreign capital. However, the actual capital flow will be gradually distributed because FTSE usually announces about 6 months in advance when changing the classification of a market.

There are currently more than 100 funds specializing in investing in Vietnam, with total assets of about 11 billion USD, compared to only 17 funds managing 3 billion USD at the end of 2014. In addition, many investment funds in Asia and emerging markets also own Vietnamese stocks in their portfolios.

If upgraded, Vietnamese stocks could account for 0.5-0.6% of the FTSE indexes, equivalent to about $1.5 billion in passive capital. In a higher weighting scenario, capital flows could reach $3 billion. For active funds, HSBC estimates that additional capital flows into Vietnam could reach $1.9-7.4 billion.

Vietnam's stock market will be considered for upgrading from a frontier market to an emerging market by FTSE in the annual index review on October 7 (Photo: Huu Khoa).

Regarding the prospect of upgrading the market, Mirae Asset representative said there are very positive signals, many side information said that everything has almost been agreed and just waiting for the announcement date.

In his personal opinion, Mr. Tri believes that the upgrade story is only a matter of time. With the current outlook, as long as this topic is still being discussed, the market still has something to look forward to.

Vietnam has been on the FTSE Russell upgrade watchlist since September 2018. Seven out of nine criteria have been met. HSBC believes that new developments in the remaining two criteria, namely the amended Securities Law, effective from January 1, 2025, and the operation of the KRX system from May, will increase the possibility of an upgrade.

Source: https://dantri.com.vn/kinh-doanh/chung-khoan-vuot-1700-diem-truoc-ky-nang-hang-nen-mua-hay-ban-20250905125543885.htm

![[Photo] Impressive display booths of provinces and cities at the Exhibition 80 years of the Journey of Independence - Freedom - Happiness](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/7/cd63e24d8ef7414dbf2194ab1af337ed)

Comment (0)