Forecast of lower export output supports coffee prices

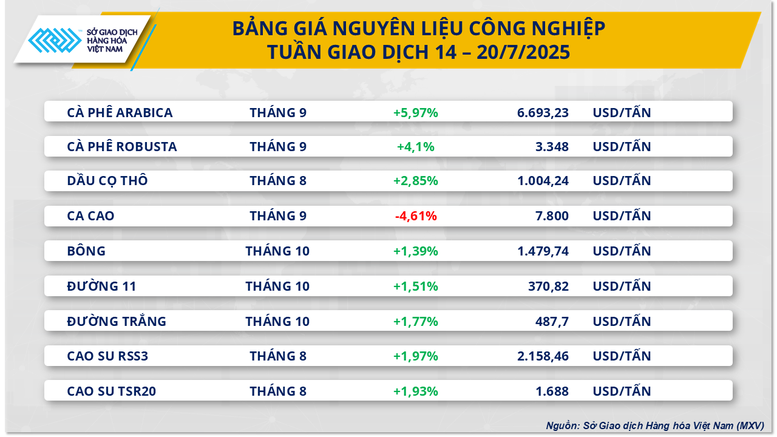

Closing the last trading week, the industrial raw material market witnessed overwhelming buying power with 8/9 items. Of which, Arabica coffee price skyrocketed nearly 6%, to 6,693 USD/ton, Robusta coffee price also recorded an increase of more than 4% to 3,348 USD/ton.

According to MXV, low inventories have made Brazil’s coffee export prospects in the 2025–2026 crop year challenging. The country’s export output is estimated to be between 34 and 41.4 million bags, down 8.75% to 25% from the previous crop year’s 45.59 million bags.

In addition, last week saw a sharp increase in the net buying position of hedge funds in the Arabica coffee derivatives market, with an increase of 8.75% to 21,809 contracts. This development contributed significantly to the significant recovery of Arabica coffee prices during the week.

Meanwhile, production in Brazil is still going well. According to Safras & Mercado, as of July 16, Brazil had completed 77% of its 2025–26 coffee harvest, up from 74% at the same time last year. Dry weather has facilitated the harvest to accelerate and put it ahead of last year.

In addition, the new tariffs from the US also make it difficult for Brazilian coffee to access the world's largest consumer market. The heavy tax on Brazilian coffee threatens to deeply disrupt the international market, because alternative sources of large volumes of Brazilian origin are currently almost impossible. In 2024, the US will consume about 24 million 60-kg bags of coffee, of which 8.1 million bags will be imported directly from Brazil.

A study by the National Coffee Association (NCA) – the body representing US coffee processing and trading companies – showed that 76% of Americans drink coffee and every $1 of imported green coffee brings $43 to the US economy , contributing $343 billion and creating 2.2 million jobs in the US. Brazilian coffee brings a lot of value to the US, so imposing tariffs will create a lot of pressure on the market.

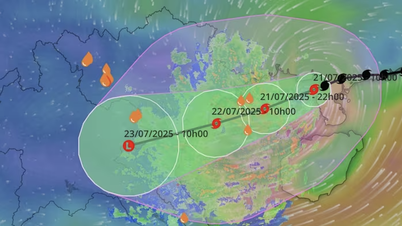

On the weather front, the World Weather Service said earlier this week that some computer models were suggesting that colder weather could hit some coffee-growing areas in Brazil by the end of July. However, current forecasts suggest temperatures will not drop to a level that would put crops at risk.

MXV believes that this week, world coffee prices, followed by domestic coffee prices, will likely continue to adjust and tend to increase in the first sessions of the week due to increased hoarding in the US before the reciprocal tax takes effect. Depending on the tariff developments and supply in Brazil, coffee prices will continue to increase or reverse and weaken at the end of the week.

Oil prices fall below $70/barrel

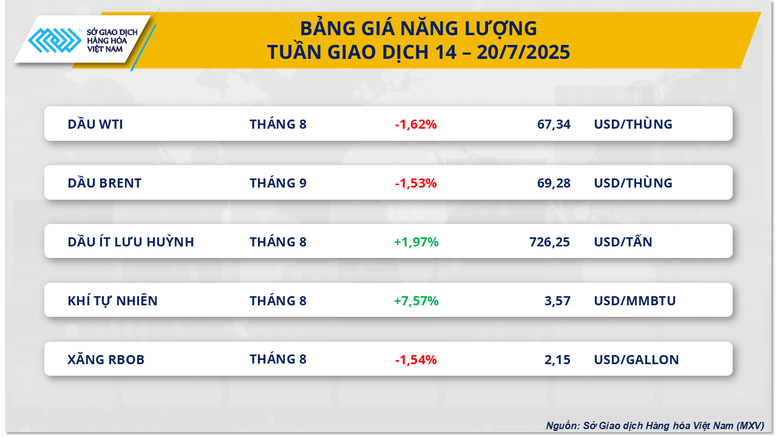

According to MXV, the energy market last week recorded clear divergences. At the end of the trading week, Brent oil prices fell below the $70/barrel threshold, stopping at $69.28/barrel, corresponding to a weekly decrease of 1.53%. Similarly, WTI oil prices also recorded a weekly decrease of about 1.62%, down to $67.34/barrel.

Geopolitical concerns have returned to global energy markets, but oil prices are still under pressure from two other factors: global trade tensions due to the White House's tariff policies and the prospect of a supply glut for the rest of the year.

On the other hand, natural gas prices on the NYMEX floor increased by 7.57% compared to the previous week's close, reaching $3.57/MMBtu, the highest level since early July. Despite the impact of natural gas inventories continuing to increase in the US, natural gas prices in the US continued to be supported by the high demand for electricity consumption of people in the context of the return of hot weather in the US.

Source: https://baochinhphu.vn/chi-so-mxv-index-tang-tuan-thu-hai-giua-bien-dong-giang-co-cua-thi-truong-102250721102710977.htm

![[Photo] National Assembly Chairman Tran Thanh Man visits Vietnamese Heroic Mother Ta Thi Tran](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/20/765c0bd057dd44ad83ab89fe0255b783)

Comment (0)