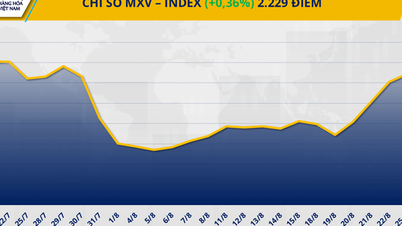

Energy commodity market in red. Source: MXV

According to MXV, at the end of yesterday's trading session, all 5 commodities in the energy group were under strong selling pressure. In particular, both main crude oil commodities recorded a decrease of more than 2%.

Specifically, Brent oil price fell to 63.25 USD/barrel, corresponding to a decrease of 2.3%; while WTI oil price recorded a decrease of 2.39%, stopping at 67.22 USD/barrel.

US President Donald Trump's unexpected move to request a change in senior personnel at the US Federal Reserve (FED) is seen by investors as a new effort to increase pressure on the FED to lower interest rates soon, but it also increases cautious sentiment in the market.

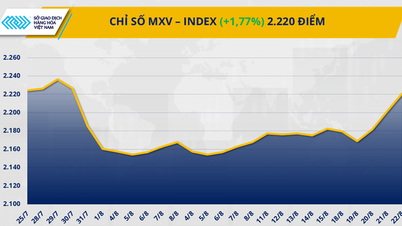

The metal commodity market is divided. Source: MXV

Meanwhile, the metal market continued to have clear divergences. Notably, COMEX copper prices fell 0.4%, falling to $4.46/pound, equivalent to $9,831/ton, ending the previous four consecutive sessions of increase.

According to MXV, copper prices are under pressure as concerns about the risk of supply disruptions at major copper mines have been somewhat alleviated.

In Vietnam, despite global supply surplus, copper prices remain high thanks to expectations of recovering industrial demand and stable demand from the electricity and construction sectors.

According to the Customs Department, in the first half of August, copper imports reached 19,448 tons, up more than 6% over the same period last year. Accumulated from the beginning of the year to August 15, the total import volume reached more than 309,000 tons, up nearly 15% over the same period in 2024.

Source: https://hanoimoi.vn/ap-luc-ban-manh-cat-dut-da-tang-4-phien-cua-mxv-index-714135.html

![[Photo] Many people eagerly await the preliminary review despite heavy rain](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/4dc782c65c1244b196890448bafa9b69)

![[Photo] Brilliant red of the exhibition 95 years of the Party Flag lighting the way before the opening](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/e19d957d17f649648ca14ce6cc4d8dd4)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

![[Photo] General Secretary To Lam attends Meeting with generations of National Assembly deputies](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/8/27/a79fc06e4aa744c9a4b7fa7dfef8a266)

Comment (0)