(Dan Tri) - Both the US and Asian stock markets increased sharply on US election day. Meanwhile, the European market remained more cautious.

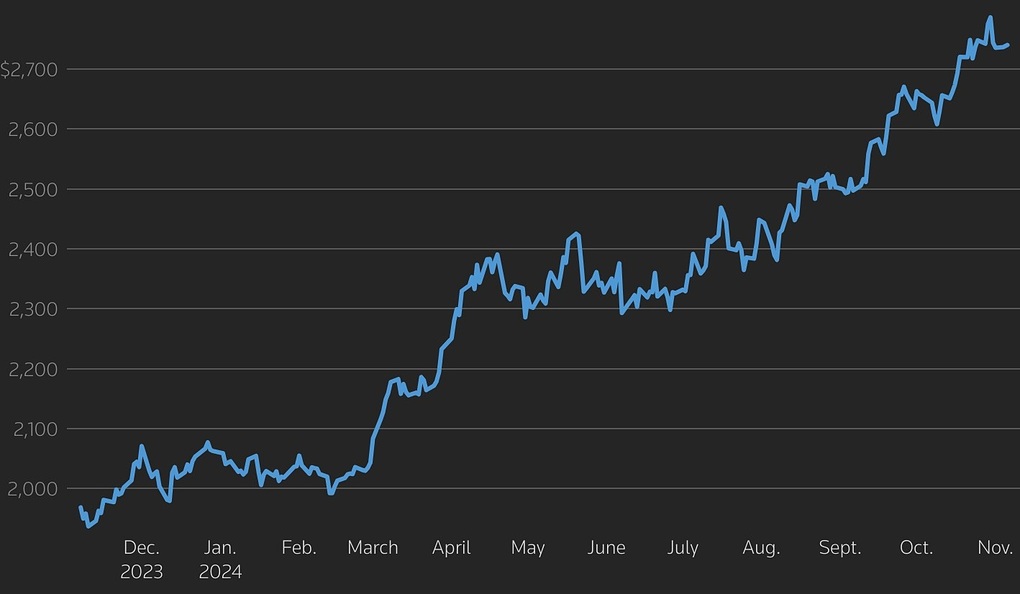

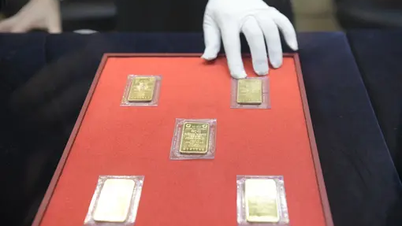

Issues surrounding the US presidential election caused the price of gold to close the trading session on November 5 up more than 7 USD to 2,743 USD/ounce.

"The uncertainty surrounding the US presidential election is affecting the market. Investors are worried that things will not go smoothly, or that import tariffs will be raised, or that economic policy will change a lot," Daniel Pavilonis, senior market strategist at financial firm RJO Futures, told Reuters .

Another reason for the rise in gold prices is that investors are almost certain that the US Federal Reserve will cut interest rates at its next meeting. Gold prices have increased 33% this year due to the low interest rate environment and economic and political instability around the world.

World gold prices have continuously increased over the past year (Photo: Reuters).

US stocks also rose sharply yesterday, thanks to optimistic data on the world's largest economy. At the end of the session on November 5, the S&P 500 index increased 1.2%, reaching 5,772 points, approaching the record level set last month. Meanwhile, the Dow Jones index increased 1%, while the Nasdaq Composite increased 1.4%.

The Institute for Supply Management (ISM) said yesterday that its services purchasing managers index (PMI) continued to accelerate in October, reaching 56 points. The US economy is increasingly forecast to have a soft landing, thanks to rising corporate profits, lower interest rates and a solid labor market.

This shows that the US economy is gradually stabilizing and minimizing the risk of recession, although concerns about prolonged inflation still exist.

Meanwhile, in Europe, the situation was somewhat more cautious, with the STOXX 600 index rising slightly by 0.1% thanks to industrial stocks, according to Bloomberg.

"A Trump victory could be good for US stocks, but a nightmare for European and international markets. If Harris wins, European and international stocks could benefit," Ben Ritchie, head of equity markets at investment firm Abrdn, told Reuters .

In Asia, Chinese stocks recorded their strongest increase in four weeks in the latest trading session, according to Business Times. Specifically, the Shanghai Composite Index increased by 2.32% to 3,387 points, while the CSI 300 index of blue-chip stocks increased by 2.53% to 4,044.57 points.

In addition, Japanese stock indexes also recorded positive signals. The Nikkei 225 index rose 1.11% to close at 38,475 points, and the Topix rose 0.76% to 2,664 points in the post-holiday trading session, according to Trading Economics .

Source: https://dantri.com.vn/kinh-doanh/vang-va-chung-khoan-toan-cau-hung-phan-trong-ngay-bau-cu-tong-thong-my-20241106151343990.htm

Comment (0)