USD exchange rate today 6/29/2025

At the time of survey at 4:30 a.m. on June 29, the central exchange rate at the State Bank was 25,048 VND/USD, unchanged from yesterday's trading session.

Specifically, at Vietcombank , the USD exchange rate is 25,880 - 26,270 VND/USD, unchanged in both directions, compared to yesterday's trading session.

NCB Bank is buying USD cash at the lowest price: 1 USD = 25,790 VND

MSB Bank is buying USD transfers at the lowest price: 1 USD = 25,866 VND

HSBC Bank is buying USD cash at the highest price: 1 USD = 26,001 VND

HSBC Bank is buying USD transfers at the highest price: 1 USD = 26,001 VND

HSBC Bank is selling USD cash at the lowest price: 1 USD = 26,237 VND

HSBC Bank is selling USD transfers at the lowest price: 1 USD = 26,237 VND

HDBank , NCB, TPB are selling USD cash at the highest price: 1 USD = 26,307 VND

NCB and TPB banks are selling USD transfers at the highest price: 1 USD = 26,307 VND

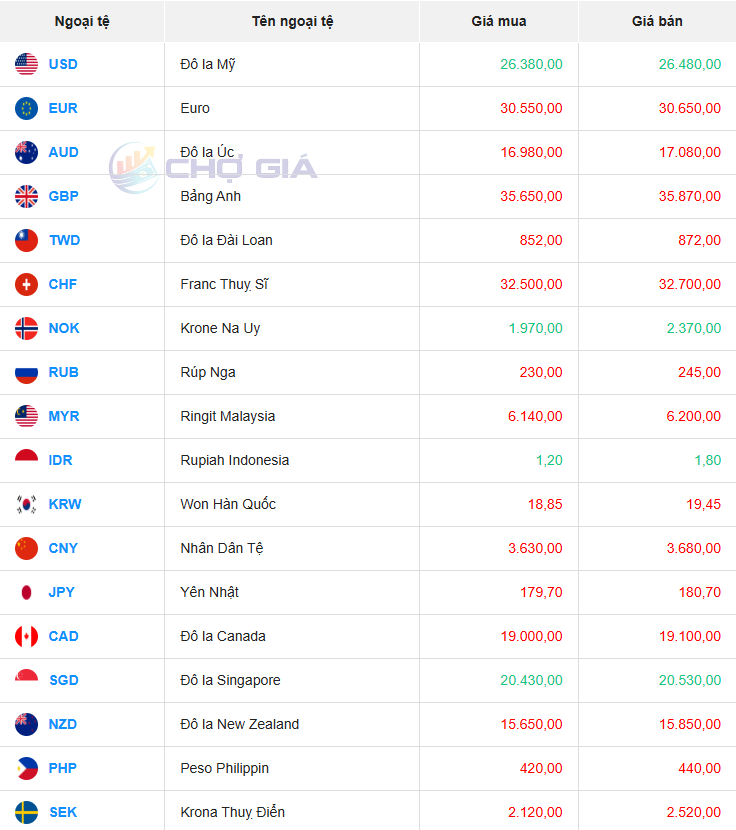

In the "black market", the black market USD exchange rate as of 4:30 a.m. on June 29, 2025 decreased by 9 VND in both buying and selling directions, compared to yesterday's trading session, trading around 26,380 - 26,480 VND/USD.

USD exchange rate today June 29, 2025 on the world market

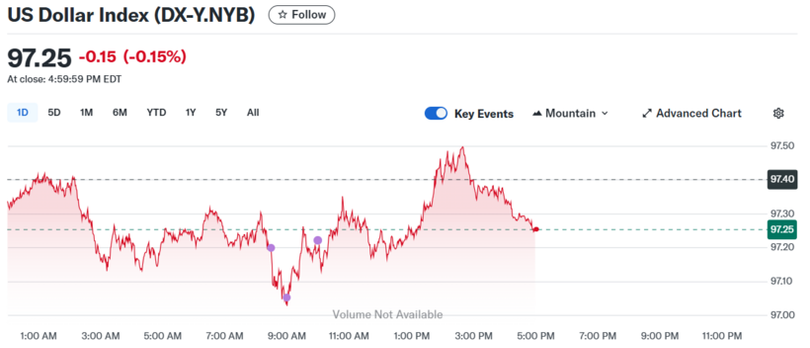

The Dollar Index (DXY), which measures the USD against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stopped at 97.25 - down 0.05 points compared to June 28, 2025.

The US dollar rose only slightly when the US announced that the core personal consumption expenditure (PCE) price index in May increased more than expected and last month.

According to analysts, despite forecasts of rising inflation in the first quarter and May compared to the same period last year, the USD had a sharp decline in a week, reaching its lowest level in the past 3 years.

Experts say that the USD has lost a lot of value in the international payment basket because geopolitical tensions in the Middle East have cooled down, as both Iran and Israel are maintaining a ceasefire. Meanwhile, Russia and Ukraine are still maintaining peace negotiations and prisoner exchanges to understand each other and get closer to find solutions to reach a peace agreement in the region.

As geopolitical tensions cool down, the USD has lost its safe-haven status. Markets are forecasting that the USD will continue to be sold off heavily, with investors shifting to the more stable EUR.

"Minneapolis Federal Reserve Bank President Neel Kashkari maintained the outlook for two rate cuts in 2025, with the first likely in September," financial markets analyst Louis Juricic told Investing.com.

Kashkari noted that falling inflation would allow the central bank to begin easing monetary policy, although he cautioned that if inflation stalls or reverses, the Fed could pause its rate-cutting cycle until prices fall again. He added that the Fed could keep rates at their new levels until it is confident that inflation is returning to its target.

Source: https://baohatinh.vn/ty-gia-usd-hom-nay-2962025-co-ban-on-dinh-post290775.html

![[Photo] Marching together in the hearts of the people](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/31/8b778f9202e54a60919734e6f1d938c3)

![[Photo] National Assembly Chairman Tran Thanh Man welcomes and holds talks with Chairman of the National People's Congress of China Zhao Leji](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/31/9fa5b4d3f67d450682c03d35cabba711)

![[Photo] General Secretary To Lam receives Chairman of the National People's Congress of China Zhao Leji](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/31/5af9b8d4ba2143348afe1c7ce6b7fa04)

Comment (0)