Energy commodity markets are dominated by green. Source: MXV

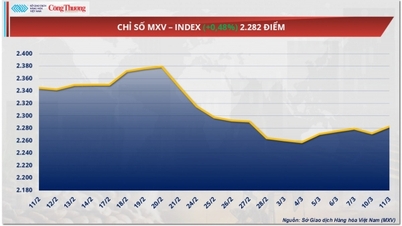

Closing, the MXV-Index increased sharply by nearly 2% to 2,268 points.

At the end of the last trading week, the energy market witnessed a strong increase in most of the key commodities in the group. In particular, oil prices extended their increase to the second consecutive week with the main driving force from geopolitical fluctuations.

Specifically, WTI oil price increased by more than 13%, to 72.9 USD/barrel - the highest level in more than 4 months, while Brent oil also recorded an increase of more than 11%, reaching 74.23 USD/barrel.

Tensions between Israel and Iran that flared up over the weekend have raised concerns about the risk of disruption to oil supplies, especially in key shipping routes such as the Strait of Hormuz, a key oil export route for many Gulf countries.

In addition, progress in trade negotiations between the world's two largest economies , the US and China, which are also the two largest sources of global oil demand, has supported the rise in oil prices, as expectations of a recovery in trade and energy demand are reinforced.

However, cautious sentiment still dominates the market as investors remain concerned about the possibility of the two countries reaching a comprehensive, long-term agreement, as well as the remaining uncertainties in bilateral trade relations.

The industrial raw material commodity market is dominated by red.

Source: MXV

Contrary to the general market trend, the industrial raw material group recorded overwhelming selling pressure on most key products in the group. In particular, the price of sugar 11 decreased by more than 2% to 355 USD/ton, the lowest level in nearly 4 years.

The main reason for the decline in sugar prices is the prospect of continued abundant global supplies in the 2025–2026 crop year.

Notably, in India, the world's second largest sugar producer, the country's Ministry of Agriculture said sugar output is expected to increase by 19% year-on-year to 35 million tons, thanks to expanded sugarcane growing areas and favorable weather conditions.

Meanwhile, global sugar demand, especially in China and the US, continues to weaken, contributing to the prolonged decline in sugar prices.

Source: https://hanoimoi.vn/tuan-bien-dong-manh-cua-thi-truong-hang-hoa-nguyen-lieu-the-gioi-705699.html

Comment (0)