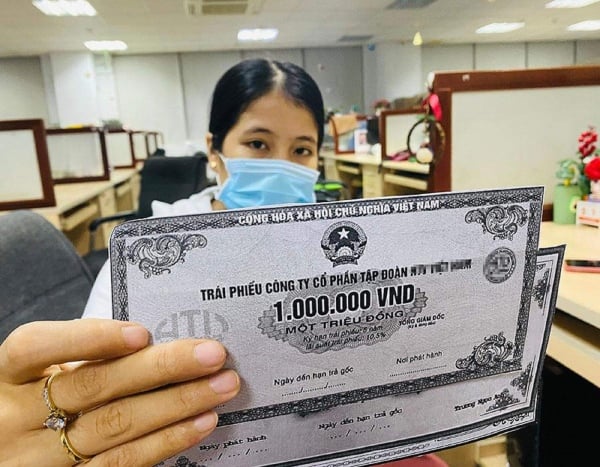

According to an updated report by VIS Rating, the total value of new issuance in May reached about VND66,000 billion, a sharp increase of 35% compared to the previous month. Notably, all issuances were individual bonds. In the first 5 months of 2025, the issuance volume reached VND137,000 billion, an increase of 79% compared to the same period last year.

Banks are still the market leader with more than VND100 trillion in bonds issued, accounting for nearly three-quarters of the total value, with banks such as MB and ACB planning to issue VND30 trillion and VND20 trillion, respectively, this year.

The secondary market also had positive developments with an average trading value of about VND5,800 billion per day - a high level compared to the average in the period 2024-2025. The trading yield of bank bonds with credit ratings of "average or higher" also increased slightly compared to the previous month, showing that investors continue to favor bank bonds in the context of market uncertainties.

However, in contrast to the improvement from the banking sector, the real estate sector continues to be the focus of concern as the situation of late bond payments becomes increasingly complicated. In May alone, the market recorded four first-time late-payment bonds from three companies. Notably, all bonds issued by companies under Hung Thinh Group have fallen into a state of late payment.

This risk may continue to spread in the coming time when the last 6 months of 2025 will witness about 474 bond codes maturing, with a total outstanding debt of up to 150,000 billion VND. Of these, up to 148 bonds with an outstanding debt of 25,800 billion VND are currently in a state of overdue payment. More worryingly, 26 other bonds issued by 15 real estate enterprises are at risk of first-time late payment, with an estimated total outstanding debt of about 19,000 billion VND.

However, the report also recorded some positive signals from the debt settlement side. Six real estate enterprises in May paid a total of nearly VND5,000 billion in overdue bond principal, a 480% increase compared to the previous month. As a result, the principal debt recovery rate in the whole market increased from 30.7% to 31.9%. Some enterprises such as Summer Beach, Seaside Homes, Dai Hung or Construction Corporation have proactively paid or gradually restructured problematic bonds.

However, experts from VIS Rating said that credit risk is still high for many non-financial enterprises, especially in the real estate sector. Indicators of financial leverage, solvency and liquidity are still low. A large proportion of issuers have not yet fully disclosed financial data, making risk assessment even more difficult.

Source: https://doanhnghiepvn.vn/kinh-te/trai-phieu-bat-dong-san-chiu-ap-luc-dao-han/20250613025425618

![[Photo] Prime Minister Pham Minh Chinh receives leaders of several Swedish corporations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/14/4437981cf1264434a949b4772f9432b6)

Comment (0)