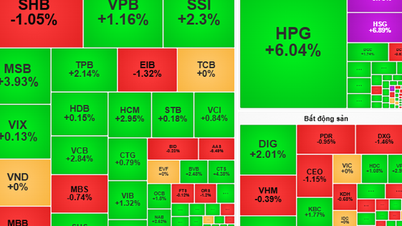

Series of major transactions in banking and real estate groups

MBBank (HoSE: MBB) registered to sell 60 million MB Securities (HNX: MBS) shares from September 3 to October 2 to reduce ownership and increase publicness. Currently, the parent bank holds 76.3% of MBS's capital and will reduce the ratio to 65.9% if the transaction is completed, earning about VND2,500 billion. Previously, MBS had closed the right to a 12% cash dividend, helping MBBank earn an additional VND520 billion. MBS shares are currently trading at VND41,700/share (August 29).

HD Bank (HoSE: HDB) recorded a change in internal shareholders when Mr. Pham Van Dau - Chief Financial Officer, registered to sell 1.3 million shares from September 5 to October 1. If successful, his ownership ratio will decrease from 4.31% to 4.28%, with an estimated value of nearly VND44 billion (at market price of VND33,450/share).

In the real estate sector, Mr. Nguyen Van Dat - Chairman of Phat Dat (HoSE: PDR) plans to sell 88 million shares from September 5 to October 3 by negotiation to meet personal financial needs. With PDR's share price reaching VND24,550/share (August 29), the deal could bring in about VND2,160 billion, while reducing his ownership ratio to 27.7%.

Expert comments after the holiday

Mr. Huynh Anh Tuan, Director of Vikki Digital Banking Securities Company, said that the cash flow in the market is still maintained at over VND40,000 billion/session, while the maximum net selling value of foreign investors is only about VND3,000 billion/session, accounting for a low proportion. According to him, positive sentiment and the prospect of upgrading the market will support the VN-Index to continue to increase, especially in the banking and securities groups.

Mr. Phan Dung Khanh, Investment Consulting Director of Maybank Investment Bank, assessed that in the short week after the holiday, VN-Index will find it difficult to surpass the resistance zone of 1,680 - 1,690 points due to reduced liquidity. However, the medium and long-term uptrend is still maintained, VN-Index is likely to surpass 1,700 points and even conquer the 1,750 point mark by the end of the year.

Mr. Nguyen Viet Cuong, Vice Chairman of the Board of Directors of KAFI Securities, said that the average liquidity in the third quarter reached about VND42,000 billion/session, double that of the first half of the year. According to him, although foreign investors were net sellers, domestic capital still played a role in supporting the market. He predicted that foreign capital could return to net buying when information about interest rates, exchange rates and Fed policies in September became clearer.

According to analysts, the VN-Index is likely to fluctuate around 1,650 points and aim for the psychological threshold of 1,700 points in the short term. In the medium term, Vietnamese stocks remain an attractive investment channel thanks to abundant liquidity, reasonable valuations, expectations of the Fed lowering interest rates, positive third-quarter business results, and prospects for market upgrade.

Source: https://baogialai.com.vn/thi-truong-chung-khoan-sau-ky-nghi-le-2-9-vn-index-huong-den-nguong-1700-diem-post565497.html

![[Photo] Opening ceremony of "Digital Citizenship - Digital School" and commitment to civilized behavior in cyberspace](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/5/222ec3b8892f443c9b26637ef2dd2b09)

![[Photo] Hanoi students excitedly and joyfully open the new school year 2025-2026](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/5/ecc91eddd50a467aa7670463f7b142f5)

![[Photo] The drum beats to open the new school year in a special way](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/5/b34123487ad34079a9688f344dc19148)

Comment (0)