Activities at the Hanoi Tax Department. Illustrative photo: VNA

Accordingly, for inspection decisions that have been issued and are being implemented, the Tax Department requires inspection teams to promptly complete the inspection to issue administrative handling decisions in accordance with legal regulations. Data entry of inspection results into tax industry applications must be completed before July 1.

Regional tax branches are required to temporarily suspend all issuance of inspection decisions until the work of restructuring the apparatus is completed.

The Tax Department said it requires immediate implementation of the above instructions to ensure consistency and avoid interruptions in the process of organizational adjustment.

According to the Tax Department, the above requirements are aimed at ensuring that tax inspections are not interrupted, and that work records related to tax inspections are handed over promptly, quickly, and effectively right after the organization of the apparatus is reorganized during the implementation of the arrangement and merger of provincial and communal administrative units and the organization of the two-level local government system and the consolidation of the apparatus of a number of units under the Ministry of Finance .

The Ministry of Finance has also submitted to the Government amendments and supplements to regulations for vertical organizations of the Ministry. Accordingly, for tax agencies, the regional tax branches will be rearranged to manage in line with provincial administrative units.

Accordingly, reorganizing from 20 regional tax branches into 34 provincial and municipal tax branches directly under the Central Government, an increase of 14 units compared to present.

Along with that, convert district-level tax teams into basic tax units under provincial and municipal tax to manage taxes in some commune-level administrative units.

According to VNA

Source: https://baothanhhoa.vn/tam-dung-viec-ban-hanh-quyet-dinh-kiem-tra-thue-253262.htm

![[Photo] Cuban artists bring "party" of classic excerpts from world ballet to Vietnam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/26/797945d5d20b4693bc3f245e69b6142c)

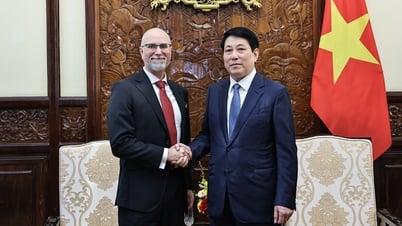

![[Photo] General Secretary To Lam receives Australian Ambassador to Vietnam Gillian Bird](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/26/ce86495a92b4465181604bfb79f257de)

Comment (0)