On the morning of June 19, Minister of Finance Nguyen Van Thang was the first member of the Government to open the 1.5-day question-and-answer session at the 9th session of the National Assembly.

Minister Nguyen Van Thang received many questions about the policy of eliminating lump-sum tax for business households, solutions to achieve the growth target of over 8% this year, attracting FDI capital and the private economy so that this resource can contribute to economic growth.

For the first time, the Minister of Finance answered questions from the National Assembly since the merger of the Ministry of Finance and the Ministry of Planning and Investment .

From June 1, Decree 70/2025 takes effect. About 37,000 households with revenue of over 1 billion VND per year in a number of industries (food and beverage, hotels, retail, passenger transport, beauty, entertainment...) must use electronic invoices generated from cash registers with data connection to tax authorities.

The Minister of Finance said that there were many problems when implementing electronic invoices in the early stages. The Ministry of Finance and the Tax Department coordinated with localities to guide and support business households in the implementation.

The Tax Department said that so far it is providing maximum support to businesses using electronic invoices but "has not fined anyone". "There is no story of fining any business in implementing electronic invoices. Only when after the implementation is smooth and some businesses still deliberately violate, then we will consider fining", Mr. Thang said.

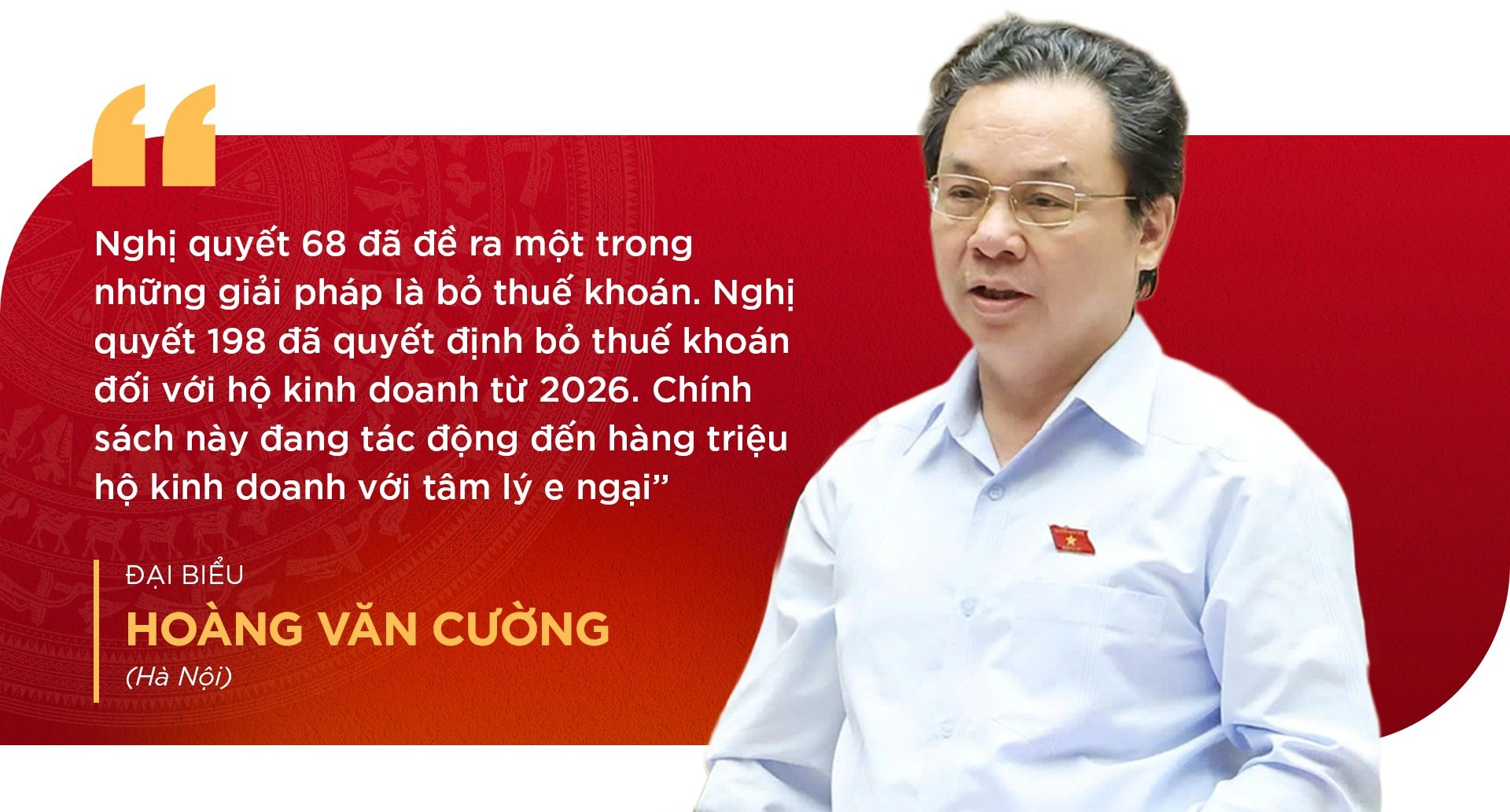

During the questioning session, delegate Hoang Van Cuong (Hanoi) emphasized that the implementation of abolishing lump-sum tax from 2026, according to Resolution 68 and Resolution 198, is directly affecting millions of business households, creating a "fearful" mentality.

Mr. Cuong said that business households are not afraid of paying taxes, but are concerned about the procedures or how to calculate them correctly. He asked the Minister of Finance: "What plans and solutions does the Government have to prepare for business households after the tax is abolished, so that they will find it more convenient, more professional and more enthusiastic about paying taxes?"

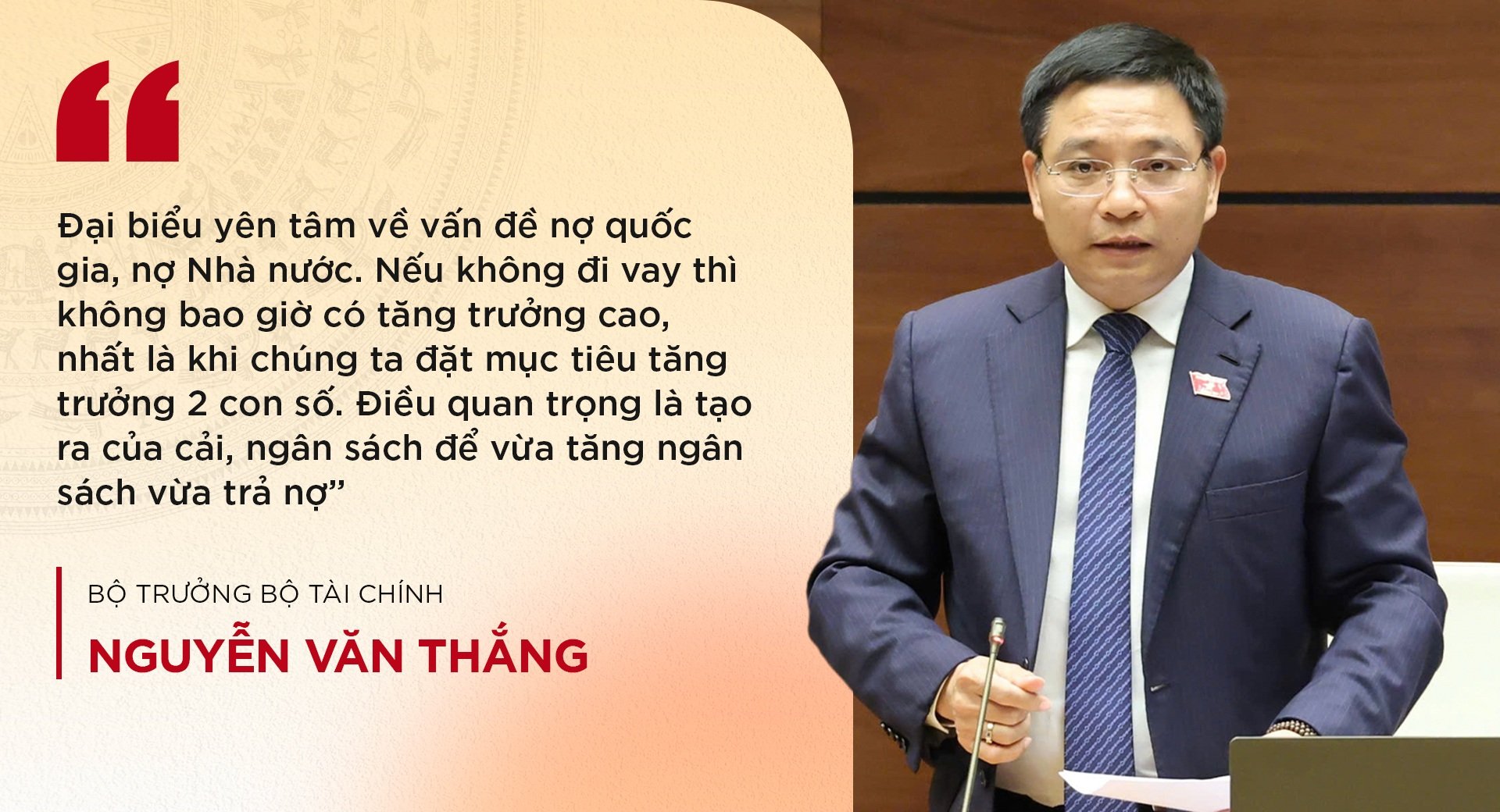

Delegate Tran Van Tuan (Bac Giang) raised the issue that the Ministry of Finance has been advising the Government and the National Assembly on many large-scale transport infrastructure projects including railways, highways, seaports, nuclear power, etc. Delegates wondered where the main source of capital comes from, whether public budget debt is guaranteed, and whether it will leave a big burden for future generations.

In response, Minister Thang said the most important thing is that the project operates effectively. If the loan is effective, the project will still have “food and savings” and contribute to society. The projects in the past have been large and have been well evaluated for economic efficiency.

The Minister emphasized that if we want to develop, we must use leverage, increase socialization, increase borrowing from the people, ODA, and borrowing from international financial organizations. If we do not borrow, we will never have high growth, especially when the Government sets a double-digit growth target. The important thing is to create wealth and a budget to both increase the budget and pay off debt.

Delegate Trieu The Hung (Hai Duong) expressed his concern about one of the most important “driving forces” of the economy, which is domestic consumption, which contributes up to 70% of GDP. The delegate acknowledged that recently, domestic consumption growth has slowed down due to declining purchasing power and consumer confidence being affected by trade fraud, counterfeit goods, fake goods, and poor quality goods.

Delegates raised the issue with the Minister of Finance about solutions to sustainably develop domestic consumption as the main driving force to contribute to double-digit economic growth in the coming time?

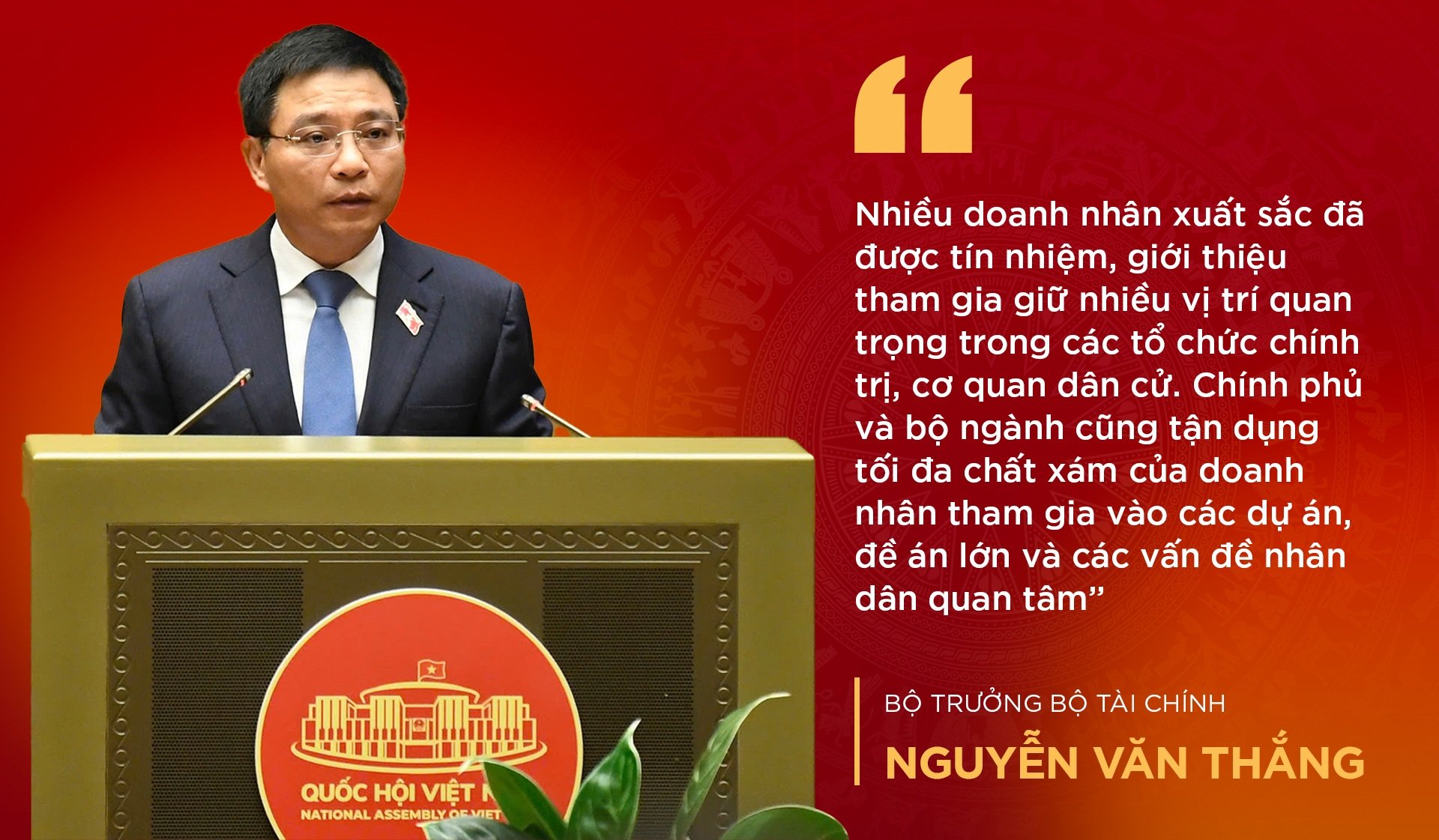

According to the Minister of Finance, in the period of innovation and integration, the team of enterprises and entrepreneurs has been affirming its position and making significant contributions to the country's development.

Many trusted businessmen hold important positions in organizations. The government and ministries also make the most of the brainpower of businessmen for major projects and issues that the Party, State and people care about.

However, the rate of entrepreneurs participating in the political system and elected bodies is still limited. Therefore, Resolution 68 affirmed the need to honor and commend entrepreneurs, and mobilize entrepreneurs with heart and vision to participate in the country's governance.

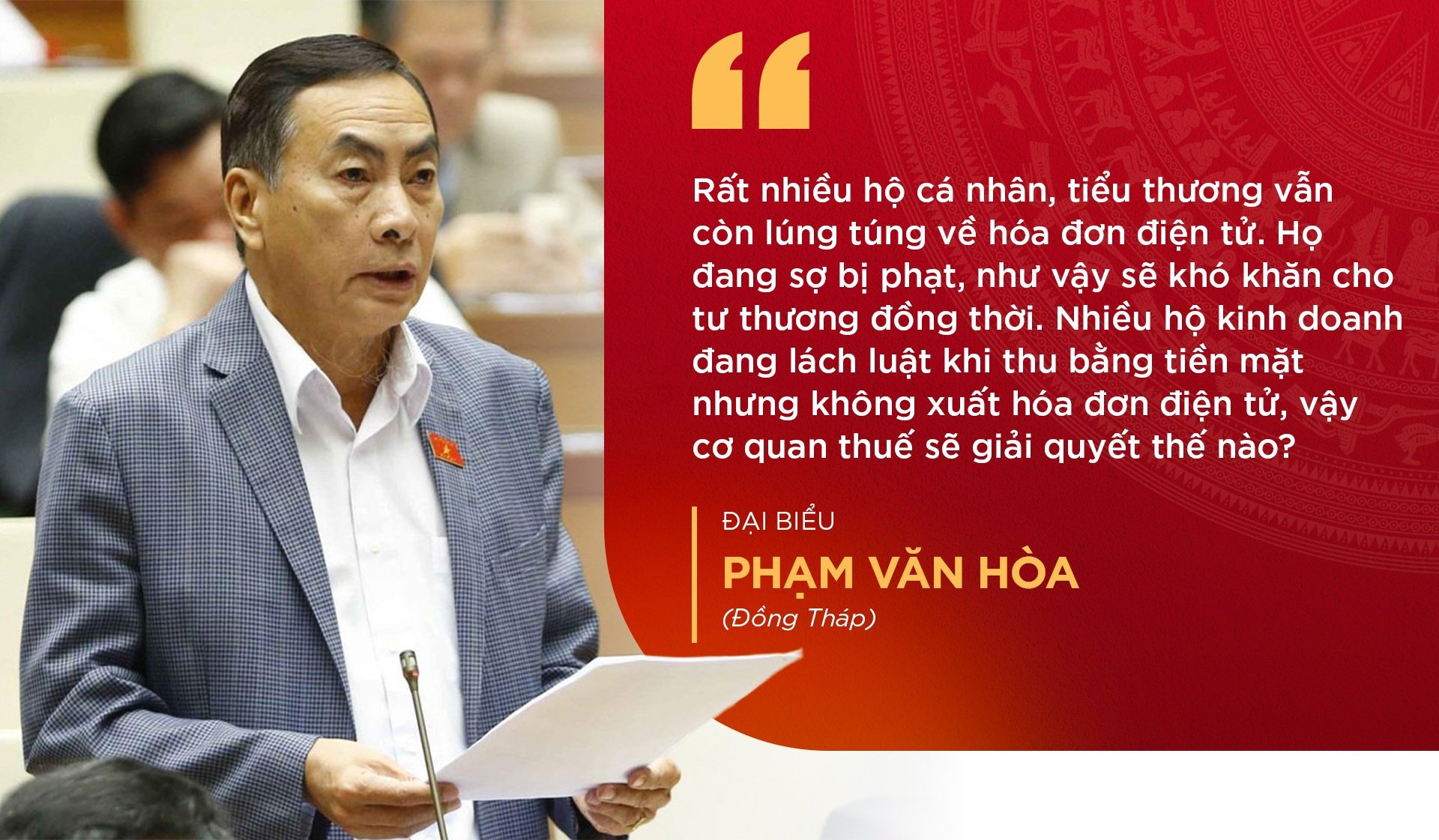

Pressing the debate button on the regulation requiring the application of electronic invoices from cash registers, delegate Pham Van Hoa (Dong Thap) said that currently many businesses and individuals are confused about electronic invoices and worried about being fined if they do not apply the correct procedure.

The delegate raised the question: "Does the Ministry of Finance have any specific solutions to guide business households in using electronic invoices, feel secure when implementing, and not fear being punished by tax authorities?"

At the same time, the delegate also reflected on the situation where some households choose to circumvent the law by only accepting cash, not issuing electronic invoices, and asked the question "What measures will the tax authority take to handle and rectify this?"

Currently, the Ministry of Finance is the representative agency of the owners of 18 corporations and general companies. Minister Nguyen Van Thang said that he has asked these enterprises to rebuild their business plans, adding a growth target of at least 8% or more, to contribute to the overall growth target of the economy.

"The State has opened up its policies to the fullest extent, only managing the capital contribution in enterprises. Enterprises have the right to be proactive, such as deciding on salary and bonus mechanisms, increasing capital... so they need to innovate their thinking and management to achieve business results of over 8%, contributing to the overall growth of the economy," he said.

Minister Thang added that state-owned enterprises themselves must also proactively innovate their thinking, management and operations, and invest in core areas to avoid spreading themselves thin.

During the question-and-answer session, delegate Le Thi Ngoc Linh (Bac Lieu) expressed concern about the situation where most private enterprises, especially small and medium-sized enterprises, although being an important driving force accounting for 40-43% of GDP and attracting 85% of the workforce, still face difficulties in accessing capital, technology and participating deeply in the global value chain...

Faced with the above situation, the Bac Lieu delegation asked the Minister of Finance to provide breakthrough policy solutions to encourage the private economy to boldly invest in research and development, innovation, and digital transformation, instead of focusing only on traditional fields. "Is there a specific financial mechanism to support leading private enterprises to reach regional and international levels?", the delegate asked.

During the question and answer session, delegate Nguyen Thi Thu Dung (Thai Binh) expressed concern about new policies related to special consumption tax, business household tax and personal income tax approved by the National Assembly.

The female delegate raised the issue of increasing special consumption tax and making tax policies for business households more transparent. “Tax policies for business households can lead to the closure of business households, which is happening recently in many localities across the country,” the delegate said.

From there, delegates asked the Minister to propose specific solutions to control and limit risks arising from this policy, ensuring the achievement of the 8% growth target in 2025 and aiming for double digits in the following years.

Minister of Finance Nguyen Van Thang said that special consumption tax plays a role in regulating consumption and aims to improve physical and mental health, increase labor productivity; ensure social security, the environment... contributing to supplementing investment resources for growth.

On the other hand, increasing excise tax to reduce the use of products harmful to health, reduce the burden of medical costs, improve the quality of human resources, help households allocate consumption better, help businesses regulate consumption to reduce goods harmful to health and this is also a solution to increase budget revenue.

Recently, the amended Law on Special Consumption Tax was passed, we have also temporarily not increased the tax, extended the roadmap to share with businesses. The leaders of the Ministry of Finance reaffirmed that the application of special consumption tax is very necessary, ensuring increased revenue, health and environment for the people.

Regarding the issue of business household tax, Mr. Thang said that we are not changing the tax policy, but only making it more transparent. Regarding the recent reflection that some business households had to close due to tax regulations, the leaders of the Ministry of Finance rejected this viewpoint.

Design: Thuy Tien

Source: https://dantri.com.vn/kinh-doanh/nhung-phat-ngon-lam-nong-phien-chat-van-bo-truong-bo-tai-chinh-20250620004440682.htm

![[Infographic] In 2025, 47 products will achieve national OCOP](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/16/5d672398b0744db3ab920e05db8e5b7d)

Comment (0)