A new survey by the Official Monetary and Financial Institutions Forum (OMFIF) shows that central banks are increasingly prioritizing gold in their long-term foreign exchange reserve strategies. The results show that 32% of central banks plan to increase their gold holdings in the next 12 to 24 months, the highest proportion in the past five years.

Not only that, 40% of them plan to continue buying gold over the next decade, far more than any other asset class. The main reason for this trend, according to OMFIF, is to diversify their reserve portfolios and protect the economy from growing geopolitical risks.

The survey of 75 central banks globally shows a clear movement away from the US dollar, with 16% of banks reporting a reduction in their dollar holdings over the past year, up from 11% in 2024. It is also the only currency to see its share of reserves shrink, while gold, the euro and the yuan are gaining traction.

One of the important reasons for the USD's gradual decline is the political situation in the US. According to the survey, 70% of central banks expressed concerns about the US political situation, double the number from last year. In addition, factors such as geopolitical instability, fiscal risks and protectionist trade policies also reduced confidence in the greenback.

In this context, gold has emerged as a comprehensive hedge. Not only is it a hedge against inflation, but it is also a safe haven during times of political uncertainty and trade tensions. Up to 96% of central banks believe that tariffs and trade protectionism pose a major threat to the global economy , and this is not a short-term concern. More than 80% of reserve managers identify geopolitical factors as one of the top three factors influencing long-term investment decisions, ahead of inflation or real interest rates.

Nevertheless, the US dollar remains the dominant global reserve currency. Over 80% of central banks believe that the US dollar still provides the necessary safety and liquidity, and predict that it will account for more than 50% of global reserves in the next decade. This suggests that any “de-dollarization” trend, if it does occur, will be gradual, not sudden.

It is worth noting that the current high price of gold is not discouraging central banks. About 90% of respondents said they remain positive on gold prices in the coming year. The majority believe prices will stabilize above $3,000 an ounce, and more than 20% predict that gold could hit a new record high above $3,500 an ounce.

Along with the OMFIF survey, the World Gold Council (WGC) also just released its annual report showing a similar trend. Both reports agree that central banks are expected to buy around 1,000 tonnes of gold this year, which if true would mark the fourth consecutive year of strong net buying by official institutions.

In the context of the global economy still having many uncertainties and the world monetary system showing signs of restructuring, the role of gold is becoming increasingly clear: not only as a safe haven asset, but also as a pillar in the national monetary strategy.

Source: https://baonghean.vn/ngan-hang-trung-uong-toan-cau-tang-mua-vang-tin-hieu-manh-me-cho-vai-tro-tien-te-cua-kim-loai-quy-10300647.html

![[Photo] Cuban artists bring "party" of classic excerpts from world ballet to Vietnam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/26/797945d5d20b4693bc3f245e69b6142c)

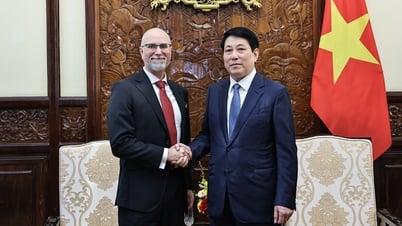

![[Photo] General Secretary To Lam receives Australian Ambassador to Vietnam Gillian Bird](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/26/ce86495a92b4465181604bfb79f257de)

Comment (0)