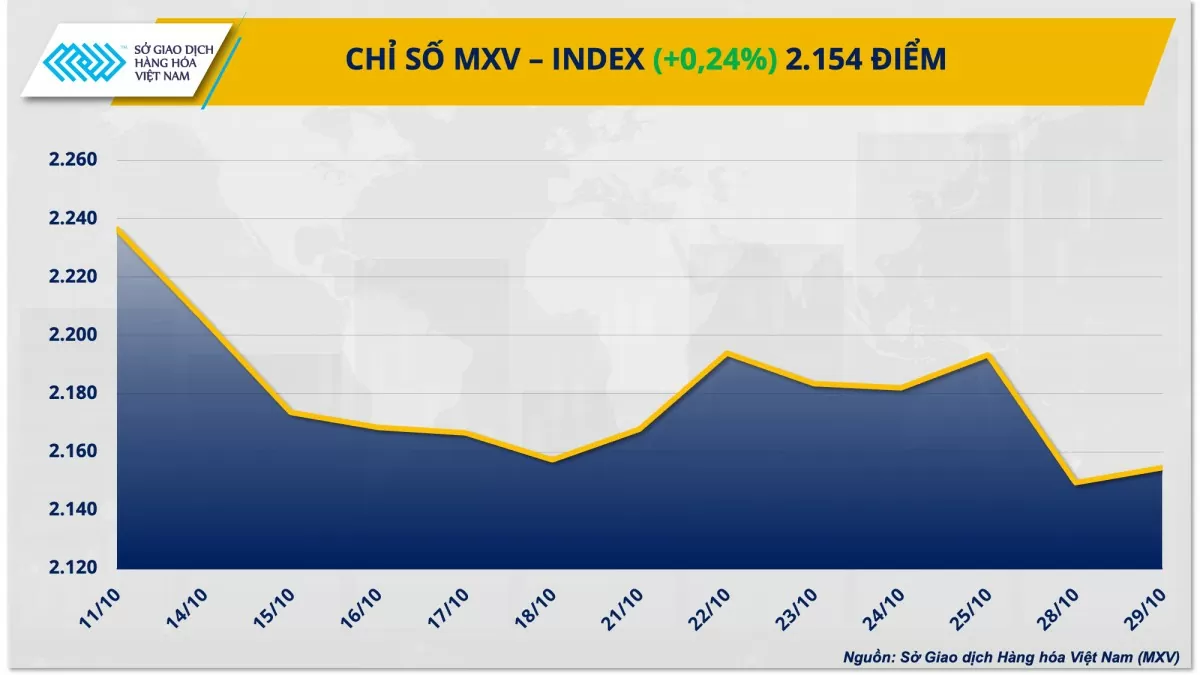

According to the Vietnam Commodity Exchange (MXV), buying power returned and dominated the world raw material market in yesterday's trading day (October 29).

At the close, the MXV-Index increased by 0.24% to 2,154 points. Notably, in the industrial raw materials market, cocoa prices continued to extend their upward streak when they broke through by more than 5%. In the agricultural market, wheat also led the upward trend of the entire group in the context of crops in major exporting countries such as the US and Ukraine being threatened by adverse weather.

|

| MXV-Index |

Cocoa prices exceed $7,200/ton

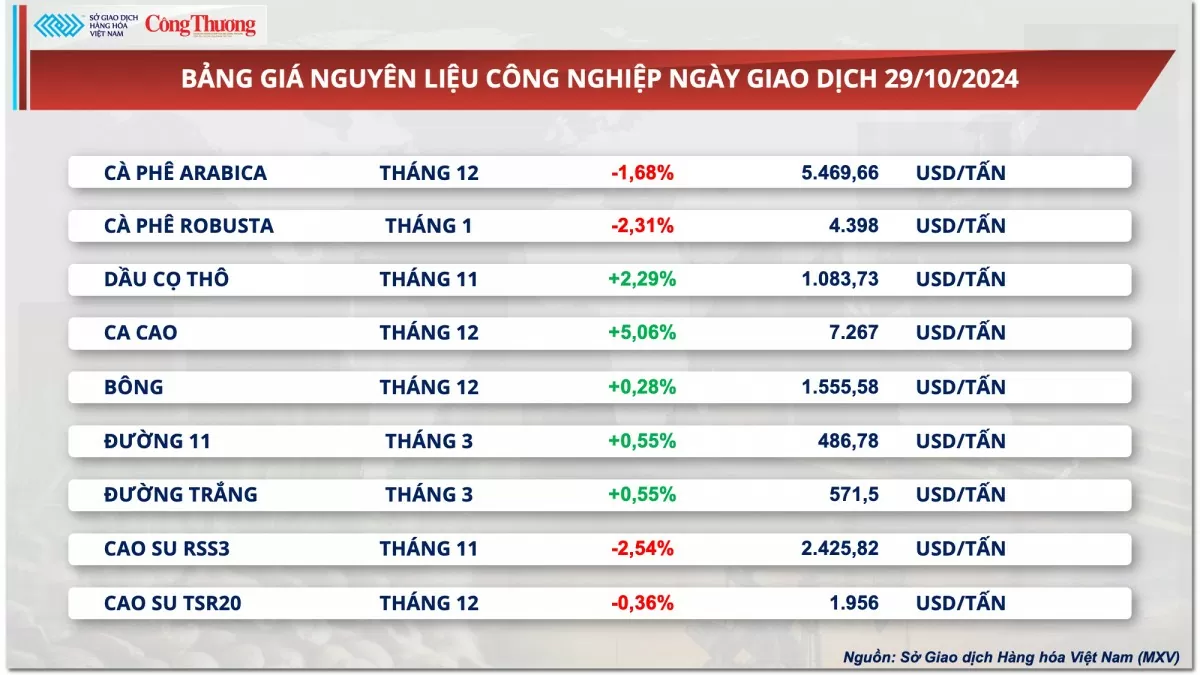

Closing yesterday’s trading session, the price list of industrial raw materials witnessed a clear division between green and red. However, buying power still dominated as many items increased in price simultaneously.

|

| Industrial raw material price list |

Notably, cocoa prices led the group's gains after surging more than 5.06% from the reference price. Continuous heavy rains in cocoa growing areas in Africa caused the market to shift from positive expectations to concerns about pest outbreaks, affecting productivity and output.

According to JPMorgan, global cocoa supply is expected to continue to be in deficit by 100,000 tons in the 2024-2025 crop year, contrary to the previous forecast of balance. However, in Ivory Coast - the world's largest cocoa producer and exporter, the new crop supply is still strong. Specifically, the amount of cocoa arriving at ports in the first 27 days of the 2024-2025 crop year reached 285,000 tons, up 26% over the same period.

On the other hand, the prices of both coffee products turned down after two consecutive sessions of increase. Arabica coffee decreased by 1.68% to 5,469.7 USD/ton while Robusta price decreased by 2.31% to 4,398 USD/ton. This development was mainly influenced by fluctuations in the USD/BRL exchange rate rather than basic supply and demand factors.

Specifically, the weakening of the Brazilian Real while the Dollar Index was flat pushed the USD/BRL exchange rate to a 12-week high. This raised concerns that Brazil could boost coffee exports to benefit from the exchange rate difference, thereby putting pressure on the global supply-demand balance.

According to CECAFE, Brazil has issued export permits for nearly 3.2 million bags of Arabica coffee in the first 28 days of October, up about 54,000 bags from the same period last month. Regarding the production outlook, although recent rains have supported the main Arabica flowering, many analysts and farmers are still concerned that the 2025/26 crop will not fully recover due to late rains.

A report from Somar Meteorologia showed that rainfall in Minas Gerais state - Brazil's largest Arabica coffee growing region - reached only 25.1mm last week, 26% lower than the historical average.

Wheat prices jump as US crop quality declines

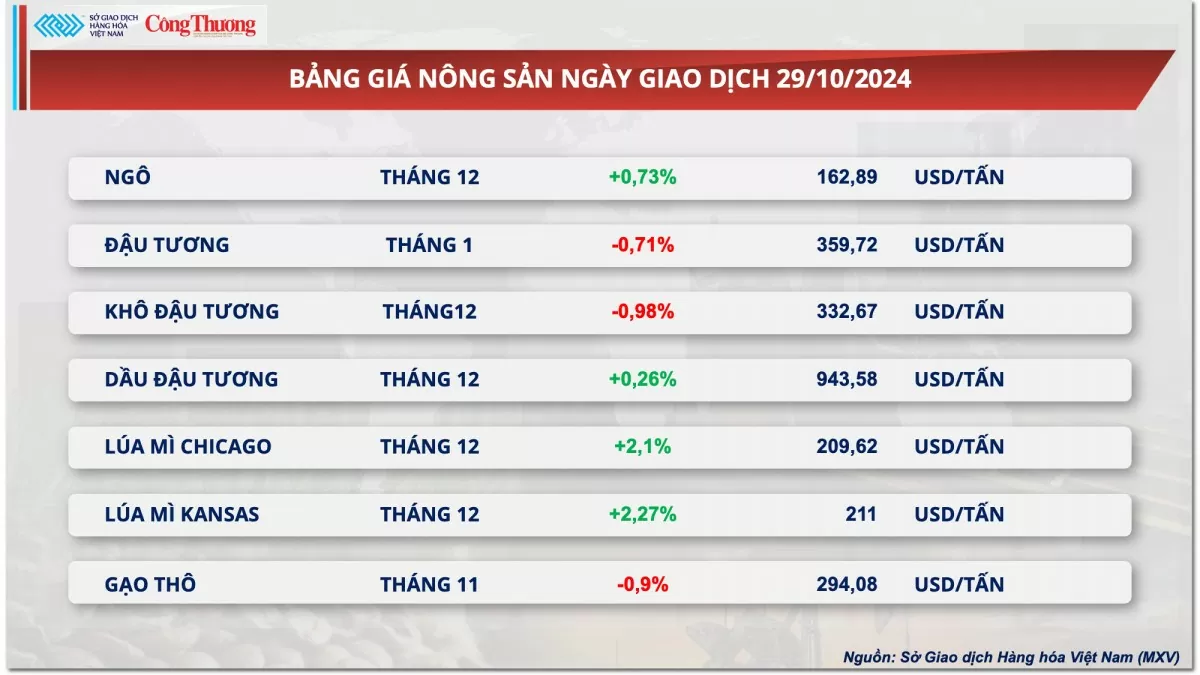

Green dominated the agricultural markets yesterday, with wheat leading the gains. With crops in major exporting countries such as the US and Ukraine threatened by adverse weather, buyers had the upper hand in wheat early in the session.

According to the USDA ’s Crop Progress report, as of October 27, farmers had planted only 80% of their expected winter wheat acreage, up 7 percentage points from the previous week but still below the market’s expectation of 83%. This progress is also slower than the 82% at this time last year and the 84% five-year average. In terms of quality, only 38% of the wheat acreage was rated good/excellent, well below the 47% at this time last year and analysts’ forecasts.

|

| Agricultural product price list |

In Ukraine, farmers had completed about 92 percent of their winter wheat planting plan as of October 28, according to the country’s Ministry of Agriculture. However, a prolonged drought from summer to early fall forced farmers to plant wheat on dry land, slowing crop growth and threatening yields, severely affecting Ukraine’s wheat production prospects for next year.

Meanwhile, December corn contract prices also improved with a slight increase of 0.73%, mainly supported by the strong increase in wheat prices, despite the positive crop situation in the US.

Specifically, according to the Crop Progress report, the corn harvest progress in the US reached 81% of the plan as of October 27, exceeding the market expectation of 80% and much higher than the 68% of the same period last year and the 5-year average of 64%. This is recorded as the fastest corn harvest speed in the US in the past decade, contributing to strengthening the prospect of this year's output reaching the second highest level in history.

In the domestic market, yesterday, October 29, the offering price of South American corn to our country's ports decreased slightly. At Vung Tau port, the offering price of corn for delivery in December 2024 fluctuated between 6,600 - 6,650 VND/kg. Meanwhile, for the delivery period in January next year, South American corn was offered at around 6,650 - 6,700 VND/kg. At Cai Lan port, the offering price was recorded 50 - 100 VND higher than at Vung Tau port.

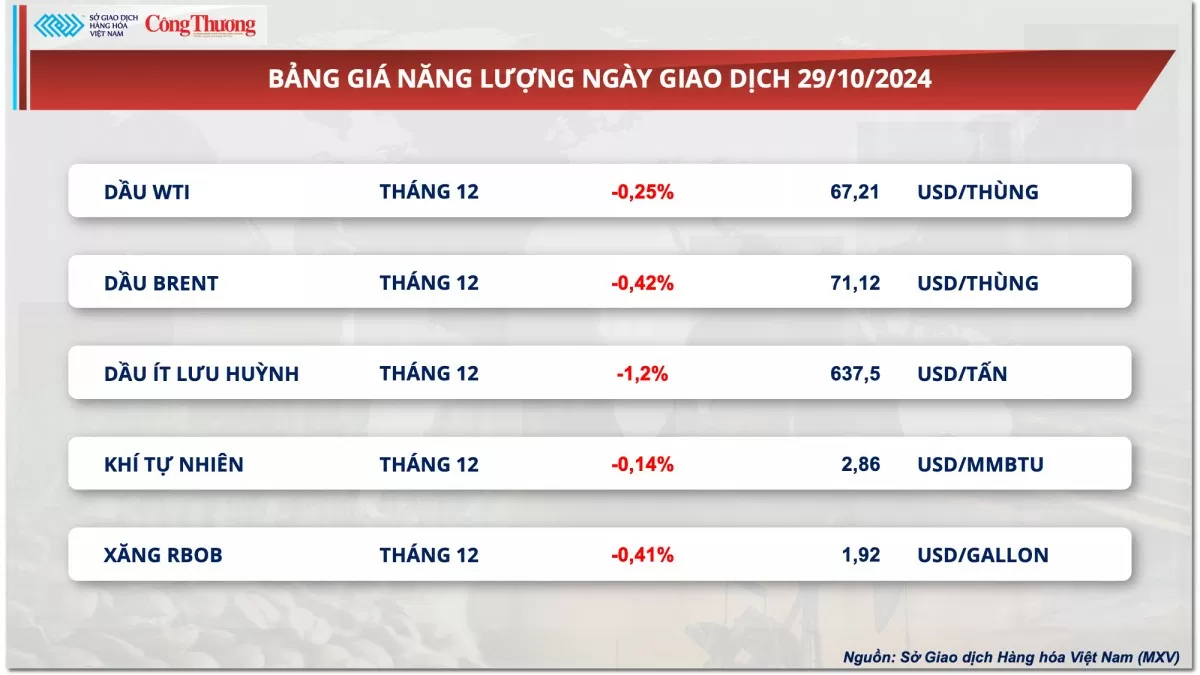

Prices of some other goods

|

| Metal price list |

|

| Energy price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-ngay-3010-luc-mua-chiem-uu-the-keo-chi-so-mxv-index-phuc-hoi-355668.html

![[Photo] Discover the "wonder" under the sea of Gia Lai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/6/befd4a58bb1245419e86ebe353525f97)

![[Photo] Nghe An: Provincial Road 543D seriously eroded due to floods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/5/5759d3837c26428799f6d929fa274493)

Comment (0)