KBC continues its plan to attract 'huge' capital

Kinh Bac Urban Development Corporation - JSC (HoSE: KBC) on June 23 announced the Board of Directors' Resolution on the plan to handle 147.1 million undistributed KBC shares in the private offering of 250 million common shares, at a price of VND23,900/share (compared to VND26,100/share at the end of the session on June 24).

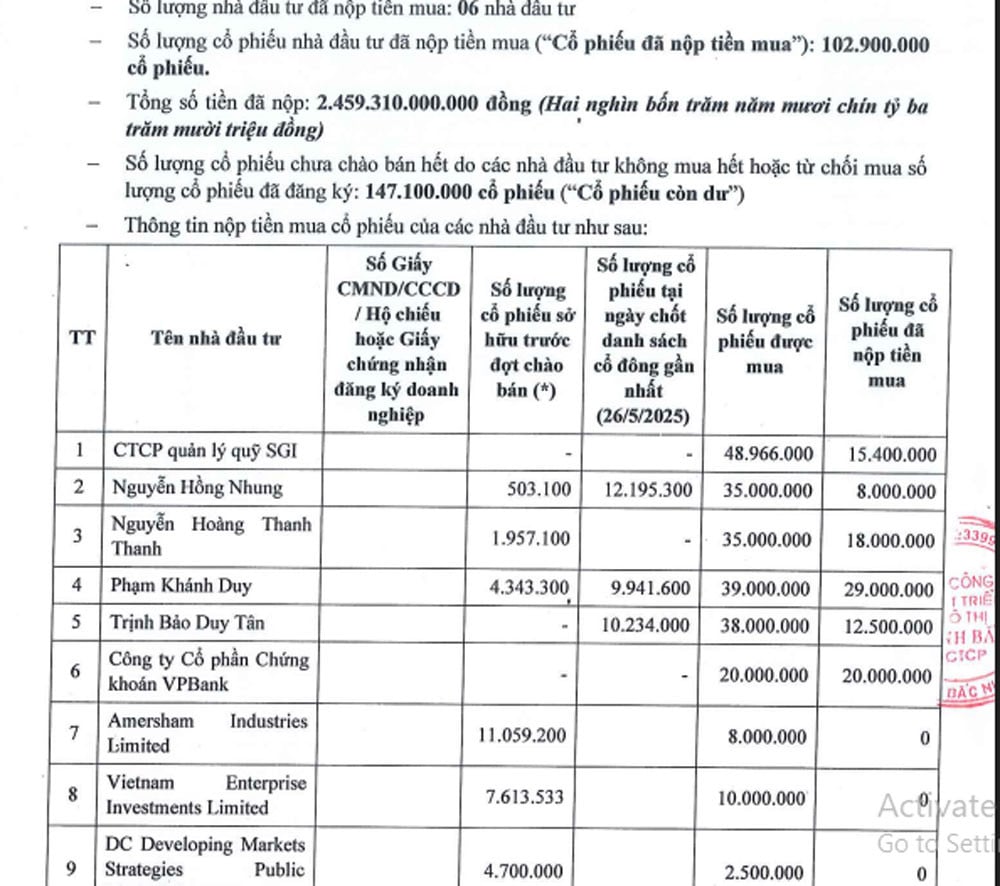

At the end of the stock purchase payment period (June 20-23), only 6 investors participated in buying 102.9 million shares, equivalent to more than VND 2,459.3 billion.

The remaining shares (147.1 million shares) will continue to be distributed by KBC to professional securities investors (domestic organizations and individuals), with a transfer restriction of 1 year from the end date of the offering.

The purpose of the issuance of 250 million shares is to raise about VND6,000 billion to restructure finances and supplement working capital.

Specifically, KBC plans to use VND4,428 billion to repay principal and interest to Saigon - Bac Giang Industrial Park JSC, VND1,462 billion to repay debt to Saigon - Hai Phong Industrial Park JSC, more than VND105 billion to repay principal to VietinBank and VND160 billion to supplement working capital.

If completed, KBC will increase the number of outstanding shares from more than 767.6 million to more than 1.01 billion shares, equivalent to charter capital of VND10,176 billion.

The initial list of expected investors includes 11 large organizations and individuals, such as DC Developing Markets Strategies Public Limited (Dragon Capital), Prudential Vietnam, SGI Fund, VPBankS Securities, Samsung Vietnam Securities, Vietnam Enterprise, Amersham Industries Limited and 4 individual investors.

However, the results showed that only VPBankS bought the full 20 million shares as registered, while other investors bought a portion or did not participate.

Along with its efforts to raise capital, KBC also attracted attention when implementing the project of urban complex, eco -tourism and Khoai Chau golf course (Hung Yen) with a total investment of 1.5 billion USD, in cooperation with The Trump Organization - a corporation related to the family of US President Donald Trump.

Trump International Hung Yen project, implemented by Hung Yen Investment and Development Corporation (a subsidiary of KBC), is positioned as the most luxurious golf course in Vietnam, with a resort exceeding 5-star standards. The project has attracted the attention of investors, thereby also demonstrating the attractiveness of Vietnam to international investors.

Sharing with Forbes and on the KBC website, Mr. Dang Thanh Tam said that IDG Capital is ready to act as the financial coordinator and also participate in capital for the project. When completed, expected after 4 years, the project will be handed over to the Trump Organization for management and operation, ensuring the quality standards of the Trump brand.

KBC's financial health and FDI attraction journey

Regarding financial health, the first quarter report of 2025 shows that KBC maintains strong growth momentum. Total assets reached more than VND 54.2 trillion, a significant increase compared to VND 44.7 trillion at the end of 2024. Cash and cash equivalents reached nearly VND 6,581 billion, slightly up from VND 6,566 billion at the end of 2024.

However, receivables increased from VND13.3 trillion to over VND16.3 trillion and inventories increased sharply from VND13.8 trillion to nearly VND20.28 trillion, reflecting large-scale investments in real estate projects and industrial parks.

Regarding debt, KBC recorded long-term debt of more than VND 17.1 trillion and short-term debt of VND 442 billion, lower than equity of nearly VND 21.5 trillion. The debt/equity ratio is quite low, compared to the average of 3 times of listed enterprises.

KBC's journey under the leadership of Mr. Dang Thanh Tam is a testament to the efforts to attract foreign direct investment (FDI) into Vietnam.

Over the past decades, Mr. Tam has turned industrial parks in the KBC ecosystem into destinations for many global corporations such as Foxconn, Luxshare, Goertek (Apple's partner) and LG, with a total investment of tens of billions of USD.

Investors from Korea, Japan and now the US, especially The Trump Organization, are also attracted by Vietnam's transparent business environment and preferential policies.

The Trump International Hung Yen project is an important milestone, not only because of its $1.5 billion scale but also because of its cooperation with a global brand with high transparency standards. Mr. Tam shared that The Trump Organization only works with partners who are not involved in unclear financial issues and are thoroughly checked.

Source: https://vietnamnet.vn/lam-du-an-ty-usd-voi-trump-organization-dai-gia-viet-quyet-huy-dong-du-6-000-ty-2414669.html

![[Photo] Brilliant red of the exhibition 95 years of the Party Flag lighting the way before the opening](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/e19d957d17f649648ca14ce6cc4d8dd4)

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

![[Photo] General Secretary To Lam attends Meeting with generations of National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/d869c6b3e4da42399e2cd0f4ca26050c)

Comment (0)