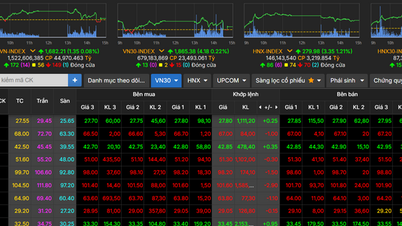

End of August 2025, VN-Index closed at 1,682.21 points, up 179.7 points, equivalent to an increase of 12% compared to the end of July.

Money in stocks increased dramatically

Liquidity stock market This month saw a sharp increase, with an average trading value of VND 46,596 billion/session, up 42%. According to data from Fiintrade, this is the strongest monthly increase of the index since June 2020.

Since the beginning of the year, the VN-Index has increased by 32.8%, far exceeding the increase in 2024 (+12.11%) and 2023 (+12.2%).

Cash flow in the market is clearly differentiated. Banking, steel, construction, and oil and gas production groups strongly attract capital, while real estate and food sectors decline and information technology, retail, chemicals, and electricity sectors hit a 10-month low.

In terms of capitalization, VN30 continued to be the focus when cash flow was concentrated strongly, helping this group of stocks increase by 15.5%, outperforming the VN-Index.

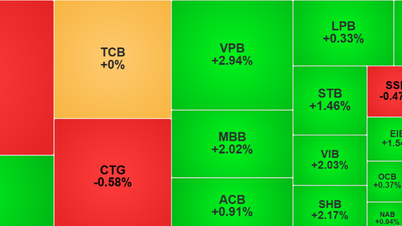

However, the notable point is the activities of foreign investors. Foreign investors net sold more than VND29,400 billion in August, a record high for the month, a sharp reversal from the slight net buying trend in July.

Net selling activities spread across 17/19 sectors, most notably in banking, steel, information technology, securities, real estate, retail and food and beverage.

If looking at individual stocks, foreign investors sold the most net FPR with nearly 5,000 billion VND, followed by HPG with 4,820 billion VND and VPB with nearly 2,500 billion VND.

SSI, VHM, CTG, MBB, VCB, STB... a series of stocks that have increased strongly recently are also in the group of stocks that have suffered the strongest net selling pressure from foreign investors.

In the opposite direction, foreign investors bought the most SHS (+1,222 billion VND), GMD (+719 billion VND), DCM (+360 billion VND), TPB (+254 billion VND)...

Is the valuation still reasonable?

The Vietnamese stock market in 2025 has witnessed many strong fluctuations. Just a few months ago, the market experienced a sharp decline. In April, the VN-Index plunged from the 1,300 point range to the bottom of 1,073.61 points after US President Donald Trump Announce new tariff policy.

Bottom-fishing cash flow appeared in the 1,070 - 1,100 point range, helping the market stop its decline and quickly recover to over 1,200 points in April.

At the same time, the net selling pressure of foreign investors also cooled down, contributing to strengthening the confidence of domestic investors. Thanks to that, the index continued to break through to the 1,400 point mark, amid expectations of a reasonable tariff agreement between Vietnam and the US in the future.

In early July, US President Donald Trump unexpectedly announced a 20% tax on goods exported from Vietnam to the US on the social network Social Truth. This tax rate was already anticipated by the market, so concerns about the negative impact on Vietnam's production and economy quickly cooled down.

Foreign investors have thus returned to net buying in July after a long period of net selling, contributing to the market's momentum. The VN-Index not only surpassed the old peak of 1,508 points (2022) but also continuously set new highs. From the bottom of 1,073.61 points, the index has increased by 57.2% when reaching its recent historical peak.

According to Shinhan Securities experts, although VN-Index continuously sets new peaks, the valuation level of the whole market is still at a reasonable level. On August 25, the P/E valuation of the whole market reached 14.66 times, lower than the 10-year average (15.1 times) and only slightly higher than the 5-year average (14.35 times).

Source: https://baoquangninh.vn/khoi-ngoai-ban-rong-ky-luc-chung-khoan-van-co-thang-tang-manh-nhat-5-nam-3374086.html

![[Photo] National Assembly Chairman Tran Thanh Man receives First Vice Chairman of the Federation Council of Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/2/3aaff46372704918b3567b980220272a)

![[Photo] National Assembly Chairman Tran Thanh Man meets with First Secretary and President of Cuba Miguel Diaz-Canel Bermudez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/2/c6a0120a426e415b897096f1112fac5a)

![[Photo] Lao President Thongloun Sisoulith and President of the Cambodian People's Party and President of the Cambodian Senate Hun Sen visit the 95th Anniversary Exhibition of the Party Flag Lighting the Way](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/2/3c1a640aa3c3495db1654d937d1471c8)

Comment (0)