Photo: THANH DAT

In this afternoon's trading session, the prices of gold bars and gold rings of domestic brands simultaneously decreased in both directions (buying and selling) after remaining unchanged throughout the morning session.

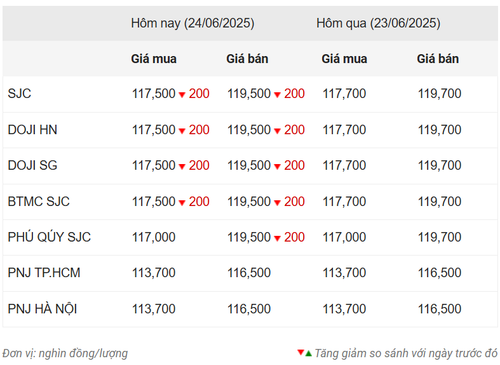

Specifically, at 3:00 p.m. on June 24, Saigon Jewelry Company (SJC) listed the buying and selling price of SJC gold bars at 117.5-119.5 million VND/tael, down 200,000 VND per tael for both buying and selling compared to the previous session. The buying and selling difference was 2 million VND.

Gold price statistics of Dragon Viet Online Service Joint Stock Company VDOS - Updated at 3:00 p.m. on June 24.

The price of SJC 9999 gold ring is 113.5 million VND/tael for buying and 116 million VND/tael for selling, down 200 thousand VND/tael for both buying and selling.

Meanwhile, DOJI gold bar price in Hanoi and Ho Chi Minh City was bought at 117.5 million VND/tael and sold at 119.5 million VND/tael, down 200 thousand VND per tael in both directions (buying-selling) compared to the previous session's close.

This brand listed the price of Doji Hung Thinh Vuong 9999 gold ring down 500 thousand VND per tael in both buying and selling compared to yesterday's closing price, trading at 114-116 million VND/tael, respectively.

PNJ Gold listed buying price at 113.7 million VND/tael and selling price at 116.5 million VND/tael, unchanged in both buying and selling price compared to the previous session.

As of 3:00 p.m. on June 24 (Vietnam time), the world gold price decreased by 41.64 USD/ounce compared to the previous session to 3,326.33 USD/ounce.

World gold price chart on June 24. (Photo: kitco.com)

The world gold price today plummeted, the main reason being that investors' sentiment became more optimistic after the geopolitical situation in the Middle East eased, the demand for gold - a safe asset - decreased significantly. Since then, many people have taken advantage of selling to take profits, causing the gold price to decrease today.

However, market analysts emphasize that gold is still in a long-term uptrend.

Recent US inflation data was weaker than expected, with the consumer price index (CPI) rising just 0.1% in May. This has reinforced expectations that the US Federal Reserve (FED) will cut interest rates in September. Lower interest rates make gold more attractive to investors because it is not affected by the opportunity cost of other interest-bearing assets.

Today, the USD-Index fell to 98.12 points; the yield on 10-year US Treasury bonds rose to 4.328%; US stocks rose sharply; world oil prices fell, trading at 68.11 USD/barrel for Brent oil and 66.09 USD/barrel for WTI oil.

Source: https://baotuyenquang.com.vn/gia-vang-ngay-24-6-vang-nhan-vang-mieng-dong-loat-giam-nhe-sau-ba-phien-di-ngang-lien-tiep-214023.html

![[Photo] General Secretary To Lam works with the Standing Committee of Quang Binh and Quang Tri Provincial Party Committees](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/25/6acdc70e139d44beaef4133fefbe2c7f)

![[Photo] More than 124,000 candidates in Hanoi complete procedures for the 2025 High School Graduation Exam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/25/fa62985b10464d6a943b58699098ae3f)

![[Photo] First training session in preparation for the parade to celebrate the 80th anniversary of National Day, September 2nd](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/25/ebf0364280904c019e24ade59fb08b18)

Comment (0)