Domestic gold price today August 27, 2025

As of 4:00 a.m. today, August 27, 2025, the domestic gold bar price is reaching a new record peak. Specifically:

DOJI Group listed the price of SJC gold bars at 126.1-127.7 million VND/tael (buy - sell), an increase of 500 thousand VND/tael for buying - an increase of 600 thousand VND/tael for selling compared to yesterday.

At the same time, the price of gold bars was listed by Saigon Jewelry Company Limited - SJC at 126.1-127.7 million VND/tael (buy - sell), an increase of 500 thousand VND/tael for buying - an increase of 600 thousand VND/tael for selling compared to the closing price on August 26 yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 127-127.7 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 600 thousand VND/tael for buying and 800 thousand VND/tael for selling.

The price of gold bars at Bao Tin Minh Chau Company Limited was traded by the enterprise at 126.1-127.7 million VND/tael (buy - sell), the price increased by 500 thousand VND/tael in the buying direction - increased by 600 thousand VND/tael in the selling direction compared to the same period yesterday.

The price of SJC gold bars at Phu Quy is traded by businesses at 125.1-127.7 million VND/tael (buy - sell), the gold price remains unchanged in the buying direction - increased 600 thousand VND/tael in the selling direction compared to yesterday.

As of 4:00 a.m. on August 27, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 119.3-122.3 million VND/tael (buy - sell); an increase of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 119.6-122.6 million VND/tael (buy - sell); an increase of 400 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, August 27, 2025 is as follows:

| Gold price today | August 27, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 125.6 | 127.1 | - | +500 |

| DOJI Group | 125.6 | 127.1 | - | +500 |

| Red Eyelashes | 126.4 | 126.9 | +400 | +300 |

| PNJ | 125.6 | 127.1 | - | +500 |

| Bao Tin Minh Chau | 125.6 | 127.1 | - | +500 |

| Phu Quy | 125.1 | 127.1 | +500 | +500 |

| 1. DOJI - Updated: August 27, 2025 04:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| AVPL/SJC HN | 126,100 ▲500K | 127,700 ▲600K |

| AVPL/SJC HCM | 126,100 ▲500K | 127,700 ▲600K |

| AVPL/SJC DN | 126,100 ▲500K | 127,700 ▲600K |

| Raw material 9999 - HN | 111,000 ▲500K | 112,500 ▲500K |

| Raw material 999 - HN | 110,900 ▲500K | 112,400 ▲500K |

| 2. PNJ - Updated: August 27, 2025 04:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC 999.9 gold bar | 126,100 ▲500K | 127,700 ▲600K |

| PNJ 999.9 Plain Ring | 119,600 ▲500K | 122,600 ▲800K |

| Kim Bao Gold 999.9 | 119,600 ▲500K | 122,600 ▲800K |

| Gold Phuc Loc Tai 999.9 | 119,600 ▲500K | 122,600 ▲800K |

| PNJ Gold - Phoenix | 119,600 ▲500K | 122,600 ▲800K |

| 999.9 gold jewelry | 118,700 ▲500K | 121,200 ▲500K |

| 999 gold jewelry | 118,780 ▲500K | 121,080 ▲500K |

| 9920 jewelry gold | 117,590 ▲500K | 120,090 ▲500K |

| 99 gold jewelry | 117,590 ▲500K | 120,090 ▲500K |

| 916 Gold (22K) | 108,620 ▲460K | 111,120 ▲460K |

| 750 Gold (18K) | 83,550 ▲370K | 91,050 ▲370K |

| 680 Gold (16.3K) | 75,070 ▲340K | 82,570 ▲340K |

| 650 Gold (15.6K) | 71,430 ▲320K | 78,930 ▲320K |

| 610 Gold (14.6K) | 66,580 ▲300K | 74,080 ▲300K |

| 585 Gold (14K) | 63,550 ▲290K | 71,050 ▲290K |

| 416 Gold (10K) | 43,070 ▲210K | 50,570 ▲210K |

| 375 Gold (9K) | 38,100 ▲190K | 45,600 ▲190K |

| 333 Gold (8K) | 32,650 ▲170K | 40,150 ▲170K |

| 3. SJC - Updated: 8/27/2025 04:00 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 126,100 ▲500K | 127,700 ▲600K |

| SJC gold 5 chi | 126,100 ▲500K | 127,720 ▲600K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 126,100 ▲500K | 127,730 ▲600K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 119,600 ▲500K | 122,200 ▲500K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 119,600 ▲500K | 122,100 ▲500K |

| Jewelry 99.99% | 119,100 ▲400K | 121,100 ▲400K |

| Jewelry 99% | 114,900 ▲396K | 119,900 ▲396K |

| Jewelry 68% | 75,006 ▲272K | 82,506 ▲272K |

| Jewelry 41.7% | 43,153 ▲166K | 50,653 ▲166K |

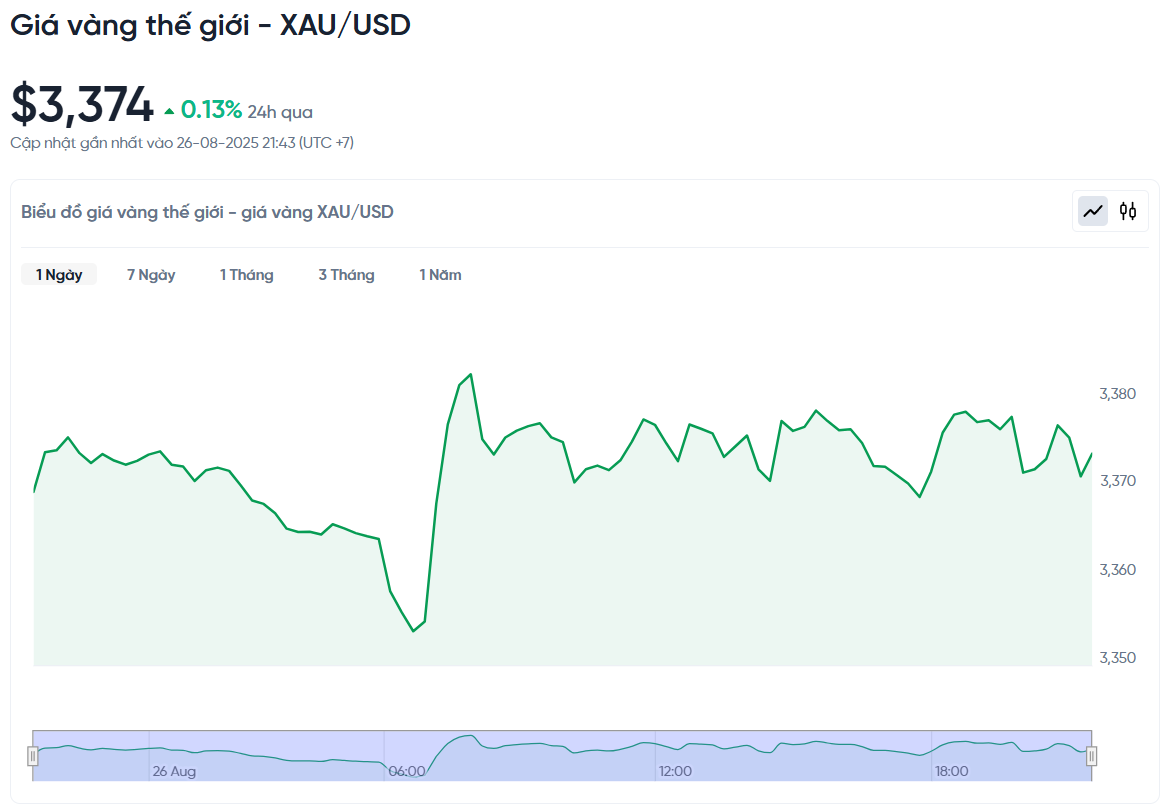

World gold price today August 27, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:00 a.m. on August 27, Vietnam time, was 3,374 USD/ounce. Today's gold price increased by 4.36 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,530 VND/USD), the world gold price is about 107.95 million VND/tael (excluding taxes and fees). Thus, the price of gold bars is 19.76 million VND/tael higher than the international gold price.

Gold prices rose slightly, mainly due to a series of favorable US economic indicators. In addition, confidence in the US Federal Reserve (Fed) was shaken after President Donald Trump unexpectedly fired a governor of the central bank. In that context, gold prices became a safe haven for investors.

Specifically, the spot gold price increased by 0.13%. During the session, the gold price even reached a record high of 3,386.27 USD/ounce. The price of gold futures for delivery in December also increased slightly by 0.1% to 3,420.40 USD/ounce.

The initial surge in gold prices was sparked by President Trump’s unprecedented move to fire Fed Governor Lisa Cook, who was accused of being involved in mortgage lending. This action raised concerns about the Fed’s independence. Analysts said the event had a positive impact on gold prices, as the Fed’s monetary policy is a key factor influencing gold prices today.

In addition, global trade developments are also attracting attention. China will send Vice Commerce Minister Li Chenggang to the US to meet with officials to continue discussions on the trade deal, a move seen as a positive signal for a high-level meeting between Mr. Trump and President Xi Jinping.

Outside the U.S., political concerns in France have also been growing. Prime Minister François Bayrou has called for a confidence vote, which could lead to the government falling as early as next month. Investors fear that political uncertainty will continue to weigh on French assets and European markets.

At the same time, the US government announced that it would impose a 50% tariff on goods imported from India from August 27, in order to pressure Russia to sit at the negotiating table to end the war in Ukraine. These factors combined to cause volatility in the international financial market, but benefited the price of gold as a safe haven.

Recent economic data also supports this expectation. World gold prices rose slightly after new economic data from the US was released. The US Department of Commerce said durable goods orders fell 2.8% in July. This figure was better than economists' forecast of a 4% decline, but still showed signs of slowing economic activity.

Silver edged down 0.2% to $38.49 an ounce. Platinum edged up 0.2% to $1,345.05 an ounce. Palladium edged up 0.6% to $1,345.05 an ounce, recovering from its lowest since July 9.

Gold Price Forecast

Domestic gold prices yesterday had many notable fluctuations. Specifically, the price of gold bars at SJC, PNJ, DOJI, BTMC stores was adjusted up sharply, to 126.1 - 127.7 million VND/tael (buy - sell).

But in the banking sector, Sacombank suddenly raised the price of gold bars to 124 - 130 million VND/tael (buy - sell). This is the highest price ever officially listed by a bank on the market.

Gold prices are currently being affected by a number of factors. According to Bloomberg, the main reason for the recent surge is that investors are unable to find a more attractive place to park their money. Some experts have expressed concern that this could be a sign of speculative fever, also known as 'irrational euphoria', and could create a gold price bubble.

The global economic backdrop also plays a role. China’s economy is showing signs of deflation and domestic demand is not really strong. This situation could weaken businesses and make the gold price rally unstable.

However, most believe that gold is still the top safe asset. Experts believe that the US Federal Reserve (Fed) will soon return to its easing policy by cutting interest rates. This often weakens the USD and creates momentum for gold prices to increase. In addition, geopolitical tensions around the world continue to push investors to seek gold as a shield to protect assets.

Tai Wong, an independent trader, said that Fed Chairman Jerome Powell’s recent remarks at the Jackson Hole conference were a clear signal of a possible rate cut in September. This decision has provided strong support for the gold market. However, he also noted that the $3,400/ounce price level will be a key hurdle to overcome.

Ole Hansen, an expert at Saxo Bank, predicts that gold prices are about to enter a positive phase. After a relatively quiet summer, the Fed's monetary policy is expected to give gold a boost. Hansen expects the Fed to cut interest rates in the final months of the year, which usually weakens the US dollar and pushes gold prices higher, possibly even reaching the record level of over $3,500 like in April.

While confidence in the Fed’s interest rate cuts is supporting gold, a weaker dollar and political risks are key factors in the near term, according to French bank Société Générale. The bank remains bullish on gold this year and even expects prices to surpass $4,000 by mid-2025. It said it would not sell until prices reach that level.

Geopolitical factors remain a long-term support. The Western freeze on the assets of the Russian Central Bank is seen as an important precedent, encouraging other central banks to continue buying gold as a hedge against inflation. While tensions have eased since the start of the year, global uncertainty remains three times higher than the historical average, and flows into gold ETFs remain steady.

Source: https://baonghean.vn/gia-vang-hom-nay-27-8-gia-vang-tang-dat-dinh-130-trieu-10305304.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

![[Photo] Many people eagerly await the preliminary review despite heavy rain](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/4dc782c65c1244b196890448bafa9b69)

![[Photo] Brilliant red of the exhibition 95 years of the Party Flag lighting the way before the opening](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/e19d957d17f649648ca14ce6cc4d8dd4)

![[Photo] General Secretary To Lam attends Meeting with generations of National Assembly deputies](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/8/27/a79fc06e4aa744c9a4b7fa7dfef8a266)

Comment (0)