Domestic gold price today June 27, 2025

As of 4:30 a.m. on June 27, 2025, the domestic gold bar price is based on the closing price yesterday, June 26. Specifically:

DOJI Group listed the price of SJC gold bars at 118-120 million VND/tael (buy - sell), an increase of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 118-120 million VND/tael (buy - sell), an increase of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 119.2-120 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 400 thousand VND/tael for buying and 500 thousand VND/tael for selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 118-120 million VND/tael (buy - sell), the price increased by 500 thousand VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 117.2-120 million VND/tael (buy - sell), gold price increased by 400 thousand VND/tael in buying direction - increased by 500 thousand VND/tael in selling direction.

As of 4:30 a.m. on June 27, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 115-117 million VND/tael (buy - sell); the price increased by 500 thousand VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 115-118 million VND/tael (buy - sell); the price increased by 500 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, June 27, 2025 is as follows:

| Gold price today | June 27, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 118 | 120 | +500 | +500 |

| DOJI Group | 118 | 120 | +500 | +500 |

| Red Eyelashes | 119.2 | 120 | +400 | +500 |

| PNJ | 118 | 120 | +500 | +500 |

| Bao Tin Minh Chau | 118 | 120 | +500 | +500 |

| Phu Quy | 117.2 | 120 | +400 | +500 |

| 1. DOJI - Updated: June 27, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 118,000 ▲500K | 120,000 ▲500K |

| AVPL/SJC HCM | 118,000 ▲500K | 120,000 ▲500K |

| AVPL/SJC DN | 118,000 ▲500K | 120,000 ▲500K |

| Raw material 9999 - HN | 109,500 ▲500K | 112,000 ▲500K |

| Raw material 999 - HN | 109,400 ▲500K | 111,900 ▲500K |

| 2. PNJ - Updated: June 27, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 114,200 ▲600K | 117,000 ▲700K |

| HCMC - SJC | 118,000 ▲500K | 120,000 ▲500K |

| Hanoi - PNJ | 114,200 ▲600K | 117,000 ▲700K |

| Hanoi - SJC | 118,000 ▲500K | 120,000 ▲500K |

| Da Nang - PNJ | 114,200 ▲600K | 117,000 ▲700K |

| Da Nang - SJC | 118,000 ▲500K | 120,000 ▲500K |

| Western Region - PNJ | 114,200 ▲600K | 117,000 ▲700K |

| Western Region - SJC | 118,000 ▲500K | 120,000 ▲500K |

| Jewelry gold price - PNJ | 114,200 ▲600K | 117,000 ▲700K |

| Jewelry gold price - SJC | 118,000 ▲500K | 120,000 ▲500K |

| Jewelry gold price - Southeast | PNJ | 114,200 ▲600K |

| Jewelry gold price - SJC | 118,000 ▲500K | 120,000 ▲500K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 114,200 ▲600K |

| Jewelry gold price - Kim Bao Gold 999.9 | 114,200 ▲600K | 117,000 ▲700K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 114,200 ▲600K | 117,000 ▲700K |

| Jewelry gold price - Jewelry gold 999.9 | 113,500 ▲600K | 116,000 ▲600K |

| Jewelry gold price - Jewelry gold 999 | 113,380 ▲590K | 115,880 ▲590K |

| Jewelry gold price - Jewelry gold 9920 | 112,670 ▲590K | 115,170 ▲590K |

| Jewelry gold price - Jewelry gold 99 | 112,440 ▲590K | 114,940 ▲590K |

| Jewelry gold price - 750 gold (18K) | 79,650 ▲450K | 87,150 ▲450K |

| Jewelry gold price - 585 gold (14K) | 60,510 ▲350K | 68,010 ▲350K |

| Jewelry gold price - 416 gold (10K) | 40,910 ▲250K | 48,410 ▲250K |

| Jewelry gold price - 916 gold (22K) | 103,860 ▲550K | 106,360 ▲550K |

| Jewelry gold price - 610 gold (14.6K) | 63,410 ▲370K | 70,910 ▲370K |

| Jewelry gold price - 650 gold (15.6K) | 68,050 ▲390K | 75,550 ▲390K |

| Jewelry gold price - 680 gold (16.3K) | 71,530 ▲410K | 79,030 ▲410K |

| Jewelry gold price - 375 gold (9K) | 36,150 ▲220K | 43,650 ▲220K |

| Jewelry gold price - 333 gold (8K) | 30,930 ▲200K | 38,430 ▲200K |

| 3. SJC - Updated: June 27, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 118,000 ▲500K | 120,000 ▲500K |

| SJC gold 5 chi | 118,000 ▲500K | 120,020 ▲500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 118,000 ▲500K | 120,030 ▲500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 113,800 ▲300K | 116,300 ▲300K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 113,800 ▲300K | 116,400 ▲300K |

| Jewelry 99.99% | 113,800 ▲300K | 115,700 ▲300K |

| Jewelry 99% | 110,054 ▲297K | 114,554 ▲297K |

| Jewelry 68% | 71,933 ▲204K | 78,833 ▲204K |

| Jewelry 41.7% | 41,501 ▲125K | 48,401 ▲125K |

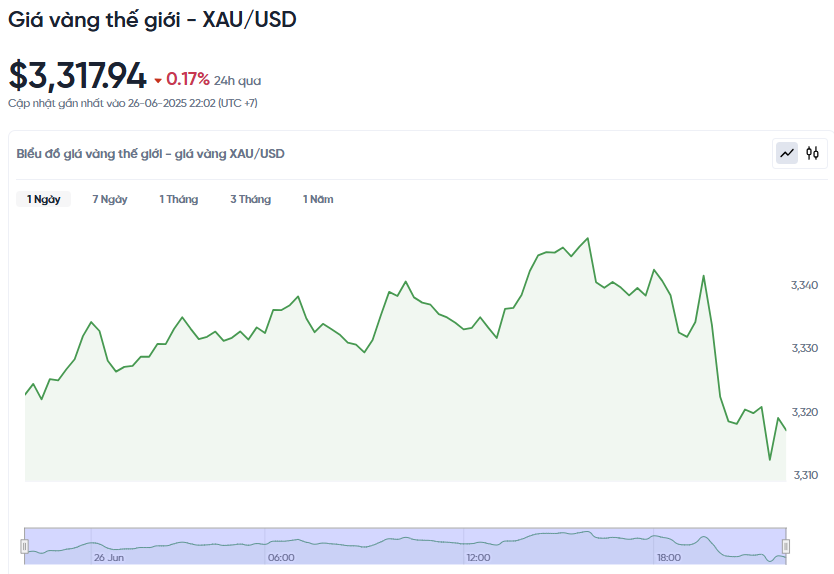

World gold price today June 27, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 a.m. on June 27, Vietnam time, was 3,317.94 USD/ounce. Today's gold price decreased by 5.64 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,290 VND/USD), the world gold price is about 108.62 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 11.38 million VND/tael higher than the international gold price.

World gold prices today tend to decrease slightly, under pressure from the cooling of geopolitical tensions in the Middle East along with uncertainties related to the US Federal Reserve's (Fed) interest rate adjustment roadmap.

Gold prices are trading near session lows after the latest economic data showed US durable goods sales rose 16.4%, following a revised 6.6% decline in April. The figure was much better than expected, as economists had expected a rise of only around 8.5%.

Specifically, spot gold prices fell 0.17% to near $3,300/ounce, while gold futures in the US also fell 0.4% to $3,329.20.

According to David Meger, director of metals trading at High Ridge Futures, the reason for the recent decline in gold prices is that the situation in the Middle East is no longer as tense as before. In addition, the market is also under pressure from expectations of an interest rate cut, which many investors expected, but continued to be delayed due to concerns about rising inflation due to the tariff policies of former President Trump.

Meanwhile, Richmond Fed President Thomas Barkin said it was difficult to predict how tariffs would affect inflation in the US economy. Meanwhile, Chicago Fed President Austan Goolsbee said President Trump's replacement of the Fed chief would not change monetary policy from the outside.

The market currently expects the Fed to cut interest rates twice this year, by a total of 50 basis points, starting in September. Gold is often seen as a safe investment during times of uncertainty and inflation, but when interest rates rise, gold becomes less attractive because it does not pay interest.

The latest data showed the U.S. economy contracted faster than expected in the first quarter, partly due to weaker consumer spending and the negative impact of tariffs. Investors are now looking to Friday’s PCE report for further clues on inflation trends.

Elsewhere in the precious metals market, palladium fell 2.5% to $1,084.41, while platinum rose 1.7% to $1,377.62, its highest since September 2014. Spot silver edged up 0.2% to $36.39.

Gold Price Forecast

Technically, the bulls in the August gold futures market still hold the short-term advantage. Their next target is to close above the strong resistance at the June high of $3,476.30. Meanwhile, the bears are aiming to push the price below the important technical support at $3,300.

The immediate resistance is at Tuesday’s high ($3,385) and then at $3,400. The immediate support is at Wednesday’s low ($3,325.5) and then this week’s low ($3,308.3). The Wyckoff Market Rating Index is currently at 6.5, indicating a slight uptrend.

Experts expect gold prices to continue to rise thanks to the Fed's plan to cut interest rates not only this year but also in the following years. A weaker US dollar also supports gold prices, along with strong buying demand from global central banks.

After a year of strong gains, many investors are starting to take profits. If geopolitical and US-China trade tensions ease, gold prices could fall 5-10% to $3,100 or even below $3,000 an ounce.

Many organizations believe that gold will continue to increase in price, possibly reaching $3,500–4,000/ounce by 2026. History shows that gold is an asset that has consistently increased in price over decades.

Gold prices rose slightly despite investors shifting their focus from geopolitical risks to monetary policy, indicating strong buying power. Notably, gold prices rose despite a weaker US dollar and easing tensions in the Middle East, demonstrating strong interest from both retail and institutional investors.

Fed Chairman Jerome Powell’s testimony before the US Congress is being closely watched. The market is expecting the Fed to cut interest rates in July, with the current rate forecast at 24.8%. This will continue to influence gold price trends in the coming time.

Source: https://baonghean.vn/gia-vang-hom-nay-27-6-2025-vang-trong-nuoc-tang-cao-hon-vang-the-gioi-11-trieu-dong-10300718.html

Comment (0)