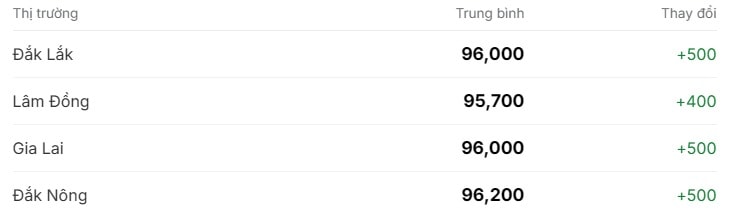

Domestic coffee prices today July 25, 2025

Domestic coffee prices on July 25, 2025 continued to increase slightly, with an average increase of 400 to 500 VND/kg, bringing the current coffee price to 96,200 VND/kg.

Specifically:

In Dak Lak , today's coffee price is 96,000 VND/kg, an increase of 500 VND compared to yesterday.

In Lam Dong , today's coffee price is 95,700 VND/kg, an increase of 400 VND compared to yesterday.

In Gia Lai, today's coffee price is 96,000 VND/kg, an increase of 500 VND compared to yesterday.

In Dak Nong (old, now about to merge with Lam Dong), today's coffee price is 96,200 VND/kg, an increase of 500 VND compared to yesterday.

International coffee prices today July 25, 2025

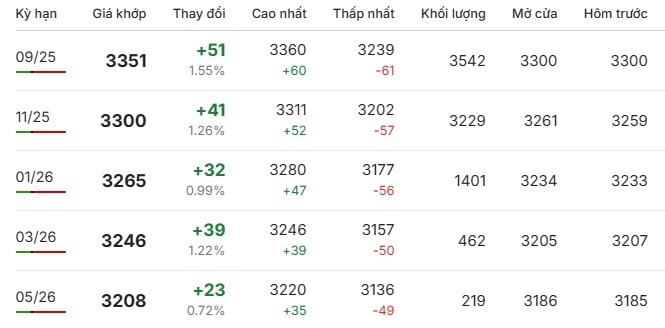

Robusta Coffee Price London July 25, 2025

The London Robusta coffee market on July 25, 2025 recorded a simultaneous increase in prices across all major trading terms. The 09/2025 futures contract increased by 51 USD to 3,351 USD/ton, equivalent to an increase of 1.55%.

The following terms also recorded positive increases, including: 11/2025 increased by 41 USD (1.26%) to 3,300 USD/ton, 01/2026 increased by 32 USD (0.99%) to 3,265 USD/ton, 03/2026 increased by 39 USD (1.22%) to 3,246 USD/ton and 05/2026 increased by 23 USD (0.72%) to 3,208 USD/ton.

This development shows investors’ optimism in the face of positive signals from the world coffee market. Supply and demand factors and economic policies still play an important role in orienting coffee price trends in the coming time. The price increase on the London floor can have a positive impact on domestic coffee prices, requiring producers and traders to closely monitor to have appropriate business strategies.

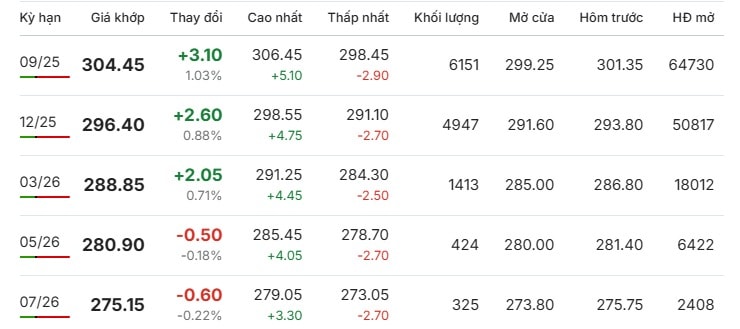

New York Arabica Coffee Price July 25, 2025

Arabica coffee prices on the New York floor on July 25, 2025 recorded mixed developments in trading terms. The nearest term in September 2025 increased by 3.10 cents, equivalent to 1.03%, to 304.45 cents/lb.

Subsequent maturities such as December 2025 and March 2026 also increased by 2.60 cents (0.88%) and 2.05 cents (0.71%) respectively. However, further maturities such as May 2026 and July 2026 recorded a slight decrease, down 0.50 cents (0.18%) and 0.60 cents (0.22%) respectively.

This development shows caution and short-term price adjustment in the Arabica coffee market. Supply and demand factors and economic policies still play an important role in orienting price trends in the coming time. The move on the New York floor may affect the domestic coffee market in Vietnam, requiring producers and traders to closely monitor to make appropriate decisions.

Market Overview 7/25/2025

On the London floor, the Robusta coffee market recorded a simultaneous increase in prices across major trading terms, with the strongest increase in the most recent term 09/2025, up 51 USD (1.55%) to 3,351 USD/ton. The following terms also increased positively, showing investors' optimism in the face of positive signals from the world coffee market. However, this increase was still somewhat limited due to the increase in Robusta inventories monitored by ICE to the highest level in nearly 12 months, reaching 6,410 lots. In addition, the prospect of a larger crop in Vietnam and stable supply from Brazil and Indonesia put pressure on prices. In addition, concerns about frost in Brazil also contributed to supporting Robusta coffee prices in the short term.

Meanwhile, the Arabica coffee market on the New York floor had mixed developments across terms. The nearest term 09/2025 increased slightly by 3.10 cents (1.03%) to 304.45 cents/lb, along with the terms 12/2025 and 03/2026 also increased. However, the further terms such as 05/2026 and 07/2026 decreased slightly, indicating caution and short-term price adjustments. Arabica inventories fell to a three-month low of 806,062 bags, providing support for prices. The price spread between terms on the New York floor remained wide, reflecting a clear differentiation compared to the London Robusta market.

Geopolitical and trade policy factors are also being closely watched, especially the possibility of the US imposing a 50% tariff on coffee imports from Brazil from August 1, which could alter coffee export flows and affect global prices. At the same time, the European Union Deforestation Regulation (EUDR) is also creating cautious buying activities for roasters and market participants.

In addition, the reversal of prices on the London floor and the narrowing of the futures spread are showing initial signs of a structural shift in the Robusta market, but there are no clear signs of a return to normality in the futures price curve.

Overall, the coffee market is currently in a complex and volatile phase with many factors of supply and demand, weather, trade policy and environmental regulations interacting. Producers, traders and investors need to continue to closely monitor developments to have appropriate business strategies and risk management, take advantage of opportunities from the price increase trend while preparing to respond to short-term adjustments.

Source: https://baodanang.vn/gia-ca-phe-hom-nay-25-7-ngap-tran-sac-xanh-robusta-phuc-hoi-arabica-tang-nhe-3297799.html

![[Photo] National Assembly Chairman Tran Thanh Man receives Chairman of Morocco-Vietnam Friendship Association](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/26/b5fb486562044db9a5e95efb6dc6a263)

Comment (0)