Distinguish between hoarding and speculation for taxation purposes

The Government requires the Personal Income Tax Law to clearly stipulate that income from gold trading is subject to tax. This provision aims to increase transparency and limit gold speculation. The Ministry of Finance is assigned to coordinate with the State Bank to unify this content in the draft law.

Sharing with VietNamNet reporter, economic expert Nguyen Quang Huy, CEO of the Faculty of Finance - Banking (Nguyen Trai University) said that gold has long been not only a financial asset but also associated with the habit of accumulation and the precautionary mentality of many families. Therefore, the way to design tax policies needs to be sophisticated enough to clearly distinguish between legitimate hoarding behavior and business-based speculative activities.

Mr. Huy proposed that personal income tax should only be applied to the actual profit, that is, the difference between the selling price and the proven purchase price, instead of the entire transaction value. This is the key point to avoid negative impacts on people who only sell gold when they have essential needs.

In addition, it is necessary to set reasonable tax exemption thresholds, such as tax exemption if annual profits are below a certain level, or if transaction volumes are small. This approach ensures fairness and allows the regulatory agency to focus resources on large-scale cases, instead of dealing with millions of small transactions.

Taxing income from gold trading is considered by experts to be appropriate and timely in order to limit speculation and surfing. Photo: Thach Thao

A common concern is that people who save all their lives and then need to sell their savings will be taxed. According to Mr. Huy, this is a legitimate concern and needs to be resolved with a humane mechanism.

“The solution could be to exempt or reduce taxes for transactions that are proven to have a long-term holding period, for example two years or more. That way, people who consider gold as savings will not be affected, while short-term buying and selling activities are subject to tax,” said Mr. Huy.

To truly limit speculation, according to the expert, tax policy needs to be directional, encouraging stable holdings, but increasing the cost of swing trading. Higher tax rates can be applied to large-scale, repeated transactions that demonstrate a business nature.

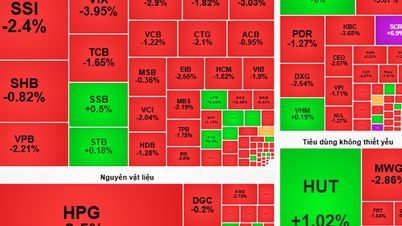

At the same time, it is necessary to go hand in hand with more fundamental solutions such as developing safe and transparent alternative financial products such as gold certificates, electronic gold accounts, gold ETFs; increasing the attractiveness of deposit channels, bonds, and stocks; publicizing price information to reduce differences; and strictly managing gold trading activities.

Vietnamnet.vn

Source: https://vietnamnet.vn/danh-thue-thu-nhap-tu-mua-ban-vang-can-phan-biet-tich-tru-va-dau-co-2443068.html

![[Photo] Science and Technology Trade Union honors exemplary workers and excellent union officials](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/17/842ff35bce69449290ec23b75727934e)

![[Photo] General Secretary To Lam chairs a working session with the Standing Committee of the Government Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/17/cf3d855fdc974fa9a45e80d380b0eb7c)

Comment (0)