In a special report entitled “ Gold demand: the role of the official sector and geopolitics ” , ECB experts said that central banks' gold holdings have increased to 20%, surpassing the 16% of the Euro.

Gold prices in 2024, adjusted for inflation, have already surpassed the peak set during the 1979 oil crisis. Central bank gold reserves are now close to Bretton Woods levels, although they represent a small fraction of global gold supply.

With its soaring market value and large holdings, gold is now the world's second-largest reserve asset.

According to the report, gold demand from central banks in 2024 will account for more than 20% of total global demand, double the average of about 10% in the previous decade.

The boom began after the Russia-Ukraine conflict in 2022, when central banks increased their gold reserves to hedge against geopolitical risks and diversify reserves.

However, gold demand from the jewelry and investment sectors still accounts for the majority, totaling around 70% of total demand. In 2024, the decline in jewelry demand in China will be offset by a strong increase in investment in gold.

Motivation to buy gold

A survey by the World Gold Council of nearly 60 central banks from February to April 2024 found that the top three reasons these institutions buy gold include: long-term storage value and inflation protection, effectiveness during times of crisis, and the ability to diversify their reserve portfolios.

In addition, the risk of debt default and political instability are also considered important factors driving the decision to increase gold reserves.

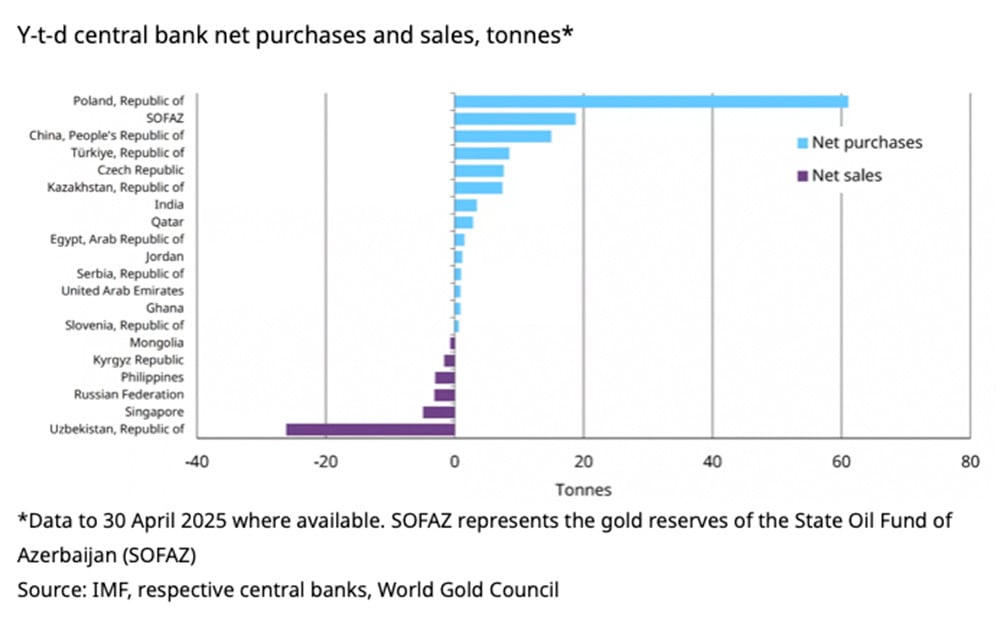

Türkiye, India and China are the three countries leading this trend, with a total of more than 600 tonnes of gold purchased since the end of 2021.

The ECB noted that geopolitical factors are playing an increasingly important role. The correlation between gold prices and real yields has broken down following the Russia-Ukraine conflict, a sign that non-financial factors, especially geopolitical risks, are having a strong impact on gold prices.

The ECB warned that the future price rally in gold will depend on the ability to expand supply. Over the past decades, the supply of gold has shown flexibility, especially through the growth of above-ground gold reserves.

“Increased demand from the official sector could continue to support the growth of global gold supply,” the ECB concluded.

According to the WGC, central banks bought 244 tonnes of gold in the first quarter of 2025. Although 21% lower than the same period last year (309.9 tonnes), this is still a significant figure, showing that the buying trend is continuing.

In 2024, global central banks bought 1,062 tonnes of gold, marking the third consecutive year that net purchases exceeded 1,000 tonnes. This is the highest accumulation since the 1950s.

Many experts and reports predict that global central banks will likely buy about 1,000 tons of gold in 2025. If this scenario occurs, the net gold buying trend will last for the fourth consecutive year.

Source: https://vietnamnet.vn/vang-but-pha-ngoan-muc-dung-thu-2-trong-kho-du-tru-toan-cau-2410999.html

![[Photo] Hanoi students excitedly and joyfully open the new school year 2025-2026](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/5/ecc91eddd50a467aa7670463f7b142f5)

![[Photo] The drum beats to open the new school year in a special way](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/5/b34123487ad34079a9688f344dc19148)

![[Photo] Opening ceremony of "Digital Citizenship - Digital School" and commitment to civilized behavior in cyberspace](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/5/222ec3b8892f443c9b26637ef2dd2b09)

Comment (0)