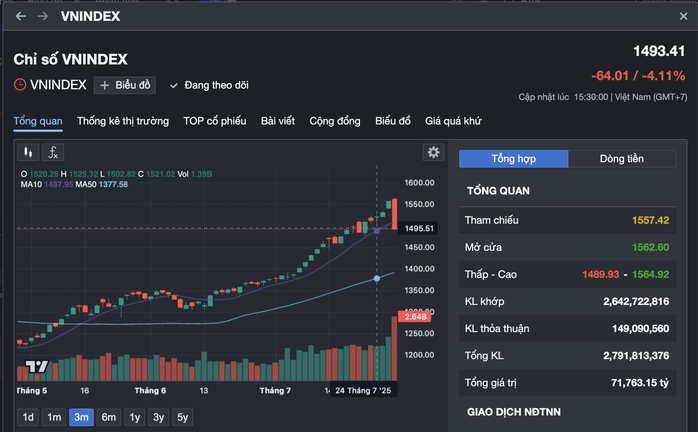

At the end of the trading session on July 29, the Vietnamese stock market surprised when the VN-Index fell sharply by 64.01 points (4.11%) to 1,493 points; the HNX Index also lost 3.2% to 255.36 points while the Upcom Index fell to 106.07 points.

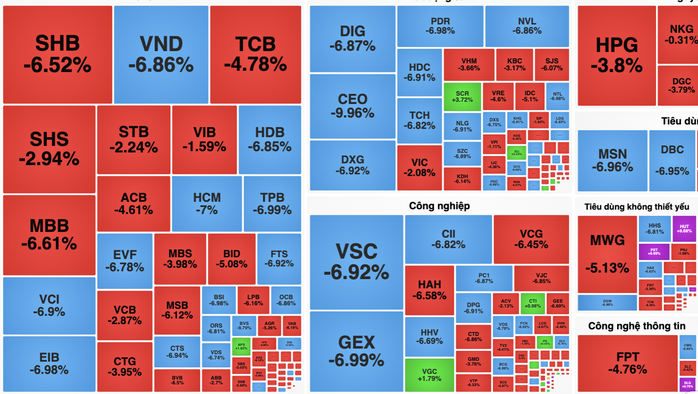

Stocks hit the floor in droves

Not only did the market experience strong fluctuations in points, it also recorded a trading session with record liquidity, when the trading value on the HOSE floor alone exceeded VND 71,700 billion - the highest ever. A series of stocks hit the floor, surprising investors - when the market had just had strong trading sessions - stocks hit the ceiling before.

Across forums and investment groups, many investors who had just bought stocks at ceiling prices 1-2 days before, but had not yet transferred them to their accounts, have now turned around and hit the floor, causing heavy losses.

Ms. Bich Van (an investor in Ho Chi Minh City) said that she was busy with work today. In the afternoon, she opened the electronic board and was shocked to see the market "fly" more than 64 points, the stocks in her portfolio hit the floor, and she had not had time to take profit.

Stocks hit the floor in a row in today's sharp decline

According to Vietnam Construction Securities Company (CSI), under strong profit-taking pressure, a series of stocks are lying on the floor, trading psychology shows signs of panic, and demand is weak. On the HOSE floor, there are 314 stocks decreasing in price, completely overwhelming the only 41 stocks increasing in points. The largest matched liquidity since the stock market started operating, surpassing the session of decrease on the day of the announcement of the corresponding tax and 94 9 higher, nearly twice the average level of 20 sessions.

"This is a session of unexpected decline in both amplitude and liquidity. The uptrend has been reversed after today's sharp decline. However, the VN-Index is likely to have a recovery after the unexpected sharp declines, then return to the correction phase. The recovery phase is an opportunity for investors to continue to sell off their stock holdings and limit bottom fishing at the present time. It is expected that after the recovery phase, the VN-Index will adjust to the support zone around 1,420 points, at which point new buying positions will begin to be activated" - CSI Securities experts predicted.

Record liquidity is a good sign

Speaking to a reporter from Nguoi Lao Dong Newspaper, Mr. Truong Hien Phuong, Senior Director of KIS Vietnam Securities Company, said that in the current market context, this is an inevitable adjustment in an upward cycle. These adjustment sessions are necessary to bring stock prices and the market to a more reasonable price range.

"This is a normal phenomenon, creating opportunities for investors who are standing outside to disburse to buy stocks. This will help the market increase more strongly and sustainably. When the VN-Index increased from 1,200 points to more than 1,550 points, equivalent to an increase of more than 300 points, many stocks achieved good profit margins, making investors want to take profits" - Mr. Truong Hien Phuong analyzed.

VN-Index currently breaks the 1,500 point mark

Regarding the record liquidity session of the market, experts from KIS Vietnam Securities said that the number of 2.8 billion shares traded with a value of more than 71,700 billion VND - the highest ever on the stock market. This number is surprising but not too surprising. This liquidity is not simply a new cash flow from buyers and sellers, but reflects the speed of capital turnover of investors.

In the short term, the market may correct further, but the medium and long-term outlook is positive, especially in the context of the gradual resolution of tariff issues, especially between major markets such as the US, EU, Japan, and Vietnam. Geopolitical tensions have also eased and the market expects the US Federal Reserve (FED) to cut interest rates in the near future.

Source: https://nld.com.vn/chuyen-gia-noi-gi-ve-phien-boc-hoi-dot-ngot-64-diem-cua-vn-index-196250729173409324.htm

![[Photo] National Assembly Chairman attends the seminar "Building and operating an international financial center and recommendations for Vietnam"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/28/76393436936e457db31ec84433289f72)

Comment (0)