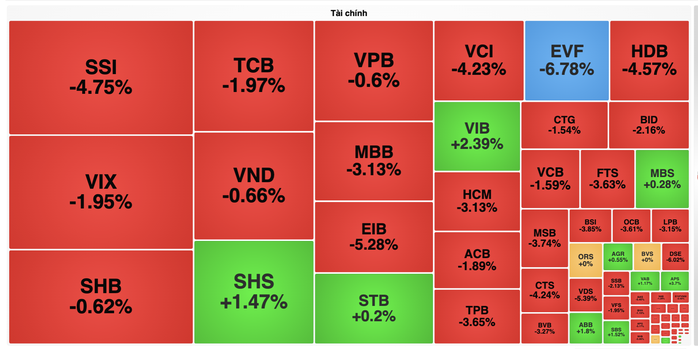

In the morning trading session on July 29, the market faced strong profit-taking pressure after a historic increase. VN-Index temporarily stopped at 1,533 points, down nearly 24 points compared to the previous session; HNX Index decreased by 1.18 points to 262.2 points while Upcom also lost 0.63 points to 106.3 points.

The market fluctuated strongly in the morning with sudden liquidity. When the transaction value on the HoSE floor reached 36,400 billion VND.

On all three exchanges, liquidity exceeded 40,000 billion VND. This is a record liquidity level in many years.

A series of stock groups fluctuated violently as selling pressure increased from investors. However, outside money waiting to buy low-priced stocks also poured in strongly, helping liquidity increase dramatically. Many stock groups in the securities, real estate, banking, etc. lines fell sharply in price.

The most negative impact on the VN-Index was on VCB, MBB, HDB, CTG; while the market was supported by the green color of oil and gas stocks such as BSR , GAS...

Many stocks in the securities and banking sectors fell sharply this morning.

According to the reporter of Nguoi Lao Dong Newspaper, many investors sold their stocks to take profits when the market fluctuated in the morning session, especially the group of securities stocks that had increased sharply in recent weeks. Some securities investment groups and brokers also announced for investors to sell or reduce the margin ratio (margin lending) to a safe level.

Notably, in the morning session alone, a total of more than 1.4 billion shares were traded. Due to the sudden increase in the number of shares traded, at some points, the securities company's electronic boards were unstable; the trading apps of some securities companies such as SSI, BSC, VPS, Mirae Asset... displayed orders, and placing orders was slow at some points.

"Seeing the market shake strongly, I closed about 30% of my portfolio in the securities and banking stocks group. Brokers in my group also recommended reducing margin and taking profits from some of the stocks that have increased strongly recently" - said Mr. Hoang Thinh, an investor in Ho Chi Minh City.

Is it not worth worrying that VN-Index will decrease sharply?

Giving a quick assessment of the morning trading session, leaders of several securities companies said the market was shaking after surpassing the historical peak at 1,550 points. Mr. Nguyen The Minh, Director of Analysis for Individual Clients, Yuanta Vietnam Securities Company, said that the VN-Index shaking and falling after a period of continuous increase was inevitable.

"However, the market is not likely to correct in the short term because it is observed that investor sentiment is still quite optimistic. The amount of money waiting outside the market to buy stocks is also very large. We need to continue observing the VN-Index with the next support level being the 1,510 point area. Investors can keep the proportion of stocks at about 50-60% of the portfolio" - Mr. The Minh said.

Mr. Dinh Minh Tri, Director of Individual Customer Analysis - Mirae Asset Securities Company, also said that the market has been rising continuously for the past 6 weeks - from mid-June until now. After increasing continuously and reaching the peak, a correction of about 1-2 weeks is also normal, not too worrying. In fact, the cash flow from investors holding cash (full cash) waiting to participate in the stock market is very large.

Foreign investors have been net sellers again in recent sessions.

Source: https://nld.com.vn/chung-khoan-sup-manh-sau-khi-vuot-dinh-nhieu-nha-dau-tu-bat-dau-lo-19625072913045534.htm

![[Photo] National Assembly Chairman attends the seminar "Building and operating an international financial center and recommendations for Vietnam"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/28/76393436936e457db31ec84433289f72)

Comment (0)